Trump Trade Reaches a Climax. Momentum May Extend Into Inauguration Day

A month after the November 5 Election Day, the 'Trump trade' is at its zenith, showing no signs of slowing down. Since the election, the performance of key U.S. market sectors underscores a significant uptrend: Bitcoin has surged by 41%, bank stocks have increased by 11%, small-cap stocks by 9%, and the S&P 500 has grown by 5%. Kabra Manish from Societe Generale expresses a buoyant outlook on the endurance of the 'Trump trade', predicting it will sustain its momentum until the upcoming Inauguration Day scheduled for January 20, 2025.

Bitcoin and the Crypto Market

With President-elect Donald Trump's nomination of Paul Atkins to chair the Securities and Exchange Commission, $Bitcoin (BTC.CC)$ smashed through the $100,000 barrier and achieved a new record high. This move is expected to introduce a new era of crypto-friendly financial regulation in Washington. Since Election Day, the price of Bitcoin has risen by over 40%, accompanied by significant increases in major cryptocurrency stocks, with $MicroStrategy (MSTR.US)$ rising by 78% and $Coinbase (COIN.US)$ by 70%.

Donald Trump emphasized Atkins's role in fostering an environment where digital assets thrive, stating that the new regulator "recognizes that digital assets and other innovations are crucial to making America greater than ever before." Kris Marszalek, CEO of Crypto.com, echoed this sentiment on social media, celebrating this milestone and emphasizing the unwavering spirit of the crypto community.

Interest in crypto is pretty much unstoppable," said Geoff Kendrick, global head of digital assets research at Standard Chartered.

Substantial institutional investments also support the surge in Bitcoin's value. Exchange-traded funds (ETFs) that invest in the cryptocurrency, managed by leading asset managers such as BlackRock and Fidelity, have attracted billions of dollars since gaining regulatory approval in January.

This trend of inflows has intensified following President Trump's decisive election victory, with approximately $4.4 billion invested since early November. Currently, BlackRock's Bitcoin ETF now holds assets totaling $45 billion.

Tesla's Fortunes

$Tesla (TSLA.US)$ shares have experienced a significant upswing, increasing approximately 42% since November 5. The recent launch of the V13 Full Self-Driving (FSD) software has further boosted investor optimism.

In a recent appearance on the Schwab Network, Dan Ives of Wedbush Securities discussed Elon Musk's strategic alignment with President Trump, predicting it will fundamentally transform his electric vehicle (EV) company.

Musk's support for Trump is set to reshape the entire landscape for Tesla Inc., particularly in areas of autonomous AI and regulation," Ives stated.

Ives also noted Musk's previously peripheral position during the Biden and Obama administrations, contrasting it with his current significant influence under Trump. "Under the Trump administration, Tesla has significant influence, particularly in discussions concerning China tariffs. These discussions are pivotal, almost akin to an AI ambassador role," he explained. Ives emphasized the immense value of autonomous technology for Tesla, estimating, "AI alone, the autonomous piece, could be worth a trillion dollars for Tesla Inc."

Small Caps

Since Election Day, the $Russell 2000 Index (.RUT.US)$, which represents small-cap stocks, has climbed 7.4%. There is growing optimism that the performance of small-cap stocks could further improve under the Trump administration, driven by expectations of favorable fiscal policies that could stimulate growth. Small companies, typically more sensitive to economic shifts due to their smaller cost bases, may significantly impact their profits from even minor revenue changes.

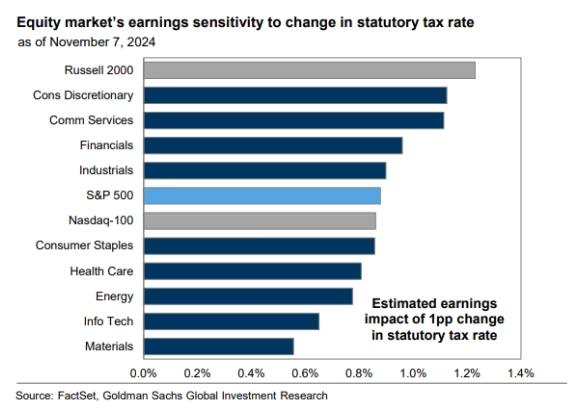

Additionally, cutting corporate taxes would disproportionately benefit smaller companies that derive a larger share of their revenue and profits domestically. Goldman Sachs has provided a chart illustrating the high sensitivity of Russell 2000 stocks to tax rate changes, underscoring the potential impact on small caps.

Furthermore, the Trump administration is anticipated to relax merger regulations, potentially leading to many small companies being acquired at a premium. Beyond mergers, regulatory relaxations could benefit smaller companies more than larger ones, adding another layer of potential advantage for small caps under the new administration.

Challenges in the Pharmaceutical Sector

Contrastingly, the pharmaceutical sector has faced challenges under Trump's presidency, particularly with the controversial appointment of vaccine skeptic Robert F Kennedy Jr as Health Secretary. Following his appointment, shares in $Pfizer (PFE.US)$ and $Moderna (MRNA.US)$, both developers of Covid-19 vaccines, saw declines. Kennedy's anti-vaccine stance and other controversial opinions have sparked significant backlash within the industry.

RFK Jr has once said: "There's no vaccine that is safe and effective."

According to The Telegraph, Mr. Kennedy's skepticism towards vaccines might be a form of political retribution aimed at Trump. This comes after Trump's disputes with vaccine manufacturers towards the end of his term in 2020, where he accused them of withholding positive Covid vaccine test results until after his electoral defeat.

Source: Financial Times, Bloomberg, The Telegraph

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

72441451 :

104088143 : Good

103677010 : noted

Adrianlim90 : 1

acon8 : nice