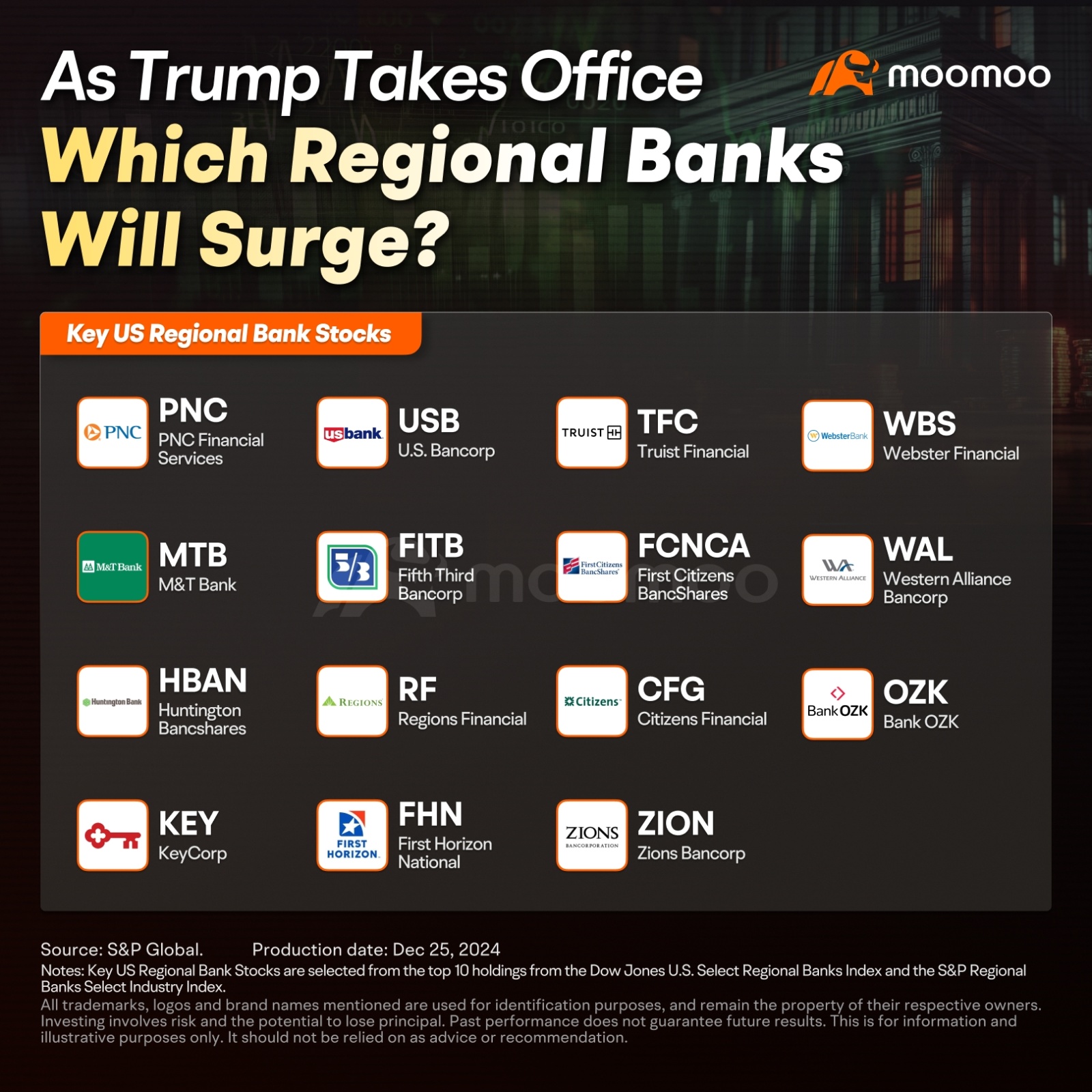

As Trump is expected to officially take office as the 47th President of the United States on January 20, 2025, and implement his policies, the banking sector, especially regional banks, may become an important investment opportunity. Trump's administration has explicitly stated its intention to relax banking regulations, particularly for smaller and mid-sized banks, which could ignite growth potential in these institutions. With a more relaxed regulatory environment, low interest rates, and economic stimulus measures, regional banks may experience new growth opportunities.

Ultratech : trump is a monster