TSMC Joins Nvidia, AMD in Options Hotlist After Trump's Remarks on Semiconductors

$Taiwan Semiconductor (TSM.US)$ joined $NVIDIA (NVDA.US)$, $Advanced Micro Devices (AMD.US)$ , and $Broadcom (AVGO.US)$ in the hotlist of the day's most-active stock options as former President Donald Trump said Taiwan took the U.S.'s chip business.

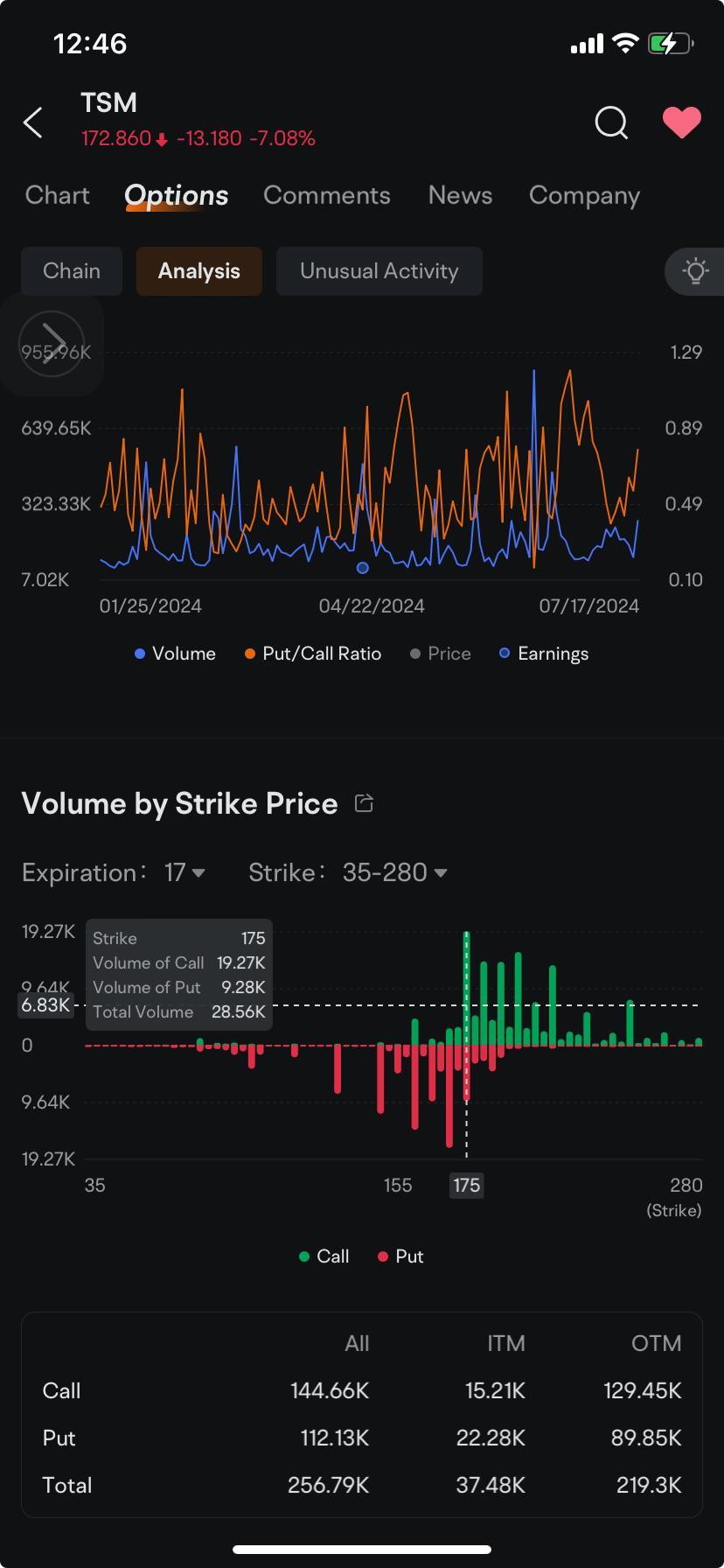

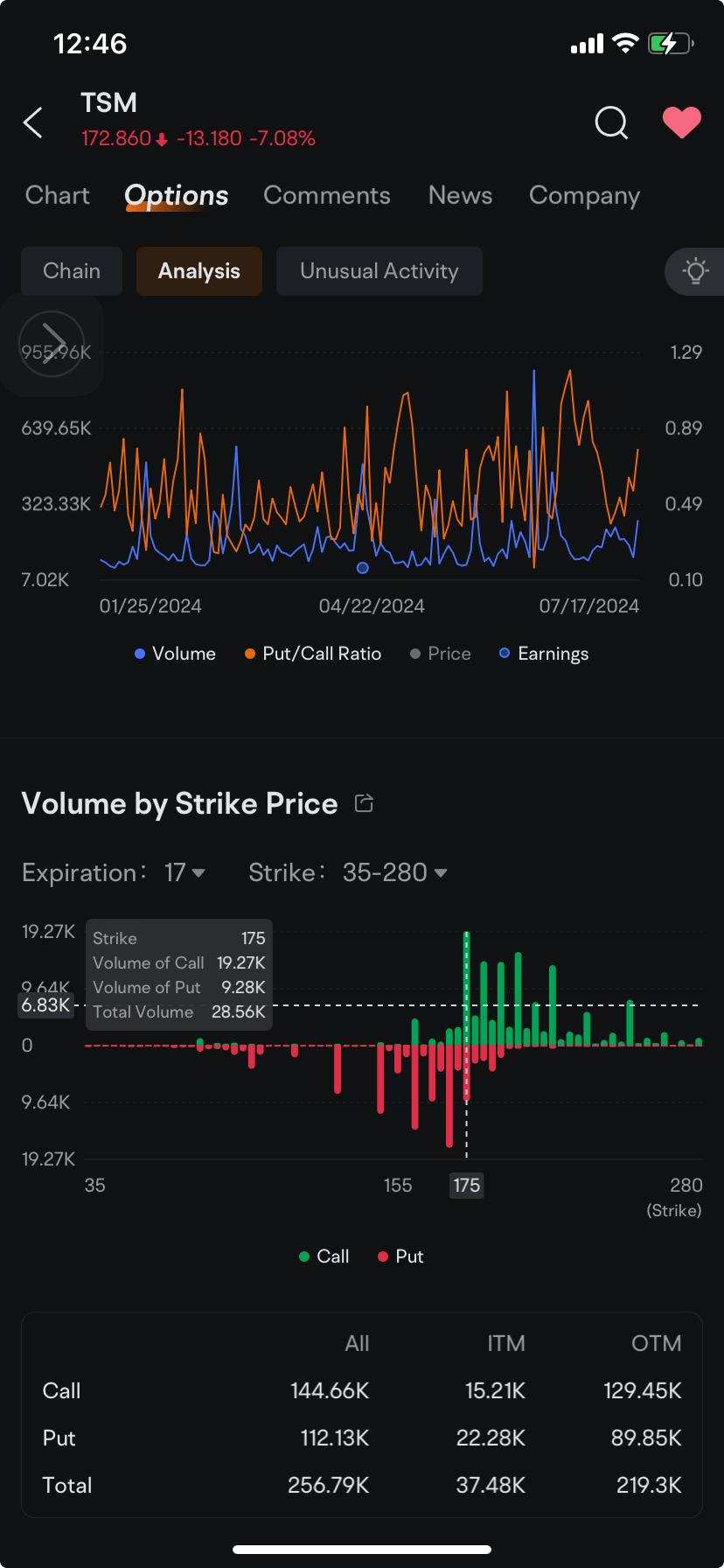

More than 250,000 TSMC stock options changed hands as of 12:49 p.m. in New York Wednesday, behind Nvidia's 3.98 million contracts, AMD' s 718,520 and Broadcom's 347,330, exchange data tracked by moomoo showed.

The heaviest volume in TSMC options are found in contracts that give the holders the right to buy the stock at $175 across 17 expiration dates stretching through Jan. 16, 2026.

Investors and speculators are exiting calls that give the holders the right to buy TSMC shares at $175 as the stock price slumped below that level less than two days before the contract expires. Volume reached 7,830, surpassing open interest of 7,060. The volume jumped from just 467 calls on Thursday as the contract price sank 60% to $5.30.

The stock fell 6.6% to $173.83. Earlier, Trump said Taiwan should pay the U.S. for its defense, Bloomberg Businessweek reported. He also said the U.S. lost its edge in the semiconductor industry because of Taiwan. Nvidia, which counts TSMC among its suppliers, and Broadcom each lost 7%, while AMD tumbled 8.4%.

Fund outflows from TSMC outpaced inflows by $80.51 million, capital trend data tracked by moomoo showed. That took this month's net outflows $1.53 billion, the second straight month that the stock saw funds pulled money from the stock.

Fund outflows from TSMC outpaced inflows by $80.51 million, capital trend data tracked by moomoo showed. That took this month's net outflows $1.53 billion, the second straight month that the stock saw funds pulled money from the stock.

Financial giants are also taking a bearish position on the stock option. At 11:23:13 a.m. in New York, a block trade was posted involving a buyer paying a $6.23 million premium for put options that give the holder the right to sell 520,000 TSMC shares by Jan. 17, 2025.

At that exact time, another bearish block trade was posted involving a financial giant who stands to collect a premium of $3.82 million for writing call options that give the holders the right to buy the same amount of TSMC shares at $230 each, expiring on that same date in 2025.

Share your thoughts on TSMC, Nvidia, AMD, Broadcom and other semiconductor stocks below.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

TTONE : Trump is just a big mouth, a rich madman.

༺近战法师༻ : nvda remains the king in the short term

White_Shadow : Top performer, Shall remain King through 2026

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Clarence Walker4 : No comments

54088 FROM RWS : 1

有風度的希普利 : Profit margin very high.

Leon 8888 : It's the return of the king

红财来 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104463541 : 0

71874541 : So why did you not get it back you had 4 years to do so. Dose he not no the relationship between Tiwan and the U.S. just SMH or he thinks it part of China LOL

View more comments...