Uber Plummeted, and Lyft Surged. Are Investors Overreacting to These Two Companies' Earnings Results?

Uber and Lyft's shares were mixed after the companies reported first-quarter results. While Uber Technologies shares were down about 5.7% on Wednesday, Lyft Inc was 7.1% higher.

The ride-sharing industry has been looking for a balance between cost control, driver supply, and promotion strategies. Even though Uber's results fell short of expectations and Lyft exceeded expectations, most analysts maintained their ratings on the two companies based on the competitive landscape.

■ Uber's performance slightly fell short of expectations

Uber disclosed an adjusted first-quarter loss of $0.32 per share on revenue of $10.13 billion. This result was contrary to the expectations of analysts surveyed by FactSet, who projected earnings of $0.22 per share on revenue of $10.1 billion.

One key factor impacting Uber's stock is that the company's bookings for the quarter slightly missed the mark. Gross bookings increased by 20% to reach $37.7 billion, which was slightly below the anticipated $37.93 billion, falling short by roughly 1% and sitting just under the midpoint of Uber's own guidance range. The company's gross bookings projection for the June quarter was modestly lower than what analysts had estimated.

In documentation provided for an analyst call, Uber's CFO, Prashanth Mahendra-Rajah, mentioned that the company experienced weaker ride-sharing bookings in Latin America during the quarter. Additionally, Uber noted that its freight business is facing industry-wide challenges.

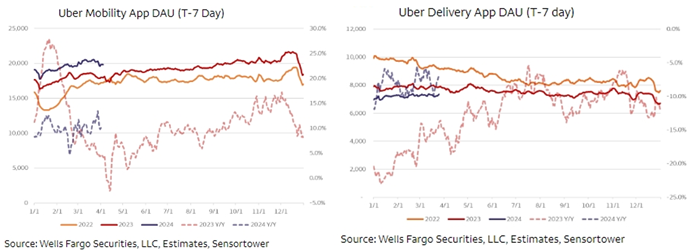

Bloomberg analyst Robert Schiffman says Uber's deceleration in bookings growth could be hinting at rider saturation in its Mobility unit, with monthly active users flat. Meanwhile, higher insurance expenses could limit margin expansion. Besides, any regulatory changes related to driver benefits in the US and European markets are still a risk to top-line growth.

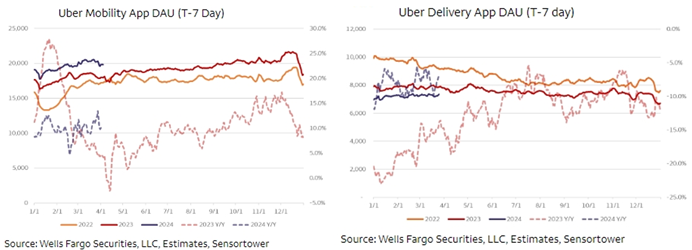

Still, Schiffman noted that Uber's dominant position in its Mobility segment and steady ramp-up of ads on its platform continue to aid its profitability view. Steady supply growth and traction in Uber One subscriptions is helping drive higher frequency on its platform. He believes Uber is likely to spin off the Freight unit due to its drag on profitability amid weak market positioning.

Though Uber's stock price is lower following 1Q results, as gross bookings slightly disappointed relative to expectations, its balance-sheet improvement hasn't slowed down, highlighted by record quarterly EBITDA and $1.4 billion in free cash flow.

■ Lyft reports better-than-expected results despite the risk of lower take rates

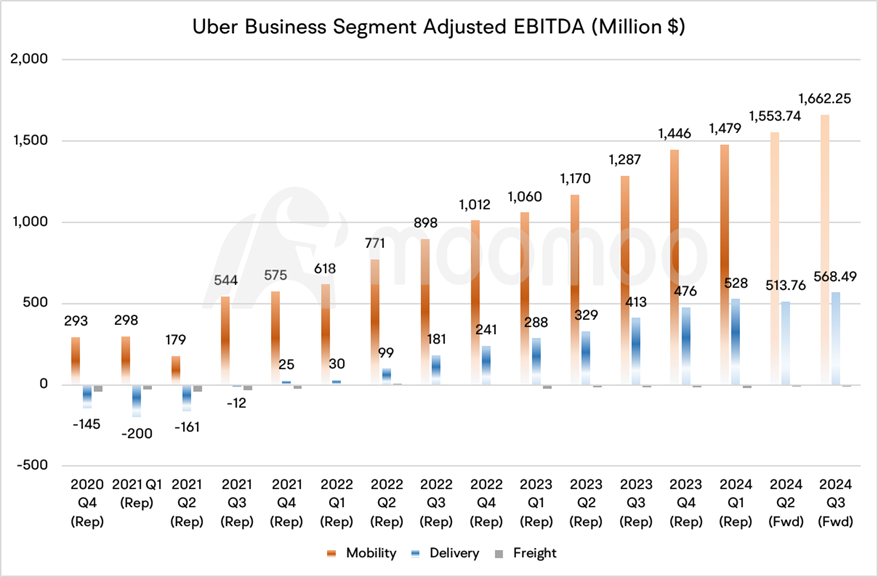

Lyft reported a 28% increase in revenue, reaching $1.3 billion, which exceeded the consensus estimate of $1.16 billion. The company's adjusted EBITDA saw a significant surge of 162%, rising to $59.4 million from $22.7 million in the same quarter of the previous year.

The number of rides during the quarter climbed by 23%, totaling 188 million, while active riders increased by 12% to 21.9 million. Lyft's gross bookings grew by 21% to $3.7 billion, a growth rate in line with that of Uber's ride-sharing division. Looking ahead to the June quarter, Lyft anticipates gross bookings to be between $4 billion and $4.1 billion, with adjusted EBITDA projected to be in the range of $95 million to $100 million.

Although Lyft reported higher-than-expected financial results and increased the frequency of individual customer rides, Schiffman believes that its take rates may still be under pressure, citing the fact that its number of active passengers has remained basically flat over the past three quarters, forcing it to use greater incentives for supply growth on its platform.

■ The ride-sharing industry is becoming increasingly fierce

It's not fair to compare the two companies directly. Uber boasts a significantly broader and more intricate business model than its counterpart, encompassing not only ride-sharing but also the delivery of food and groceries, as well as freight logistics services. With a global reach that extends far beyond Lyft's predominantly U.S.-centered operations, Uber's scale dwarfs that of Lyft, being nearly a factor of 10 larger in terms of both revenue and bookings. When it comes to market capitalization, Uber's valuation is approximately 19 times greater than Lyft's.

However, both companies face an increasingly competitive landscape. Amazon's grocery subscription and Tesla's Robotaxi may have a negative impact on the corresponding businesses of Uber and Lyft. DoorDash's order growth rate has reached 20%, almost twice that of the Uber-Instacart camp.

Hence, Uber chose to cooperate with Instacart to make up for the shortcomings of grocery delivery. Instacart's unit economics look better than rival delivery-marketplace peers, driven by its recent success with ads. The partnership with Instacart to offer restaurant delivery is likely to boost order-volume growth, which is key to expanding the high-margin ad business of all marketplaces.

■ Several analysts fine-tuned their statements about the two companies

Ralph Schackart, an analyst at William Blair, maintained his Outperform rating for Uber, acknowledging in a research note that the stock faces pressure from weaker bookings, an unanticipated loss from markdowns in its investment portfolio, and a high level of trading activity before earnings announcements. However, he believes that Uber's prospects for 2024 are positive due to product enhancements and growing margins, anticipating a potential increase in the stock's value of 20%-25% over the coming year.

Scott Devitt from Wedbush also maintained an Outperform rating with a price target of $85, noting in his research that the core business is robust. He suggests purchasing the stock during any dips in price.

Conversely, Michael McGovern of BofA Global Research retained an Underperform rating on Lyft but raised his price target to $15 from $12.50. Despite Lyft surpassing expectations in bookings, revenue, and adjusted EBITDA for the quarter, he expressed concern about the possibility of a slowdown in bookings.

Bernie McTernan of Needham, while keeping his Hold rating on Lyft, praised the company's quarterly performance. He highlighted Lyft's continuous improvements to its service platform, particularly the focus on drivers, which has led to record-high driver hours and, consequently, a better experience for riders, including shorter wait times and reduced surge pricing. McTernan also commended the revamped management team at Lyft for their enhanced execution, which he believes has positively influenced the valuation multiples investors are willing to apply to the stock.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment