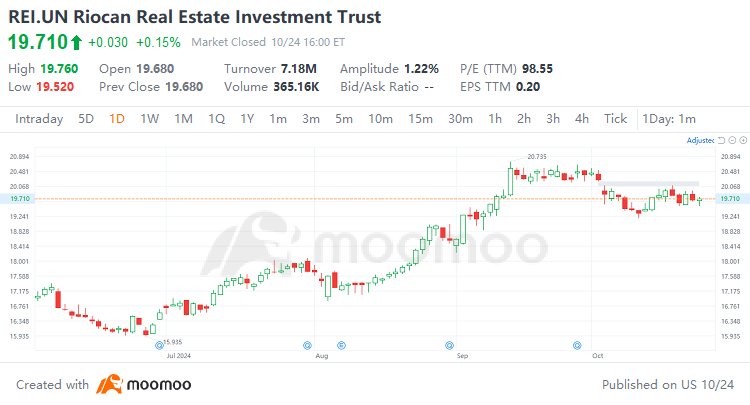

RioCan Real Estate Investment Trust is a Canadian real estate investment trust that owns, develops, and operates a retail-focused real estate portfolio, including shopping centers and mixed-use development projects, with most properties located in Ontario, Canada. RioCan's tenants include grocery stores, supermarkets, restaurants, cinemas, pharmacies, and businesses.

101550592 :

Filomena Angeles : So much grateful information..!! Thank you.