United Airlines (UAL) IV Skew Suggest Downside Post Earnings

$United Airlines (UAL.US)$ is scheduled to announce Q4 earnings results on 22 Jan (Monday) after market close.

The consensus EPS Estimate is $1.71 (-30.5% Y/Y) and the consensus Revenue Estimate is $13.55B (+9.3% Y/Y). Over the last 2 years, UAL has beaten EPS estimates 75% of the time and has beaten revenue estimates 63% of the time.

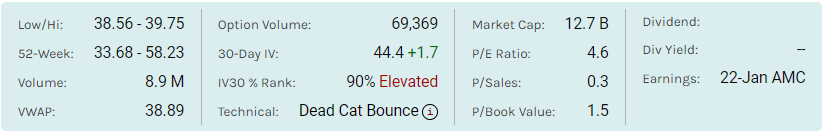

Shares of United Airlines Holdings Inc. UAL slid 2.39% to $38.82 on 19 Jan (Friday), on what proved to be an all-around great trading session for the stock market, with the S&P 500 Index SPX rising 1.23% to 4,839.81 and the Dow Jones Industrial Average DJIA rising 1.05% to 37,863.80.

United Airlines Holdings Inc. closed $19.41 short of its 52-week high ($58.23), which the company reached on 21 July 2023.

United Airlines (UAL) Technical

The current technical is showing a Dead Cat Bounce, where UAL is trying to come back from a downside but failed to do so even in an all-around great trading session on Friday (19 Jan).

United Airlines (UAL) Upcoming Earnings Guidance

UAL has issued earnings guidance for FY 2023. EPS estimate in the range of 11.00 to 12.00, which would be a 367% increase from the prior year.

United Airlines (UAL) Last Reported Earnings

UAL last reported earnings on 17 Oct 2023 after the market close (AMC). as UAL shares declined -9.7% the day following the earnings announcement to close at 36.24. Following its earnings release, 96 days ago, UAL stock has drifted +7.1% higher.

From the time it announced earnings, UAL traded in a range between 33.68 and 44.54. The last price (38.82) is closer to the lower end of range.

United Airlines (UAL) Historical Moves Ahead of Earnings

UAL historically moved higher heading into earnings more often than not. On average, the stock gained 3.1% for the 2 week period before earnings (based on the last 12 quarters of data).

United Airlines (UAL) Historical Stock Price Reaction to Earnings

UAL shares have moved lower in the immediate aftermath of earnings 7 out of 12 previous reports. On average the stock moved down -1.2% in the first day of trading after the company reported earnings.

United Airlines (UAL) Stock Behavior After Earnings

Based on the previous 12 earnings releases, UAL is more likely to trade lower 1 day after earnings for an average loss of -0.3%

United Airlines (UAL) Post Earnings Announcement Drift

UAL share price has drifted up 7.1% post earnings announcement. Using the last 12 quarters data, the average drift between earnings announcements is 3.7%. The current drift represents a positive 0.4 standard deviation move.

Current post earnings announcement drift: 7.1%

Historical average post earnings announcement drift: 3.7%

Historical post earnings drift standard deviation move: ±20.2%

United Airlines (UAL) Post Earnings Movement

The options market overestimated UAL stocks earnings move 50% of the time in the last 12 quarters. The predicted move after earnings announcement was ±5.7% on average vs an average of the actual earnings moves of 6.0% (in absolute terms).

This shows you that UAL tended to be more volatile than the options market predicted for the earnings stock price reaction.

United Airlines (UAL) Earnings Implied Volatility Crush

UAL's last earnings implied volatility (IV30) going into earnings was 41.1. The last time UAL released earnings, the implied volatility dropped to 39.2, resulting in an implied vol crush of 5%. 5 days after earnings, the 30 day IV was 38.9.

Average Implied Volatility Crush For UAL Earnings: 8%

Average 30 Day Implied Volatility 1 Day Before Earnings: 47.5

Average UAL 30 Day IV for the Day of Earnings: 43.8

Average 30 Day Implied Volatility 5 Days After Earnings: 45.0

United Airlines (UAL) IV Percentile Rank

UAL implied volatility (IV) is 44.4, which is in the 90% percentile rank. This means that 90% of the time the IV was lower in the last year than the current level. The current IV (44.4) is 2.9% above its 20 day moving average (43.1) indicating implied volatility is trending higher.

United Airlines (UAL) IV vs 20-Day HV

The current IV (44.4) in UAL is 25.0% above its 20 day HV (35.5) suggesting that options markets are predicting future volatility to trade above the most recent 20 day realized volatility.

United Airlines (UAL) Implied Volatility Skew

The implied volatility skew shows the market's bias for pricing in volatility risk to the option premium of downside puts and upside calls.

The implied volatility for downside puts is increasing relative to upside calls, this suggests the market is pricing in a larger fear to a downside move.

With low short selling interest at around 5%, UAL seem to be trying to make a recovery from its downside, but market does not seem to have placed much sentiment for an upside.

Summary

With the performance on last Friday (19 Jan), where market has generally an all-round upside, UAL seem to not able to get out of its dead cat bounce.

Appreciate if you could share your thoughts in the comment section whether you think UAL would be able to gather investors sentiment for an upside.

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment