United Airlines (UAL) Pricing Pressure Impact On Its Profitability

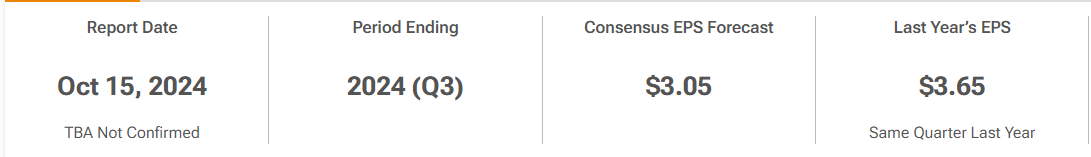

$United Airlines (UAL.US)$ is scheduled to report its Q3 earnings results on 15 Oct (Tuesday) after the market close.

Market is anticipating that United will report lower earnings for the July-September quarter than a year earlier, but higher revenue. The airline’s profit surged 23% in the second quarter, as record crowds at U.S. airports helped the carrier overcome sharply rising costs for fuel and labor.

In July, United warned that its third-quarter results would miss Wall Street’s expectation, citing a glut of U.S. flights that led to airlines cutting prices to fill seats.

The consensus EPS Estimate is $3.05 (-13.2% Y/Y) and the consensus Revenue Estimate is $14.73B (+1.7% Y/Y).

Cautious Guidance Issued For Third-Quarter In July

The management issued cautious third-quarter guidance as airline companies experience an oversupply that puts pressure on pricing and profitability. It expects Q3 profit to be in the range of $2.75 per share to $3.25 per share, which is below the market’s projection.

The company also reaffirmed full-year earnings guidance between $9 per share and $11 per share, anticipating margins to benefit from the positive cost performance.

The company has initiated a capacity reduction program that will extend into the fourth quarter, to align operations with the current demand trend. While it continues to benefit from the post-COVID upswing in long-haul travel, the company also faces challenges like delays in aircraft delivery and safety incidents.

Fed’s Rate Cut As A Catalyst For More Passenger Traffic?

The recent Fed rate cut should act as a catalyst for United’s efforts to boost passenger traffic. According to the leadership, its ambitious United Next plan is progressing as planned — expanding the network by adding new aircraft to the fleet and upgrading facilities in existing units.

Recently, the company signed a pact with Elon Musk’s satellite internet service Starlink to provide free inflight Wi-Fi to passengers. The ongoing capacity optimization, to maintain operations sustainably, has resulted in an improvement in revenue per available seat mile.

In the second quarter, net income per share, excluding one-off items, decreased to $4.14 per share from $5.03 per share in the corresponding period a year earlier. Earnings exceeded analysts’ estimates, marking the eighth beat in a row. On an unadjusted basis, net income was $1.32 billion or $3.96 per share in Q2, vs. $1.08 billion or $3.24 per share in the year-ago quarter.

Revenues increased to $14.99 billion in Q2 from $14.18 billion in the comparable period of 2023. The top line came in slightly below estimates, reversing the recent trend. Passenger revenue, which constitutes the lion’s share of the total, grew 5% year-over-year reflecting continued momentum in domestic travel.

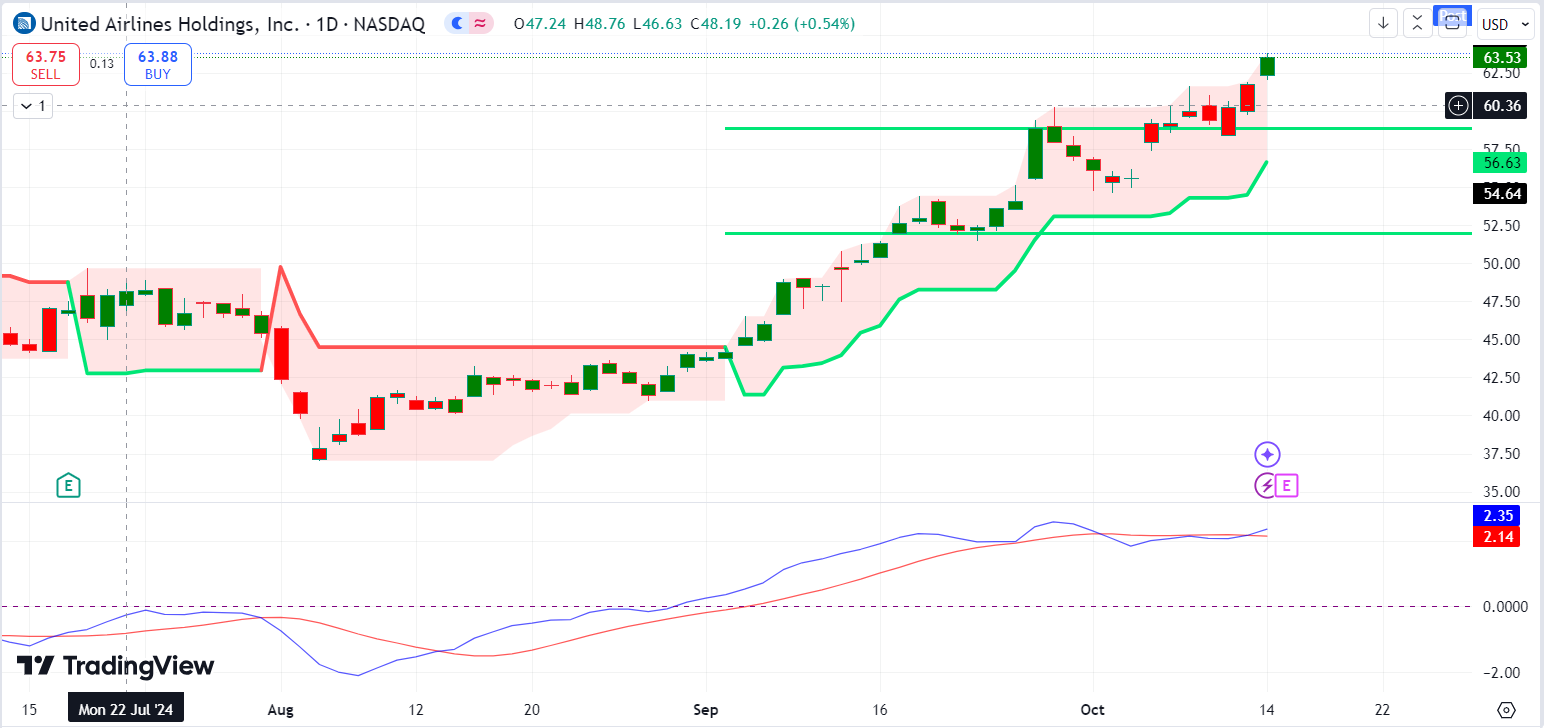

United Airlines’ stock is maintaining an uptrend ahead of next week’s earnings. It gained 2.80% on Monday (14 Oct).

Technical Analysis - MACD + Multi-time frame

We are seeing positive signal from the MTF, where UAL is trading above both short-term and long-term MA, and there is a strong uptrend from the MTF.

Considering that UAL have a mixed Q2, and we have also seen $Delta Air Lines (DAL.US)$ giving a mixed result recently, we might see a similar situation from UAL, but I am expecting the stock price to trade higher because we could see that MACD is preparing for a bullish MACD crossover.

Technical Analysis - SuperTrend Price Target

If we were to look for a higher price target for UAL ahead of its earnings, I would think that there might be range-bound trading as there is no new price target higher.

I would think that investors might be adopting a wait and see mood and see if UAL could make some significant upside move.

Summary

I think UAL similar to its peers and competitors would face challenges ahead of the geopolitical tensions in the middle east, and also the pricing that might hit their profitability.

The benefit from Fed rate cut would not been seen so fast, so I would continue to monitor and see if we could find an opportunity to trade.

Appreciate if you could share your thoughts in the comment section whether you think UAL would give a surprise earnings and their earnings guidance for fourth quarter to improve as well.

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment