Uncertainty looms ahead of Powell's speech tonight

US Market Key Charts (S&P, US Dollar, Gold)

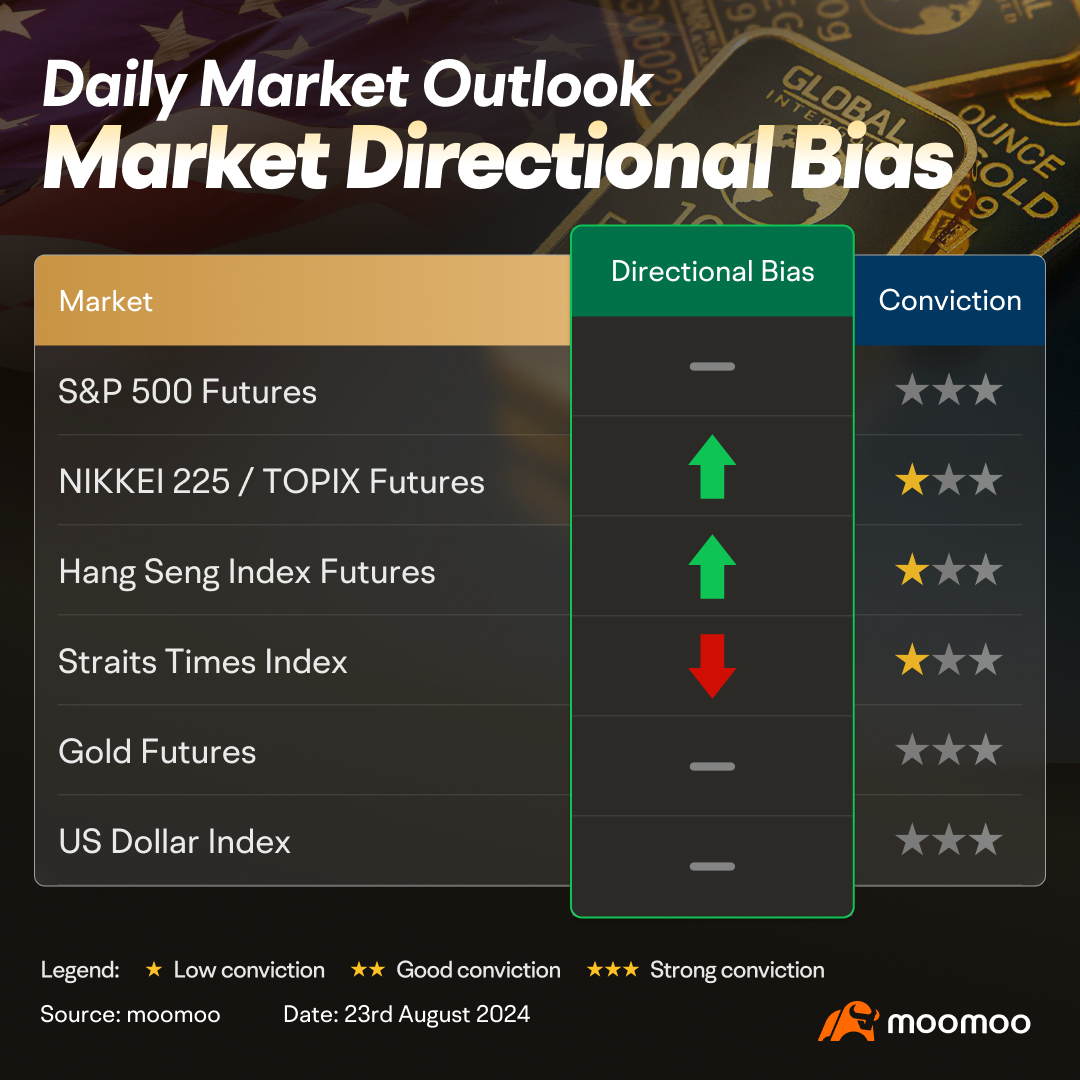

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]SPX pulled back lower last night, invalidating previous bullish view. We turn neutral now watching near term resistance at 5641.50 and support at 5558. A candlestick close back above 5641.50 will revive the bullish scenario and open further rise towards 5708.25.

Alternatively: A 4 hour candlestick closing below 5558 support level will open a deeper drop towards next support level at 5472.50.

$USD (USDindex.FX)$ (4 Hour Chart) -[NEUTRAL]View unchanged. Remain neutral for now as technical levels are unchanged, with no good levels for a meaningful risk to reward entry, price is expected to consolidate sideways between 100.830 support and 101.635 resistance. A candlestick close below 100.830 support will open a deeper drop towards 100.00

Alternatively: A 4 hour candlestick closing above 101.635 resistance will open further rise towards next resistance at 102.220.

$Gold Futures(FEB5) (GCmain.US)$ (4 Hour Chart) -[NEUTRAL] Market tested previous support at 2522.50 and is now whipsawing around the level. We turn neutral for now between resistance at 2543 and support at 2513. A candlestick close below 2513 support will open a deeper drop towards next support at 2482.

Alternatively: A 4 hour candlestick closingabove 2543 resistance will open a short term rise towards recent swing high at 2570.50.

NIKKEI 225 / TOPIX IndexFutures

$Nikkei 225 (.N225.JP)$ (4 Hour Chart) -[BULLISH↗ *]Rise in progress as expected. We maintain our bullish directional bias as long as price is holding above 37470 support with a limited push higher towards 39220 resistance. Technical indicators are still advocating for a bullish scenario. However, MACD indicator is showing a slowdown in bullish momentum.

Alternatively: A 4 hour candlestick closing below 37470 support level could open a drop towards next support level at 36500.

HSI IndexFutures

$HSI Futures(DEC4) (HSImain.HK)$ (4 Hour Chart) -[BULLISH↗ *]Prices continue to form in an ascending channel. We maintain our bullish directional bias with lowered conviction as we expect price to push towards 18000 resistance level. Technical indicators advocate for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 17200 support level could open a droptowardsnext support level at 16500.

SG Market - STI

$FTSE Singapore Straits Time Index (.STI.SG)$ (4 Hour Chart) -[BEARISH ↘ *]We turn bearish as price is nearing 3400 resistance level. We expect price to take a pause at 3400 resistance level before pushing down towards 3350 support level. Technical indicators are mixed, with 55-EMA period crossing over 21-EMA period.

Alternatively: A 4 hour candlestick closing above 3400 resistance level could open a drop towards 3450 resistance level.

Summary - What Is Happening In The Markets

US markets closed lower last night, with $E-mini S&P 500 Futures(DEC4) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ closing lower by 0.84% and 1.66%. respectively. Tech sector saw the steepest drop, with $NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$ and $Microsoft (MSFT.US)$ falling by 3.70%, 5.70% and 2.0% respectively. This is due to underperforming US manufacturing PMI data. Traders should keep a look out for Powell's speech at the Jackson Hole symposium and new home sales data released tonight.

Asian markets opened lower across the board, mirroring the US indices. $HSI Futures(DEC4) (HSImain.HK)$ drifted down the most by 0.96%. Tech sector led the drop, with $NTES-S (09999.HK)$ falling the most by 13.08%. $Nikkei 225 (.N225.JP)$ dipped by 0.16%, due to rising inflation data. Traders are cautious as they look ahead to Powell's speech at the annual Jackson Hole symposium later. $FTSE Singapore Straits Time Index (.STI.SG)$ closed marginally lower by 0.05%, with weakness from the finance and consumer durables sector. Investors sentiment have also been dampened as Singapore sets up screening for Mpox Virus after Thailand detected first mutated strains in asia.Traders should look out for CPI data released later.

Asian markets opened lower across the board, mirroring the US indices. $HSI Futures(DEC4) (HSImain.HK)$ drifted down the most by 0.96%. Tech sector led the drop, with $NTES-S (09999.HK)$ falling the most by 13.08%. $Nikkei 225 (.N225.JP)$ dipped by 0.16%, due to rising inflation data. Traders are cautious as they look ahead to Powell's speech at the annual Jackson Hole symposium later. $FTSE Singapore Straits Time Index (.STI.SG)$ closed marginally lower by 0.05%, with weakness from the finance and consumer durables sector. Investors sentiment have also been dampened as Singapore sets up screening for Mpox Virus after Thailand detected first mutated strains in asia.Traders should look out for CPI data released later.

Prepared by:

Moomoo Singapore

Isaac Lim CMT, CFTe

Chief Market Strategist

Chief Market Strategist

This report is provided for informational and general circulation purposes only and should not be construed as an offer, solicitation, or recommendation for the purchase or sale of securities, futures, or other investment products. It does not take into consideration any particular needs of any person. This advertisement has not been reviewed by the Monetary Authority of Singapore.

For full disclaimers, please visit https://www.moomoo.com/sg/support/topic5_935.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

105438147 : Half a year ago, the market confirmed that interest rates would be cut in September, but now the market is worried that the economy has entered recession!

Annq : If interest rates are cut at the highest point in the stock market, is it possible that inflation will make a comeback and then cause stagflation?