[Options ABC] Understanding changes in implied volatility for options at the NVIDIA GTC AI conference

Welcome back to moomoo! I'm Options Explorer.

Today, we're diving into understanding options' implied volatility shifts at NVIDIA's 2024 GTC AI Conference.

The event returned to an in-person setting on March 18th for the first time in five years and is a key summit for AI progress.

$NVIDIA (NVDA.US)$ launched its new AI GPU, Blackwell, and a next-gen AI supercomputer at the conference. They also announced a 6G research cloud platform to enhance wireless communication using AI.

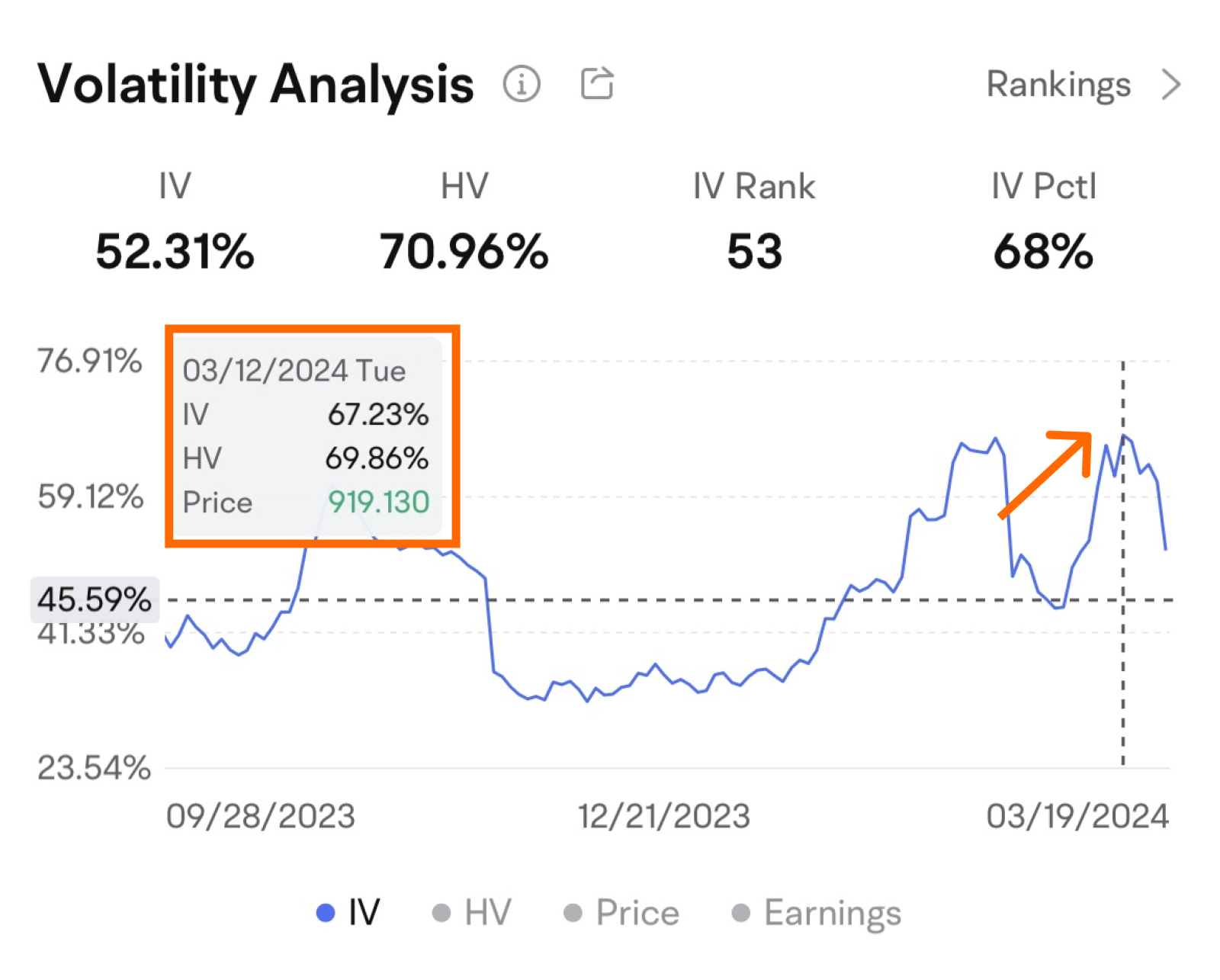

Here's a noteworthy observation from moomoo regarding NVIDIA's option chain implied volatility (IV):

Before NVIDIA's AI conference, on March 12th, the option chain's IV reached a near one-month high.

![[Options ABC] Understanding changes in implied volatility for options at the NVIDIA GTC AI conference](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240321/1711009723255-9c19d6392e.png/big?area=100&is_public=true)

Yet, once the conference commenced on the afternoon of the 18th, we saw a clear drop in IV, indicating a classic post-event IV crush in the options market.

![[Options ABC] Understanding changes in implied volatility for options at the NVIDIA GTC AI conference](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240321/1711006299525-65384d6fcc.png/big?area=100&is_public=true)

Note: Any app images provided are not current and any securities shown are for illustrative purposes only and is not a recommendation.

Some mooers might be wondering, how can one view the aforementioned IV data?

Explore the latest [Volatility Analysis] tools on moomoo, which present comprehensive IV data across the entire option chain and enable comparisons of IV levels over time for more informed trading decisions.

You could update the app to see it next week!

Once updated, tap on Detailed Quotes of underlying stock > Options > Analysis > Volatility Analysis to see them.

Note: If you meet any issues during the update, please contact us through live support or online customer service.

Before we delve deeper into explaining the IV crush, let's first review the basics.

Implied volatility (IV) measures the market's forecast of a stock's potential price changes.

It is calculated using known variables such as the stock's current price, option premiums, interest rates, and the time remaining until option expiration, typically through a standard pricing model.

In essence, IV helps gauge the cost of options:

high IV suggests they're pricier, while low IV indicates they're less expensive, all other factors being equal.

Investors often adopt a strategy of buying options when IV is low and selling when it's high, aiming to stay delta neutral—unaffected by the stock's direction.

Major events often trigger market volatility and affect option IV.

An IV crush is a sharp decline in IV post-event, like earnings reports or major meetings.

Today, we'll analyze NVIDIA's earnings to understand typical IV patterns around big events for better strategic insight.

Take a look at this chart for NVDA's earnings release dates, daily closing prices, and implied volatility (IV) over the past year.

We'll notice a strong correlation between IV spikes during earnings announcements and significant stock price fluctuations.

![[Options ABC] Understanding changes in implied volatility for options at the NVIDIA GTC AI conference](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240321/1711006299644-2aa832e662.png/big?area=100&is_public=true)

So, what's the reason behind this phenomenon?

Typically, for most stocks in the market, about 3-7 days before earnings are released, IV can increase rapidly, which drives up the price of options.

But as soon as the earnings report is officially announced, the IV drops, causing an 'IV Crush' and returning the options to their actual levels.

Many investors have found a opportunity for arbitrage in this trend.

Once it reaches this level, they attempt to exit the market and potentially earn the profits brought on by the increase in IV before the financial reports are released.

Given the strategy is theoretically a long volatility strategy, a lack of price changes until the expiry date may cause the loss of all premiums paid.

If you have a directional expectation for the stock, you can choose to purchase either a Call or a Put option.

But if you're not sure which way the stock will go, consider a Long Straddle strategy. This involves buying both a Call and a Put option at the same time.

A drawback with this is a long straddle is more expensive and would require a larger move of the underlying to potentially profit.

Click here to learn more: How Can Long Straddle Potentially Hedge Risks? A Case Study of Tesla

This is known as a Short Straddle option strategy.

Short Straddle, a trading tactic where investors sell both Call and Put at the same strike price, may generate profits in a stable market but also carries the potential for significant losses should there be significant fluctuations in the underlying stock price.

Hence, risk management and stop-loss plan is crucial when using this strategy.

Following the release of financial reports and if there appears to be an IV crush, investors should consider quickly closing their option positions.

For some traders, there's no need to make a judgment on the direction of stock prices, as the primary aim is to profit from the Potential sharp decrease in volatility before and after the report.

When IV is high, the option is also expensive.

As a hypothetical example, if you sell an option for $10 per contract and the IV drops significantly after the release of the report, the option price will likely fall correspondingly.

By buying back the option at $3 per contract, you can close your position and earn a profit of $7 per contract.

Click here to learn more: How Can Short Straddle Potentially Profit from Low Volatility: A Case Study of BAC

That's what today's lesson is all about. If you have questions or thoughts, feel free to leave a comment.

Our analysis reveals that significant events, like NVIDIA's GTC AI conference, can possibly have an impact options market volatility, presenting potential opportunities for astute investors.

Remember, options trading is high-risk, so it's crucial to assess the market thoroughly and invest with care.

Risk Statement

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc.

In the U.S., investment products and services available through the moomoo app are offered by Moomoo Financial Inc., a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) and a member of Financial Industry Regulatory Authority (FINRA)/Securities Investor Protection Corporation (SIPC).

In Singapore, investment products and services available through the moomoo app are offered through Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS). Moomoo Financial Singapore Pte. Ltd. is a Capital Markets Services Licence (License No. CMS101000) holder with the Exempt Financial Adviser Status. This advertisement has not been reviewed by the Monetary Authority of Singapore.

In Australia, financial products and services available through the moomoo app are provided by Futu Securities (Australia) Ltd, an Australian Financial Services Licensee (AFSL No. 224663) regulated by the Australian Securities and Investment Commission (ASIC). Please read and understand our Financial Services Guide, Terms and Conditions, Privacy Policy and other disclosure documents which are available on our website https://www.moomoo.com/au.

In Canada, order-execution only services available through the moomoo app are provided by Moomoo Financial Canada Inc., regulated by the Canadian Investment Regulatory Organization (CIRO).

In Malaysia, investment products and services available through the moomoo app are offered through Futu Malaysia Sdn. Bhd. ("Moomoo MY") regulated by the Securities Commission of Malaysia (SC). Futu Malaysia Sdn. Bhd. is a Capital Markets Services Licence (License No. eCMSL/A0397/2024) holder. This advertisement has not been reviewed by the SC.

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd and Moomoo Financial Canada Inc., and Futu Malaysia Sdn. Bhd. are affiliated companies.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Moo Options Explorer OP : Note:This new feature - Volatility Analysis will go live next week. Please be patient and wait for its release.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Follow me, as next week I will have an article that provides a detailed description of how to use this feature.

Follow me, as next week I will have an article that provides a detailed description of how to use this feature.

DannyK99 : did not read. is stonk go up or down?

Jay Clark501 : $NVIDIA (NVDA.US)$

BelleWeather : This is incredibly useful. And I now understand mistakes I’ve made. I should not have been trading options before! But now I clearly see the path to profitability.