U.S. election: Hong Kong market snaps win streak; Nikkei225 rallies

Hong Kong markets snap 3-day win streak on U.S. election risk aversion

•As Donald Trump takes the lead in the U.S. presidential race as of the time of writing, investors turn risk adverse amid concerns of potential tariffs on Chinese exports and its impact on global financial markets (South China Morning Post, 6 Nov).

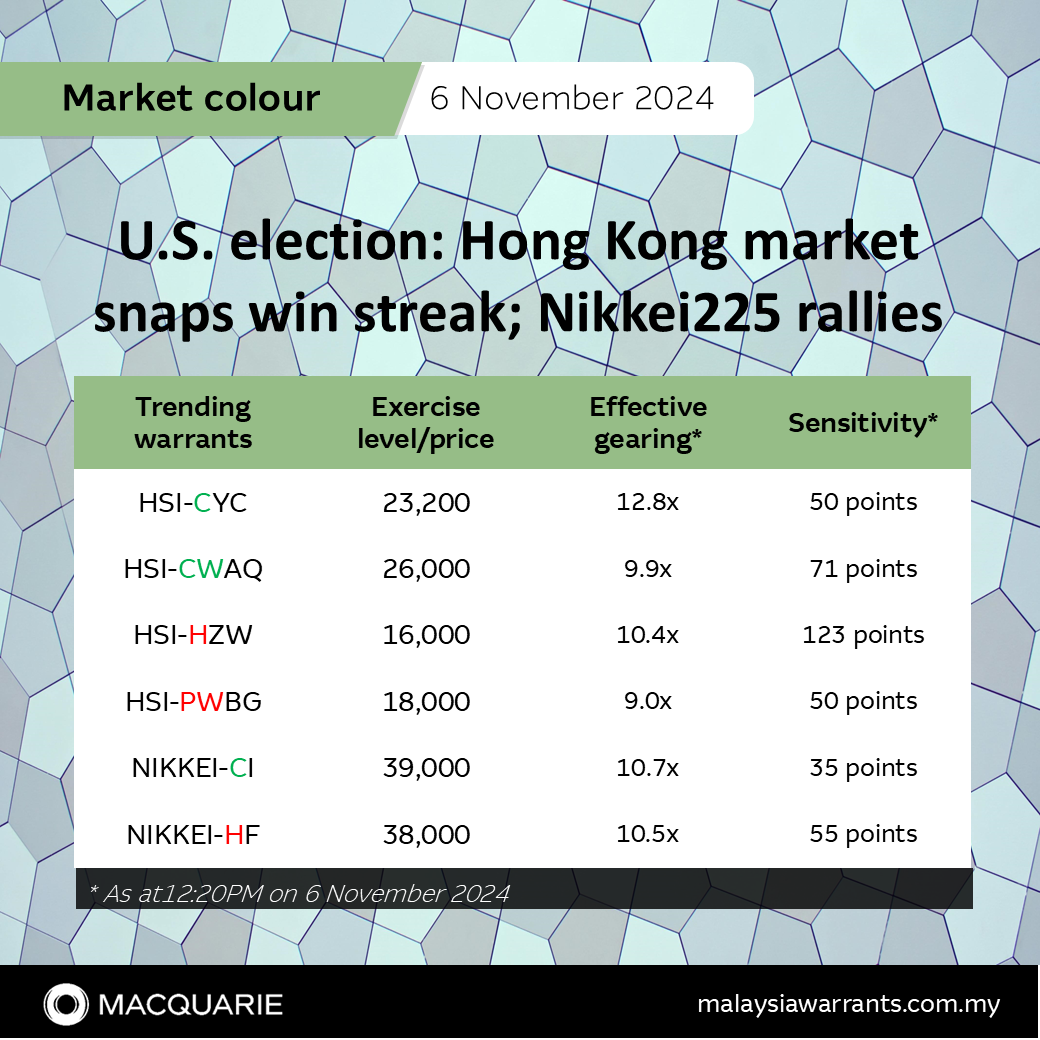

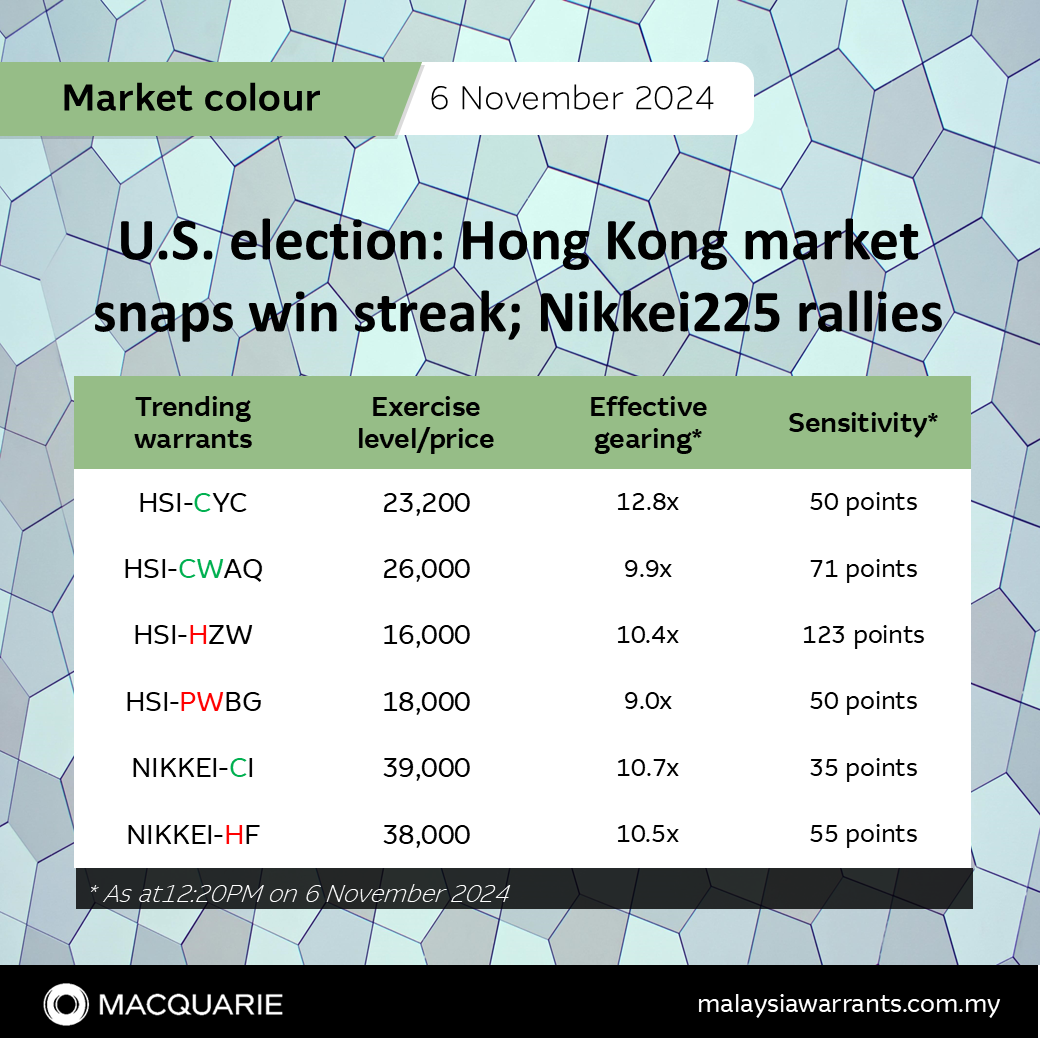

•At the lunch break, the Hang Seng Index (HSI) futures have fallen 2.6% to trade at the 20,453. With the moves in the futures, position taking was largely seen in HSI calls, with investors net buying over 27M units of HSI-CYC and 22M units of HSI-CXY as these warrants tumbled over 28% and 40% as of the lunch break. Nonetheless, bearish investors also net bought over 19M units of put HSI-PWBF.

•Meanwhile, net selling was seen in puts HSI-HZW and HSI-PWBH as these warrants surged over 33% and 26% this morning.📌Investors who wish to trade the volatility in the HSI may do so via our focus call and put warrants here.

🎎Nikkei225 rallies on the news

•On the flipside, Japanese stocks rallied this morning on news of Trump's lead as investors see a Trump victory as expansionary and inflationary, meaning it could be less likely for the Federal Reserve to aggressively cut interest rates (Bloomberg, 6 Nov). The yen weakened against the Dollar while the Nikkei225 futures are currently trading 2.7% higher from yesterday afternoon's close.

•With the moves in the futures, focus call warrant NIKKEI-CI has gained over 30%, while focus put warrant NIKKEI-HF has fallen over 24%. NIKKEI-CI and NIKKEI-HF both have effective gearings of approximately 10x, meaning they tend to move 10% for every 1% move in the Nikkei225 futures.

📌Investors who wish to gain leveraged exposure to the Nikkei225 may do so via our focus warrants here.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment