'Trump Trade' Returns as Election Nears: Impact on Global Financial Markets

Momentum is swinging toward former President Donald Trump in the presidential race, reigniting interest in the "Trump Trade."

Real Clear Politics' poll average as of Oct. 15 shows Vice President Kamala Harris's lead over Trump has narrowed to 1.7 percentage points, with support at 48.9% for Harris and 47.2% for Trump.

Betting platform Polymarket reveals Trump's support has been on the rise since overtaking Harris on Oct. 4. He now commands 55.3%, outpacing Harris's 44.4% by nearly 11 percentage points.

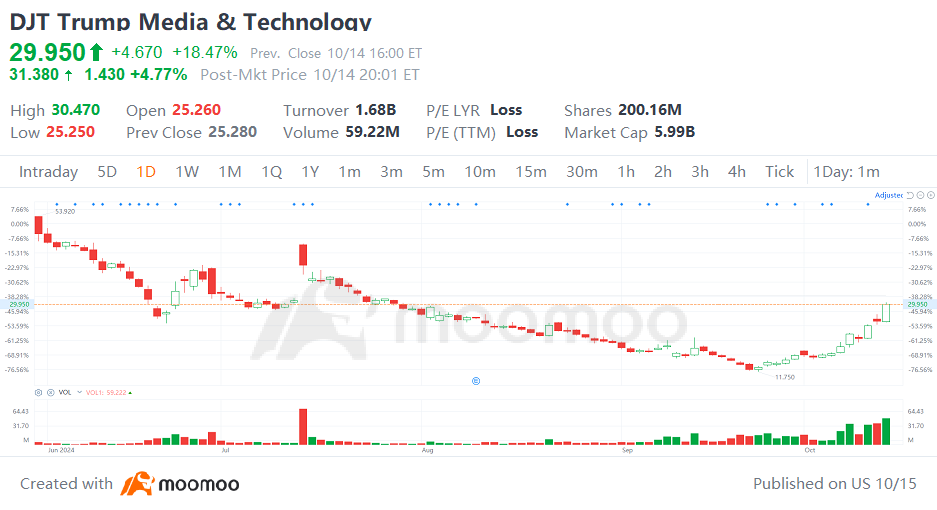

On Monday, the $Trump Media & Technology (DJT.US)$ jumped over 18%. Since the month's start, it has surged more than 85% as traders wager on Trump's potential White House return.

US Election's Potential Ripple Effect on Global Financial Markets

As the U.S. presidential election looms on November 5, global financial markets are bracing for potential turbulence. The policies of the next president could significantly impact economic conditions and, in turn, financial assets.

Equities

1) United States

Donald Trump advocates for tax cuts and deregulation, favorably impacting corporate growth. Sectors such as fossil fuels, defense, and banking could see gains. Following Trump's 2016 victory, markets quickly rebounded on expectations of robust fiscal measures.

Kamala Harris, on the other hand, prioritizes public spending and could increase corporate taxes and tighten regulations. This approach introduces uncertainty for financial and energy sectors but might benefit renewable energy and healthcare industries.

Our analysis, "Trump Trade' vs. 'Harris Trade': How They Could Shape Your Portfolio," explores how each candidate's policies could influence specific sectors.

2) Emerging Markets

Trump's protectionist trade policies may escalate tensions with China and the EU. His stance includes a baseline 20% tariff on imports, escalating to 60% on Chinese goods.

China’s recent stimulus efforts have renewed investor interest, yet potential tariff hikes and trade confrontations under Trump could counteract this momentum.

Goldman Sachs estimates a 60% tariff on Chinese goods might cause a 13% decline in China's stock market. Beijing may respond with large-scale spending initiatives alongside monetary stimulus, potentially intensifying and prolonging these measures.

UBS cautions that Trump's maximum tariffs could lead to an 11% drop in emerging market equities by 2025. The bank's emerging market risk index is at its highest in 15 years, indicating investors may not fully anticipate the downside risks associated with Trump's tariffs.

Conversely, Harris's trade policies could foster international cooperation, stabilizing supply chains and benefiting multinational firms, potentially boosting emerging market assets.

Crypto

Post-election, regulatory clarity for cryptocurrencies in the U.S. is expected to improve.

Trump has shifted from dismissing Bitcoin as a "scam" to pledging support, including a strategic national Bitcoin stockpile, aiming to make the U.S. a "Bitcoin superpower."

Harris has committed to establishing a regulatory framework for cryptocurrencies on Monday, though specifics remain forthcoming.

Bloomberg data shows U.S. spot Bitcoin ETFs attracted $556 million in inflows on Monday, the highest since early June. October has historically seen Bitcoin average a 20% increase, providing a bullish backdrop for cryptocurrencies.

Curreny and Commodity

A Trump victory could bolster the dollar through expansionary fiscal policies, while his stringent trade stance might weigh on emerging market currencies. During his previous term, the yuan hit a decade low in August 2019.

A Harris administration might adopt moderate fiscal policies, promoting a stable currency environment.

In commodities, Trump's deregulation and support for domestic production could increase fossil fuel supply, potentially lowering prices.

Harris’s focus on clean energy could drive demand for commodities like lithium and copper, integral to green technology, while reducing reliance on coal and oil. Her support for infrastructure spending could further boost demand for industrial metals.

Geopolitical uncertainties surrounding the election typically enhance demand for safe-haven assets such as gold and silver.

Source: IG, Bloomberg, Reuters, Financial Times

by moomoo News Olivia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

OBIfromMEM : DJT Stock: The Biggest Opportunity of 2024? Why Shareholders Can’t Afford to Miss This Moment | by Stock Market Loop | Oct, 2024 | Medium

103356238jenny tan :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Invest With Cici : nice article, insightful!

70193418 : Investors need to have a strong belief, but unfortunately I sold too early

151373692 :

151373692 :

joemamaa :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

joemamaa : very good stock