Two Chinese PMIs came in over the weekend, the S&P and NFLP ...

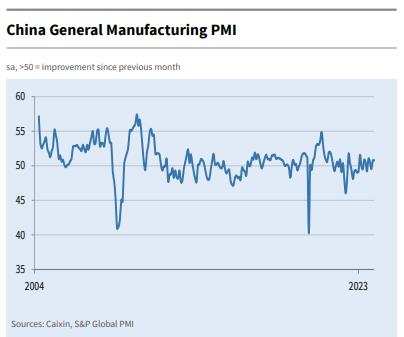

Two Chinese PMIs came in over the weekend, the S&P and NFLP (this one is put out by China's statistical bureau). The results of the two were slightly contradicting.

S&P: 50.8 in Dec, 50.7 in Nov

The recovery in manufacturing has continued for the last 4/5 months, but it is marginal at best. The soft recovery comes from weak export business (6-month low). The domestic recovery has helped production increase, but it hasn't done much to improve hiring sentiment. However, in general, the outlook for the new year seemed to be good: "Chinese manufacturers anticipate production to rise over the course of 2024 amid forecasts of firmer global demand , higher client spending and new product investment"

NFLP: 49.0 in Dec, 49.4 in Nov

China's government appears to have found a sample of manufacturing firms that were a bit more pessimistic than the S&P. The NFLP PMI found that manufacturing firms in general were seeing the worse conditions of the year. While production (50.2) was marginally increasing, new orders (48.7) and foreign orders (45.8) were both decreasing with the latter at the lowest level of 2023. In the end, Chinese manufacturing firms can't seem to maintain pricing power or staffing levels (both at the lowest of Q4 in Dec) as demand is just not strong enough to support any kind of recovery in manufacturing.

The Bottom Line:

Manufacturing malaise is a major problem for China and its ability to kickstart its economy in 2024. Both domestic and foreign demand are struggling with the latter being the main factor in keeping conditions harsh. Domestic demand seems to be improving slightly. One positive that can be take from the S&P PMIs is that the slight recovery that was reported for China in the S&P PMI is stronger than its neighbors. The general ASEAN region posted a weaker 49.7 in Dec while Australia was even worse off at 47.6. I am still cautiously optimistic that China can maintain a positive trajectory in 2024 because it can be dragged up by improvements in foreign economies like the euro area. The key to growth will be in that export orders subindex which should be monitored closely.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment