"Trump Trade" Sweeps the Market - Master the Latest Deployment Opportunities

The recent buzz surrounding former U.S. President Donald Trump has heightened expectations of his potential victory in the upcoming U.S. presidential election. As a result, the market has once again witnessed the emergence of the "Trump Trade."

For the first time, the yield on 30-year Treasury bonds has exceeded that on 2-year bonds, the futures of the three major U.S. stock indices have collectively risen, and the price of Bitcoin has surged past $60,000.

Today, we will share how to navigate the "Trump Trade" and find potential investment opportunities amid this wave of enthusiasm.

What is the “Trump Trade”?

Since Trump became the 45th President of the United States, the "Trump Trade" has frequently appeared in financial markets. It generally refers to the market's anticipated reactions to fiscal, trade, and regulatory policies that Trump might implement during his presidency.

These policies include tax cuts, financial deregulation, and other measures that often lead to specific volatility patterns in financial markets. Essentially, the "Trump Trade" is a market expectation-driven trading model.

This term actually emerged as early as 2016. After the third U.S. presidential debate on October 19, 2016, Trump's polling support began to lead. By the end of that year, the market trading during that period, driven by expectations of Trump's expansionary fiscal policies and tightening trade policies, exhibited characteristics such as high interest rates, a strong dollar, and strong U.S. stocks.

How to Play the "Trump Trade"?

Here, we outline three major directions of the "Trump Trade" and their respective characteristics:

Trump-linked stocks

There are few stocks with a clear commercial association with Trump or close ties to his political activities. The main ones are Trump Media & Technology Group ( $Trump Media & Technology (DJT.US)$), Phunware ( $Phunware (PHUN.US)$), and Rumble ( $Rumble (RUM.US)$).

These stocks are characterized by a lack of solid fundamental support and extreme price volatility, similar to meme stocks.

As of the close on July 15, DJT has a market cap of around $8 billion, Rumble around $2 billion, and Phunware less than $50 million.

After the recent shooting incident, the stock price of Trump's media and technology group surged by 75%.

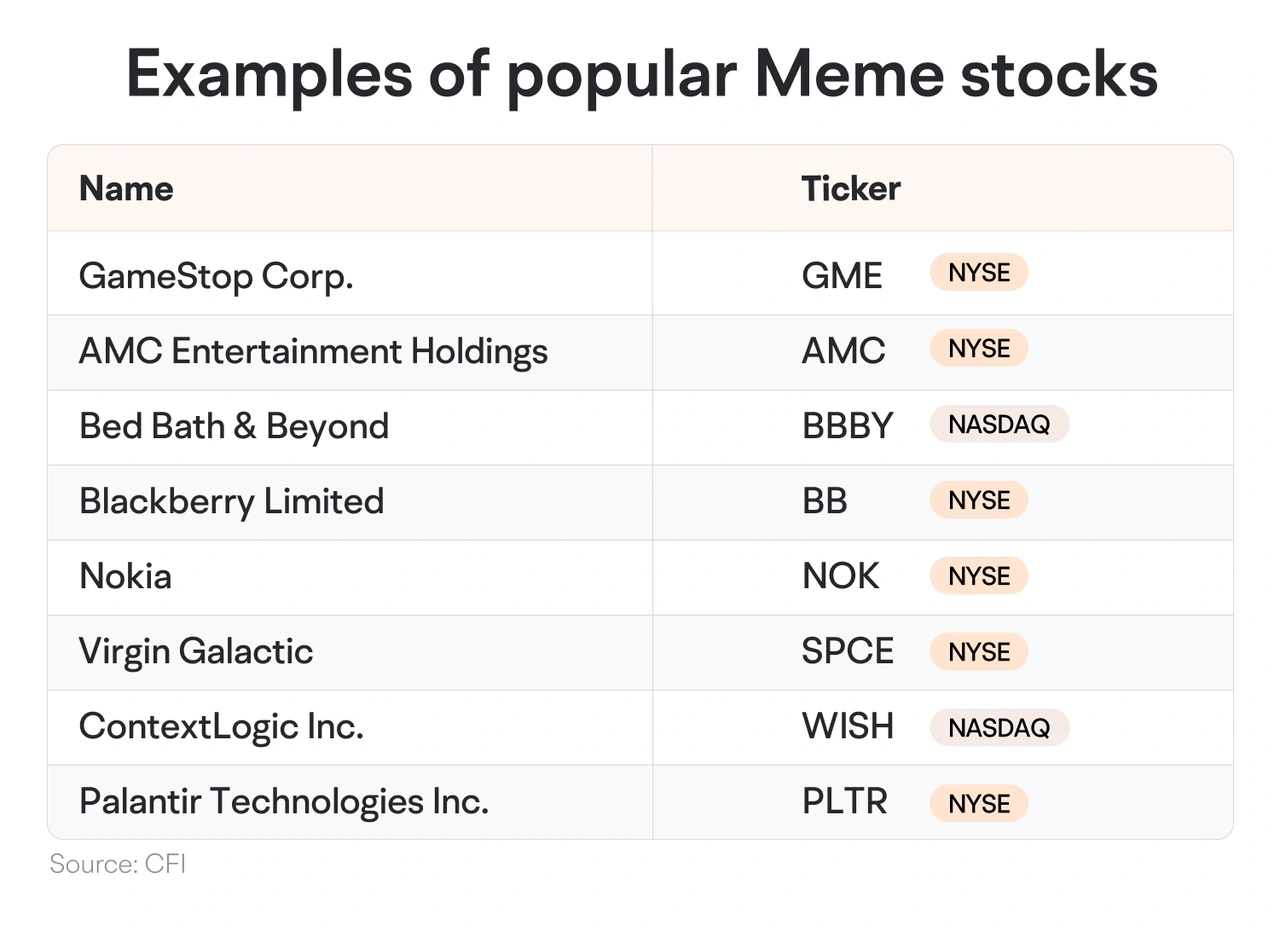

What are MEME stocks?

MEME stocks are those that gain popularity on social media platforms.

Their main characteristics are high volatility, potential for short-term gains, high risks due to their detachment from company fundamentals, and susceptibility to social media sentiment.

The following are examples of popular Meme stocks:

Policy Support Stocks

Trump's policies, when he was in office, could benefit certain industries. These stocks usually have solid fundamental support and relatively smaller volatility. Typical industries include traditional energy, finance, insurance, and agricultural equipment.

1. Traditional Energy

During Trump's administration, a series of policies supporting the fossil fuel industry were implemented, including relaxing environmental regulations and encouraging energy extraction and production. These measures significantly benefited the oil, natural gas, and coal industries.

Representative companies include ExxonMobil (stock code: $Exxon Mobil (XOM.US)$) and Chevron (stock code: $Chevron (CVX.US)$). Fortune magazine pointed out that a Trump victory might reverse the U.S. energy policy direction—Biden's climate change policies might give way to pro-fossil fuel policies, benefiting oil and gas stocks but being unfavorable for renewable energy stocks.

2. Finance and Insurance

Trump's administration implemented financial deregulation policies, including relaxing some provisions of the Dodd-Frank Act, reducing the compliance costs for financial institutions and improving their profitability. Examples include JPMorgan Chase (stock code: $JPMorgan (JPM.US)$) and Goldman Sachs (stock code: $Goldman Sachs (GS.US)$).

3. Insurance

Changes in Trump's policies in the healthcare and other insurance fields benefited some insurance companies. For example, modifications to the Affordable Care Act reduced compliance burdens for insurance companies. Representative companies include UnitedHealth Group (stock code: $UnitedHealth (UNH.US)$) and Aflac (stock code: $Aflac Inc (AFL.US)$).

4. Agricultural Equipment

Trump's administration implemented policies supporting agriculture, including tax incentives and subsidies for agricultural equipment, benefiting the agricultural equipment industry. Examples include Deere & Company (stock code: DE) and Caterpillar (stock code: $Caterpillar (CAT.US)$).

Publicly Supported Stocks

These stocks are in industries publicly supported by Trump, with cryptocurrencies being the most notable.

Thanks to Trump's favorable stance on digital cryptocurrencies, Bitcoin surged over 10% in a week, rising more than 5% in a single day to approximately $63,000 on July 15th.

Trump's supportive attitude towards cryptocurrencies has been a key factor in Bitcoin's recent rally.

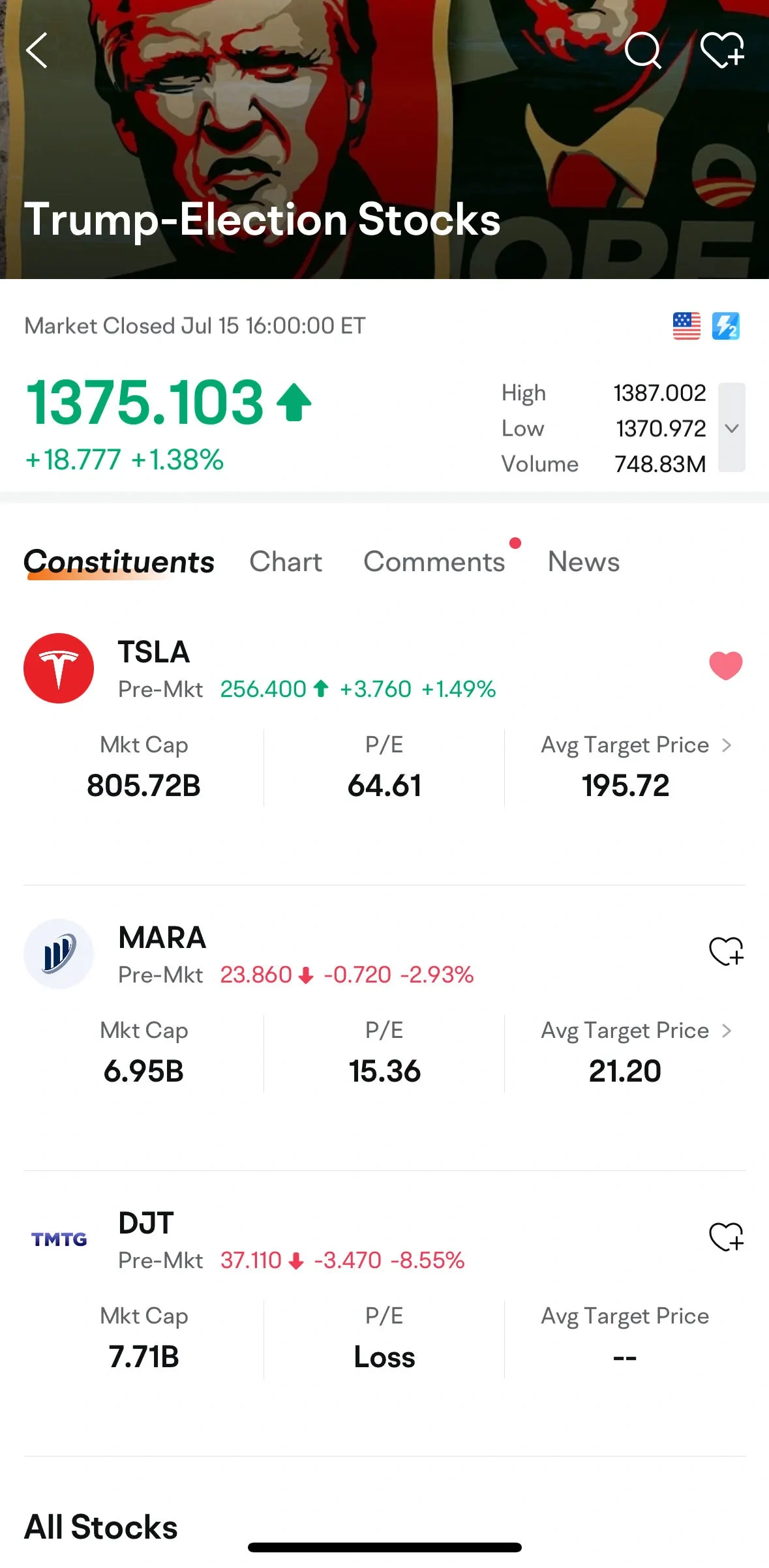

Therefore, investors should focus on key Bitcoin-related stocks, including the exchange $Coinbase (COIN.US)$, mining company $MARA Holdings (MARA.US)$, and major Bitcoin holder $Strategy (MSTR.US)$.

What's more, even though Tesla ( $Tesla (TSLA.US)$) isn't part of the traditional energy sector and could face unfavorable policies from Trump, it has still become a part of the 'Trump Trade.'

Following Musk’s public endorsement, Tesla’s stock saw an upward trend post-Trump’s shooting incident.

Given these rapid phases, timing the market is crucial. When making investment decisions, it is essential to manage risks effectively.

Based on these policy directions, moomoo has compiled a list of some Trump-Election stocks (LIST22962.US) for users to consider.

The company mentioned is for illustration purposes only, and any statement involved does not constitute investment advice.

Although Trump currently holds an advantage, nothing is set in stone with more than three months remaining until the U.S. elections.

Particularly, Trump-linked stocks might experience significant volatility. Investors might devise strategies based on the distinct characteristics of different segments of the "Trump Trade."

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

BelleWeather : Oh man. I hope you YOLO on DJT.