Universal Health (UHS) Sustained Managed Services Demand Key For Increased Revenue

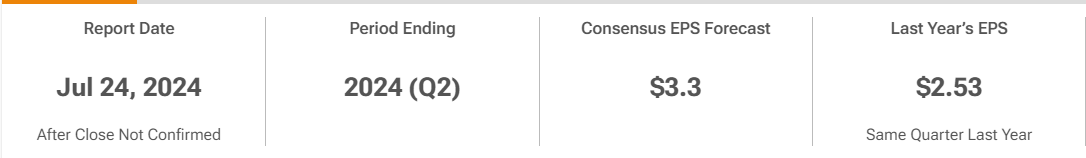

$Universal Health Services (UHS.US)$ is expected to report its results for period ending 30 June 2024 on 24 July 2024 after market close.

UHS is expected to show a rise in quarterly revenue and to report a 8.9% increase in revenue to $3.864 billion from $3.55 billion a year ago, according to the mean estimate from 14 analysts, based on LSEG data. The consensus EPS estimate for earnings per share is $3.30.

UHS operates behavioral health centers, surgical hospitals, acute care hospitals, and radiation oncology centers and provides commercial health insurance services.

UHS’s second-quarter earnings are expected to have benefited from rising admissions and revenue per adjusted admission. Sustained demand for UHS’s Behavioral Health Care Services and strong contribution from Acute Care Hospital Services are likely to have positioned the company for an earnings beat this time around.

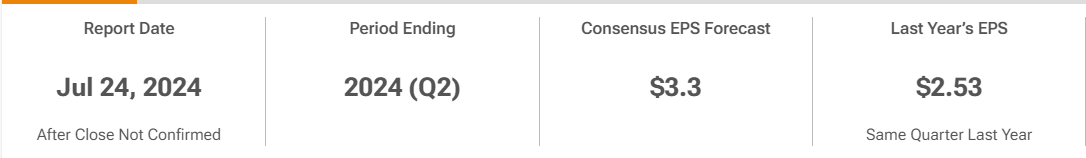

Analyst Price Target Forecast

Based on 13 Wall Street analysts offering 12 month price targets for Universal Health in the last 3 months. The average price target is $197.92 with a high forecast of $236.00 and a low forecast of $162.00. The average price target represents a 6.81% change from the last price of $185.30.

If we looked at how UHS has beaten the estimate for the past few quarter and also this is one of the healthcare stock worth placing in our defensive portfolio. At the current price, this looks like a potential BUY.

As the market is still experiencing volatility with the indices returning the previous day (22 July) gains on 23 July. It is time that we should consider some defensive stocks in our strategy.

Factors That Might Affect UHS Quarterly Though Expectation Of Beat Is High

Cost Management

Wage inflation continues to decelerate and medical specialist fees seemingly tracking in-line with full-year expectations.

Earnings Outlook

Historically the company exceeds initial estimates every year by around 30%.

Revenue Trends

Expert calls continue to point to robust revenue growth in June.

Financial Performance

Corporate adjusted EBITDA loss increased to $140 million, higher than the estimated $125 million.

Legal Uncertainty

UHS sees verdict as unprecedented vs. both its own history of similar cases as well as other cases in that jurisdiction. A lot of uncertainty remains regarding the ultimate impact — the actual financial impact will take some time to be finalized.

Operational Challenges

Same-store adjusted admissions actually declined year-over-year, citing weather, holiday impacts, and continued staffing challenges.

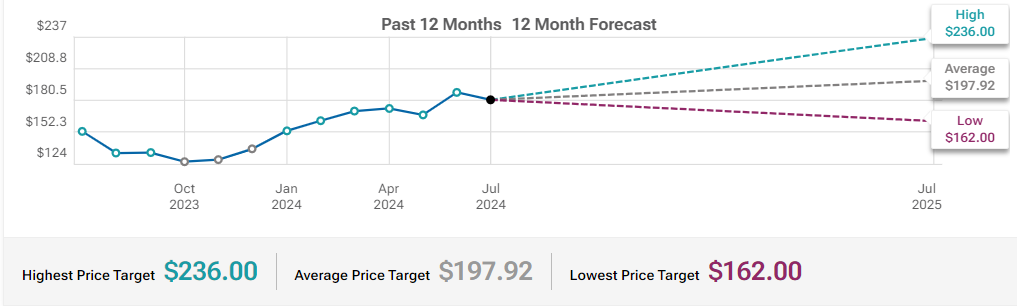

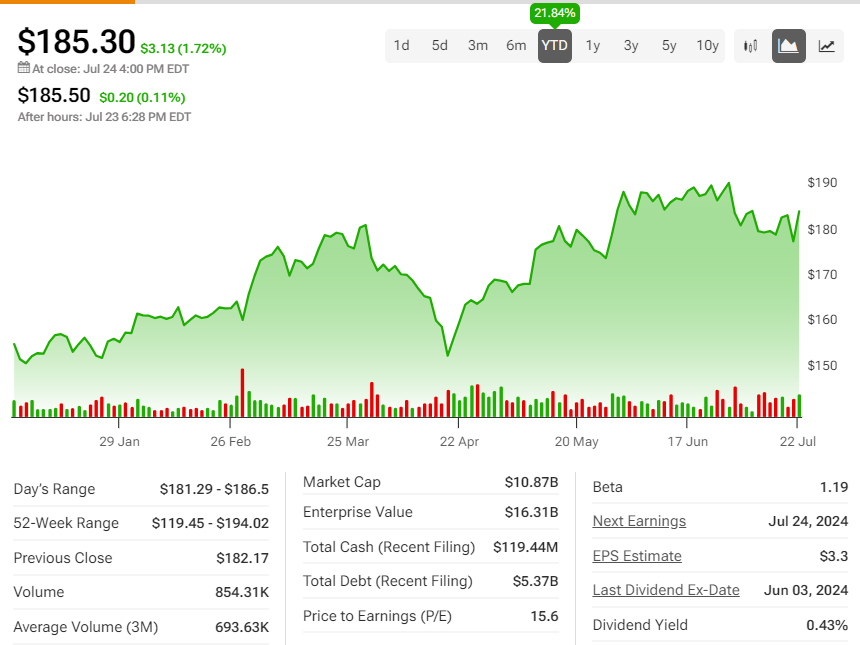

Year-To-Date Returns of More Than 20%

Even though we are seeing UHS facing some challenges, but overall the impressive 21% year-to-date returns to investors on its stock price does indicate that this stock is a potential healthcare to hold.

Considering that the demand for their sustained services would continue to grow and UHS would be in a good position to manage that. I would think this is a good stock to hold.

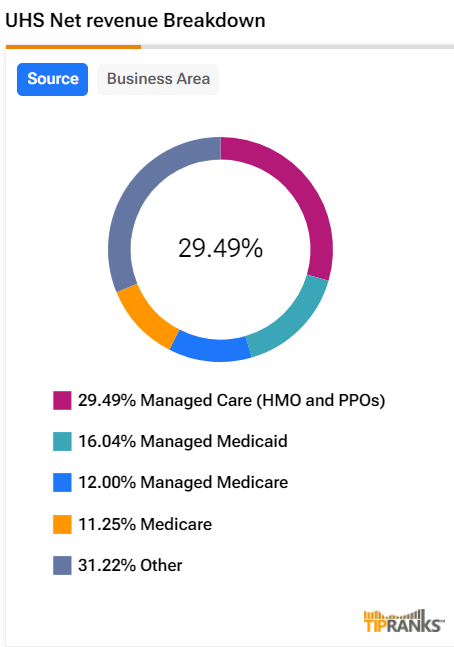

Revenue Breakdown

As mentioned above, the main thing we should be looking out in UHS earning report is its managed services, they actually make up more than 50% of the net revenue.

So as the demand for their managed service continued to grow, UHS is in a good position to beat the quarterly estimates.

Technical Indicator (MACD and KDJ)

Though the expectation of an earning beat estimate is high, the market is not so confident as seen in the technical indicator, as we can see that MACD did form a bullish crossover on 16 Jul, but it has been a weak upside since then,

As for KDJ, there is effort trying to make an upside signal, but it has been undecisive. If we looked to the stock price trading sideway, I believe investors could be adopting a wait and see attitude before UHS earnings.

So I would be monitoring how UHS would be trading today (24 July) before its earnings release after the market close.

Summary

Despite UHS expected to beat estimate for this upcoming quarterly earnings, the stock price is still trading sideway indicating investors are adopting a wait and see attitude, so this might be a good chance to look at this stock when trading start later today (24 July)

Appreciate if you could share your thoughts in the comment section whether you think UHS is a potential BUY prior to its earnings.

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment