TSMC Financial Report Review: Gross Margin Significantly Exceeds Expectations, Strong AI Demand | Moomoo Research

October 17, Thursday, TSMC, the global chip foundry giant, announced its Q3 2024 financial report. The performance in Q3 was strong, with revenue, net profit, and gross margin all exceeding expectations. Notably, the gross margin returned to around 58%, far above the market expectation of 54.8%. The guidance for the next quarter also shows revenue and gross margin significantly exceeding market expectations, indicating that AI demand remains robust.

I. Robust AI Demand and Recovery in Smartphone Demand

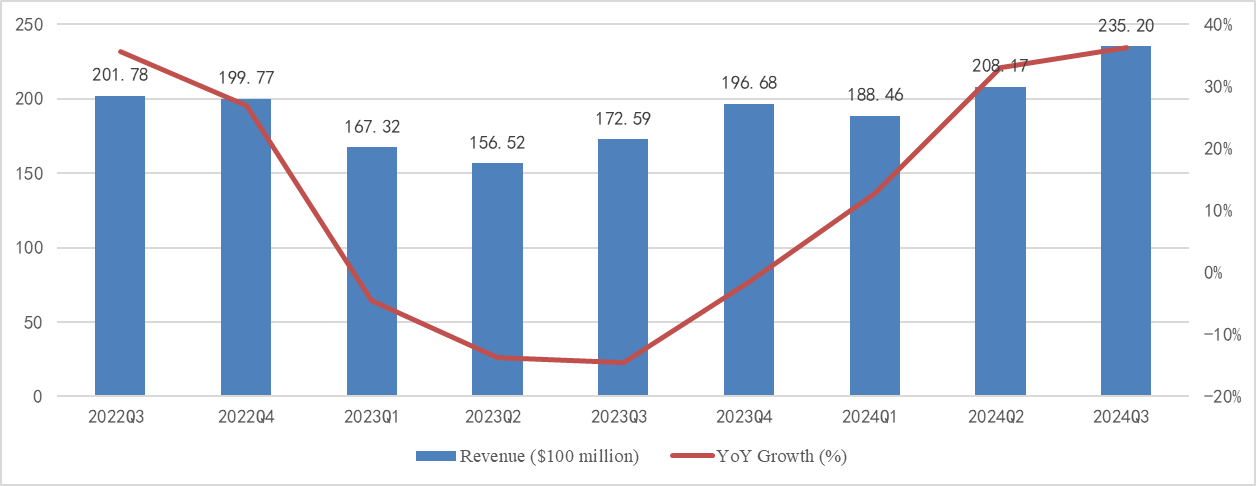

Q3 net revenue reached TWD 759.69 billion, or USD 23.5 billion, a year-on-year increase of 39%, exceeding the estimated TWD 751.06 billion. However, the revenue beat was somewhat expected due to TSMC's monthly sales data, which kept the market informed. More noteworthy is the breakdown of revenue, indicating the drivers of demand and the increase in average selling prices.

Figure: TSMC Revenue Situation

Source: Company announcement, Futu Securities compilation

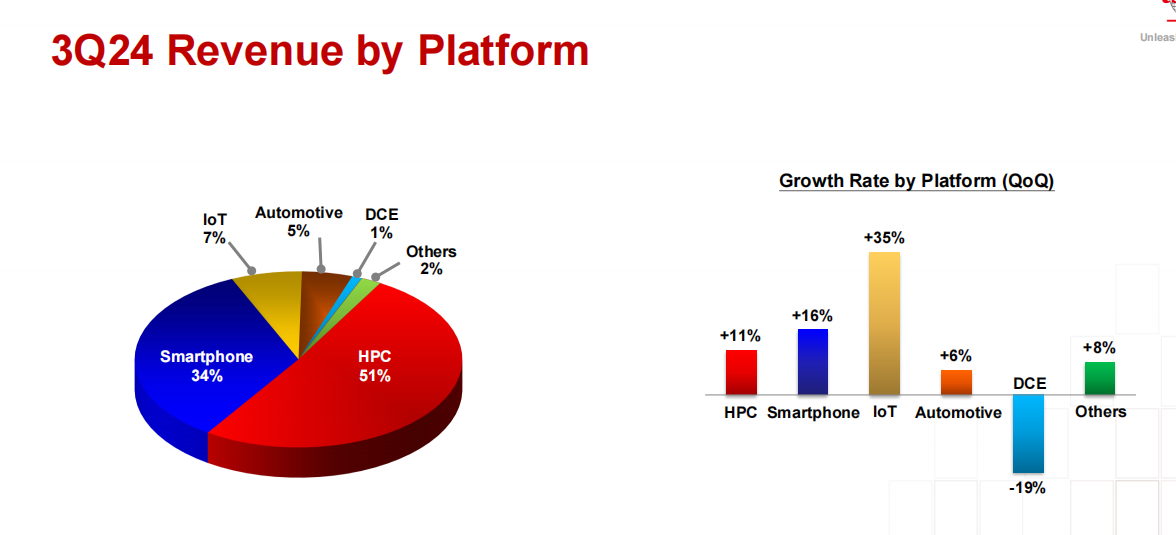

From the revenue breakdown, the high-performance computing platform accounted for 51%, while smartphone revenue accounted for 34%. Compared to the previous quarter, AI demand remains very strong, with a quarter-on-quarter increase of 11%. Meanwhile, smartphone revenue saw a quarter-on-quarter increase of 16% (up from -1% in the previous quarter), indicating a gradual recovery in smartphone demand.

Figure: TSMC Platform Sales Situation

Source: Company announcement, Futu Securities compilation

Given that Apple Intelligence is launching its major iPhone products in phases, buyers remain cautious, and Apple's iPhone 16 launch did not trigger a recent upcycle in AI smartphones. However, the global smartphone sales slump is gradually easing, with Canalys reporting a 5% year-on-year increase in global smartphone shipments in Q3, marking four consecutive quarters of growth.

Figure: Smartphone Shipment Statistics

Source: Canalys, Futu Securities compilation

The company guided Q4 2024 revenue to be between USD 26.1 billion and USD 26.9 billion, exceeding the market expectation of USD 24.9 billion. In the high-performance computing sector, NVIDIA's Blackwell will begin mass production, with market expectations that Blackwell chips will start shipping in volume, which is expected to enhance TSMC's forward guidance clarity. AMD also launched its new 3nm products, further boosting TSMC's high-performance computing revenue in the next quarter.

With strong AI demand persisting and smartphone demand having passed its low point, this creates a positive revenue outlook for TSMC in Q4.

II. Advanced Processes Drive Gross Margin Well Above Expectations

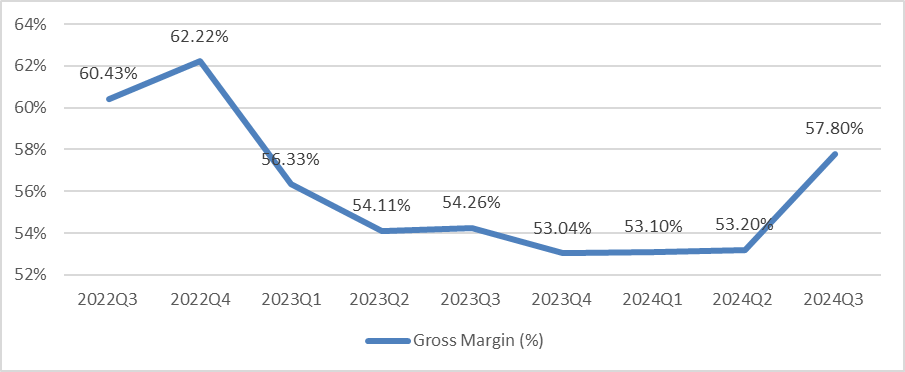

Q3 gross margin returned to around 58%, significantly higher than market expectations of 54.8%, and up 4.6% from the previous quarter. This is mainly attributed to the continued increase in 3nm production, which has driven up the average selling price and gross margin, along with improved capacity utilization.

Figure: Quarterly Gross Margin Situation

Source: Company announcement, Futu Securities compilation

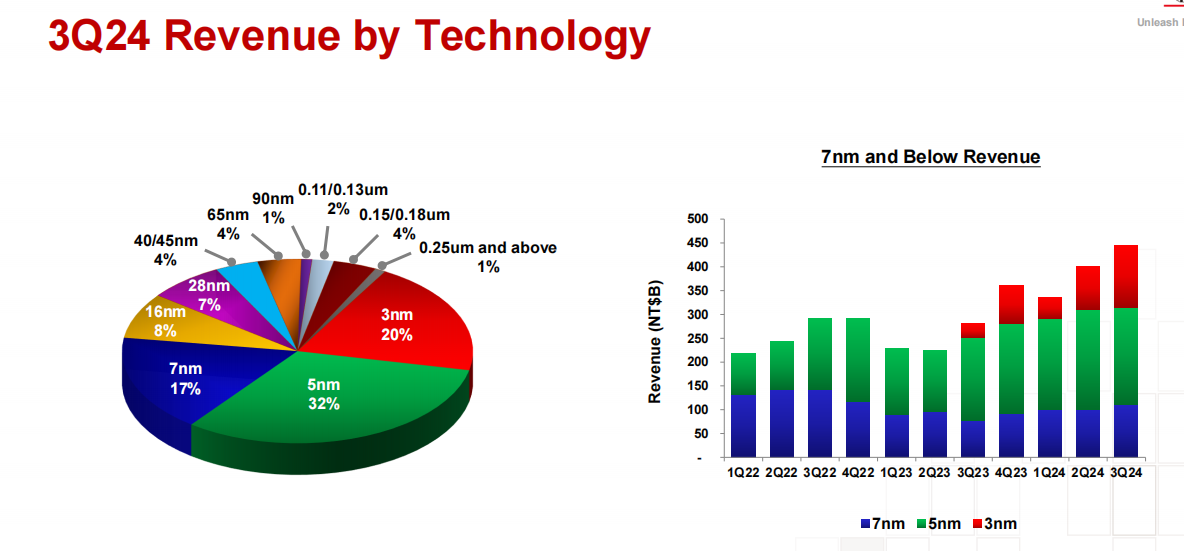

The share of high-priced advanced processes (defined as 7nm and more advanced technologies) continues to rise, with advanced processes accounting for 69% of total wafer revenue in Q3, up from 67% in the previous quarter,with 3nm shipments accounting for 20% of total wafer revenue, marking a 5% increase, which is particularly significant. The entire iPhone 16 series will adopt the 3nm node, and NVIDIA's data center GPUs primarily use 7nm and 5nm processes, gradually transitioning to 3nm.This indicates that the revenue share from advanced processes will continue to increase.

Figure: Quarterly Revenue by Technology

Source: Company announcement, Futu Securities compilation

In the company's guidance for the next quarter, gross margin is also significantly above market expectations, with the company forecasting Q4 2024 gross margin to be between 57% and 59% (market expectation of 54.7%), primarily due to higher capacity utilization in Q4 offsetting costs associated with the ramp-up of N3, the conversion costs from N5 to N3, and the adverse impact of rising electricity prices in Taiwan.

Long-term gross margin projections for 2025 are more complex, with multiple positive and adverse factors intertwining. Overall, we remain optimistic about the 2025 gross margin, as the revenue contribution from overseas factories is relatively small, and it is unlikely to significantly drag down TSMC in 2025 for the following reasons.

Positive factors include:

1) The average selling price (ASP) of cutting-edge technologies (N3, N5, and CoWoS packaging) is expected to increase. According to TrendForce, TSMC plans to raise its 3nm chip prices by over 5%, while advanced packaging prices are expected to rise by 10% to 20% next year. Given that 3nm accounted for 20% of its revenue in Q3 of FY 2024, the continued mass production of 3nm will further enhance the company's average selling price, positively impacting its gross margin.

2) Improvements in process yield and capacity utilization.

3) With the end of the semiconductor inventory adjustment, utilization rates for N7 and mature nodes are expected to recover.

Potential adverse factors include:

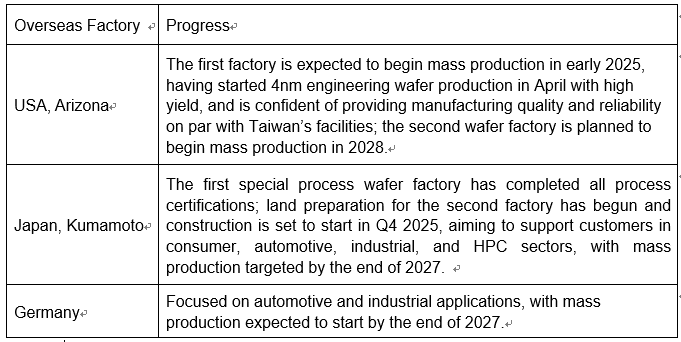

1) Overseas factories will begin ramping up production next year, which may negatively impact gross margins, leading to a dilution of 2-3 percentage points in gross margin each year over the next three years.

2) Cost inflation, particularly the continued rise in electricity tariffs in Taiwan. Higher electricity costs and inflation will dilute TSMC's gross margin by at least 1%.

3) Given the extremely high demand for N3, there may be further conversion of N5 capacity to N3.

III. TSMC has essentially achieved a de facto monopoly

Currently, TSMC has essentially established a de facto monopoly, with challenges faced by Intel and Samsung enhancing TSMC's position as the preferred AI foundry. In the foundry sector, TSMC holds a dominant position in competition and has an advantageous position in negotiations with suppliers and customers—after all, chip companies seeking the best chips have little choice but to go through TSMC.

According to Counterpoint Research, TSMC held a 62% market share in the global foundry market in Q2. Long-term, as chip processes advance into the "5nm" and "3nm" era, Samsung has lost market share and Intel's yields have not met expectations. Undoubtedly, TSMC is likely to maintain a significant market lead.

The current issue TSMC faces is still insufficient capacity in advanced processes. In a "seller's market" environment, TSMC may be able to sustain its current high profit margins for an extended period.

Figure: Global Foundry Market Share Situation

Source: Counterpoint Research, Futu Securities compilation

Summary

TSMC's financial report this time was very impressive, not only guiding a strong AI demand outlook but also indicating a recovery in smartphone demand, with gross margin recovery well above expectations. As a manufacturing company, TSMC achieved a net profit margin of 42.8% in Q3, establishing a high profit level with a strong de facto monopoly position.

Based on this backdrop, we believe that TSMC will continue to maintain a high revenue growth rate in 2025, with room for further improvement in gross margin. Compared to peers in the U.S. semiconductor sector, TSMC's valuation remains relatively cheap. However, considering the potential adverse impacts of geopolitical risks, especially with the ongoing U.S. elections, the increasing risk factors are likely to apply some discount to TSMC's valuation and investment sentiment in the near term. If the valuation falls back to a trading range below 20 times for 2025, the margin of safety will be stronger.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

john song : looks good