TSMC's Bleak Semiconductor Outlook Fuels Sell-Off in $135 Calls

$Taiwan Semiconductor (TSM.US)$'s bleak outlook on the semiconductor industry is fueling the biggest sell-off in call options that give the holder the right to buy the stock at $135 by tomorrow, as shares slumped deeper below that strike price.

TSMC, as the world's largest contract chipmaker is known, saw its shares tumble 3.9% after the company cut its forecast for this year's total market growth, excluding memory chips, to 10%, from "more than 10% three months earlier." The reduction was due to a contraction in automotive chips seen by the Taiwanese company.

The dimmer forecast adds to concerns about whether this year's surge in the share price of chipmakers were justified. On Wednesday, ASML shares sank, sparking a sell-off in other chipmakers including market leader $NVIDIA (NVDA.US)$ and $Arm Holdings (ARM.US)$. The share slump came after the maker of lithography machines used in mass production of chips, reported first quarter net bookings that missed analysts' estimates by about 1.5 billion euros.

The PHLX Semiconductor Index has fallen almost 7% in the past five days, trimming the rally over the past year to 48%, amid worries that the industry is still struggling to recover from an industry glut seen in 2023. The industry got a boost from the surging popularity of generative artificial intelligence that's been driving demand for high powered chips needed to run such applications.

Just before noon in New York, about 16,910 $135 call options were already traded, more than double the 7,140 open interest. That's the heaviest volume seen since activity in the contract started to pick up in August 2023.

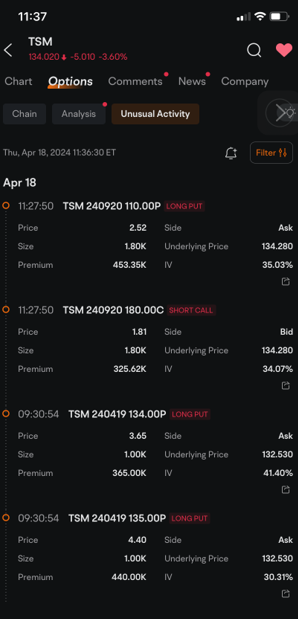

Even whales to spend are jumping in on the action. At 9:30:54 a.m. in New York, a block trade for put options that give the holder the right to sell TSMC shares at $134 by tomorrow was posted, with the buyer paying a $365,000 premium. At that exact time, another block trade for $135 put options for another 100,000 shares was also posted, with a premium of $440,000.

Unusual activities were spotted even for contracts going as far out as Sept. 20. The two block trades posted at 11:27:50 a.m. in New York, including the put options that give the holder the right to sell 180,000 TSMC shares at $110 each by September. The buyer paid a premium of $453,350 for those puts.

The other block trade involved the sale of calls that give the holder the right to buy the stock at $180 each, with the seller standing to collect a $325,620 premium for the contracts written.

The block trade for the $180 calls boosted the volume for those contracts to 2,017, from just 32 on Wednesday, while trading activity on the $110 puts more than doubled to 2,138.

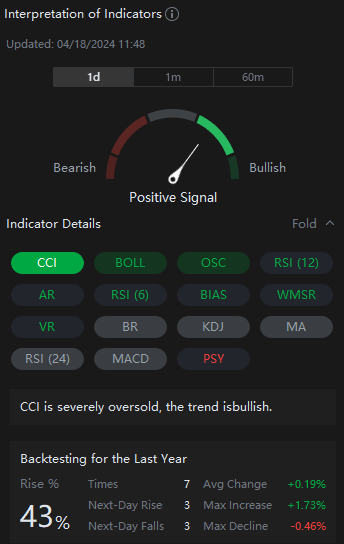

Despite Thursday's sell-off, nine of the 15 technical indicators tracked by moomoo are flagging positive signs, signaling the stock is oversold and could be poised for a rebound.

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

104613757(Lim) : The future of the leading semiconductor boss can be expected

70732196 : Should be below 130 soon.

Willingnow : How can they portray a bleak picture with operating margin over 50%. That’s the scary part!