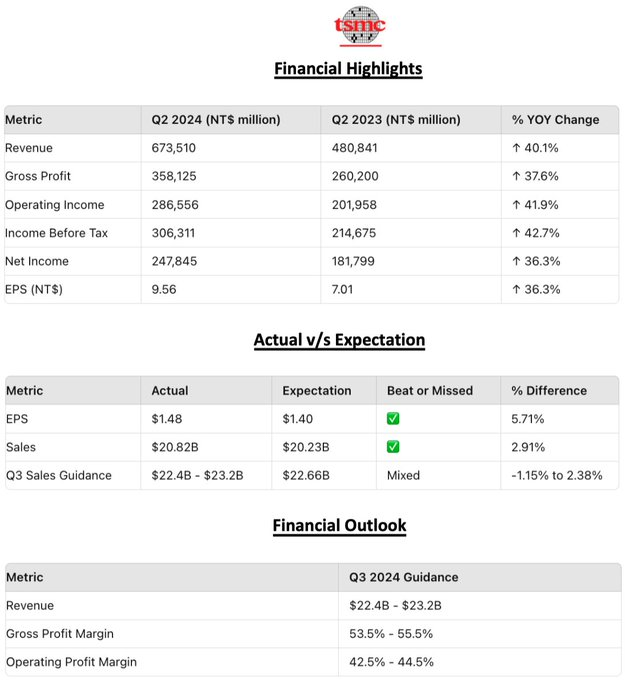

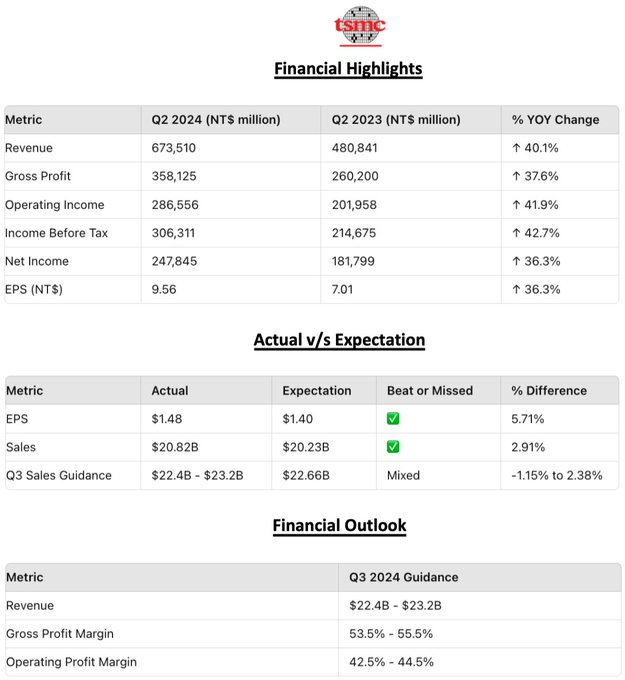

TSMC's Q2 Earning Report

$Taiwan Semiconductor(TSM.US$ Revenue up 40.1% YoY to NT$673.51B, EPS at NT$9.56, a 36.3% increase!

👉 Business Highlights:

➡️ Strong demand for 3nm and 5nm technologies supported business growth.

➡️ Shipments: 3nm accounted for 15%, 5nm for 35%, and 7nm for 17% of total wafer revenue.

➡️ Advanced technologies accounted for 67% of total wafer revenue.

➡️ Expect strong smartphone and AI-related demand in Q3 2024.

➡️ Strong demand for 3nm and 5nm technologies supported business growth.

➡️ Shipments: 3nm accounted for 15%, 5nm for 35%, and 7nm for 17% of total wafer revenue.

➡️ Advanced technologies accounted for 67% of total wafer revenue.

➡️ Expect strong smartphone and AI-related demand in Q3 2024.

👉 Financial Performance:

➡️ Total Revenue: NT$673.51 billion, up 40.1% YoY, up 13.6% QoQ.

➡️ Gross Profit: NT$358.125 billion, up 37.6% YoY, up 13.9% QoQ.

➡️ Operating Income: NT$286.556 billion, up 41.9% YoY, up 15.1% QoQ.

➡️ Income Before Tax: NT$306.311 billion, up 42.7% YoY, up 14.9% QoQ.

➡️ Net Income: NT$247.845 billion, up 36.3% YoY, up 9.9% QoQ.

➡️ Diluted EPS: NT$9.56, up 36.3% YoY, up 9.9% QoQ.

➡️ Total Revenue: NT$673.51 billion, up 40.1% YoY, up 13.6% QoQ.

➡️ Gross Profit: NT$358.125 billion, up 37.6% YoY, up 13.9% QoQ.

➡️ Operating Income: NT$286.556 billion, up 41.9% YoY, up 15.1% QoQ.

➡️ Income Before Tax: NT$306.311 billion, up 42.7% YoY, up 14.9% QoQ.

➡️ Net Income: NT$247.845 billion, up 36.3% YoY, up 9.9% QoQ.

➡️ Diluted EPS: NT$9.56, up 36.3% YoY, up 9.9% QoQ.

👉 Business Segments:

➡️ Wafer revenue: 3nm (15%), 5nm (35%), 7nm (17%).

➡️ Wafer revenue: 3nm (15%), 5nm (35%), 7nm (17%).

👉 Margins:

➡️ Gross Margin: 53.2%.

➡️ Operating Margin: 42.5%.

➡️ Net Profit Margin: 36.8%.

➡️ Gross Margin: 53.2%.

➡️ Operating Margin: 42.5%.

➡️ Net Profit Margin: 36.8%.

👉 CEO Statement:

"Our business in the second quarter was supported by strong demand for our industry-leading 3nm and 5nm technologies, partially offset by continued smartphone seasonality,” said Wendell Huang, Senior VP and Chief Financial Officer of TSMC. “Moving into third quarter 2024, we expect our business to be supported by strong smartphone and AI-related demand for our leading-edge process technologies.”

"Our business in the second quarter was supported by strong demand for our industry-leading 3nm and 5nm technologies, partially offset by continued smartphone seasonality,” said Wendell Huang, Senior VP and Chief Financial Officer of TSMC. “Moving into third quarter 2024, we expect our business to be supported by strong smartphone and AI-related demand for our leading-edge process technologies.”

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment