Unlocking Opportunities on Canada's Interest Rate Cut: An Investment Guide about High Dividend ETF

In the previous article introducing REITs, we analyzed the interest rate reduction expectations in Canada and recommended a series of REITs and related ETFs as good investment targets in the event of lower interest rates:Unlocking Opportunities on Canada's Interest Rate Cut: An Investment Guide about REITs

In this article, we will introduce another type of hedging tool: High dividend ETF products.

During an interest rate reduction cycle, high dividend assets are often highly sought after due to their unique income characteristics. What are the reasons for this?

Under the control and guidance of the central bank, the current market's interest rate reduction expectations are mainly focused on a "soft landing," which typically involves using moderate interest rate policies to maintain stable economic growth. This type of soft landing is usually accompanied by loose monetary policies, an increase in market liquidity, and an increase in investor risk appetite, leading them to pursue higher potential returns. In such situations, the overall valuation level of the stock market often rises. High dividend stocks, with their inherent defensiveness and stable cash flow generation, become even more attractive to investors as the risk-free interest rate decreases, resulting in a reduction in the discount rate and an increase in the present value of the stocks. Their valuation may increase even further, becoming an object of pursuit for capital inflows.

At the same time, during an interest rate reduction cycle, the decrease in the risk-free interest rate not only intuitively reduces the yields of safe assets like bank deposits and government bonds, but also significantly widens the interest rate spread between high dividend stocks and these low-risk investments. This increased interest rate spread, like a gravitational field, guides investors who seek stable returns towards high dividend stocks, searching for better returns beyond low-yield assets, thereby boosting the demand and valuation of such stocks.

In summary, during an interest rate reduction cycle, the attractiveness and market performance of high dividend products can be boosted along with an increase in valuation, becoming the preferred investment option for investors.

So, how should we choose high dividend products?

The core of high dividend lies in the sustainability of dividends, which is essentially the stable earning ability and cash flow of the company, requiring an excellent business model. Specifically, companies that meet the following conditions will be better choices:

- The industry they belong to is relatively traditional, and their production and management methods are relatively mature. In 2023, coal, banking, petroleum and petrochemicals, home appliances, and transportation are the top five industries with the highest dividend yields for listed companies.

- They have stable operations, small performance fluctuations, and preferably some growth. These companies have relatively abundant cash flow, relatively mature production and management methods, and lower requirements for the proportion of retained profits available for distribution, as they do not need to invest in new processes and technologies, so they have the ability and motivation to implement high dividend payout ratios.

- They have a history of stable dividends. The best way to judge whether a company is willing to return to shareholders is to review its historical data. Generally speaking, a company's operating style has continuity, and companies that can maintain stable dividends year after year are more trustworthy.

- Profit growth is key. When selecting companies, not only should investors be attracted by high dividend yields, but they should also check whether the company's profit indicators (earnings per share) are increasing year by year or at least remaining stable. If a company has a high dividend yield but declining profits, it may be difficult to sustain future dividends.

The above is the overall screening criteria for high dividend individual stocks, but investors should also analyze specific issues comprehensively and make investment decisions based on multiple dimensions such as financial report performance and historical data, rather than making generalizations.

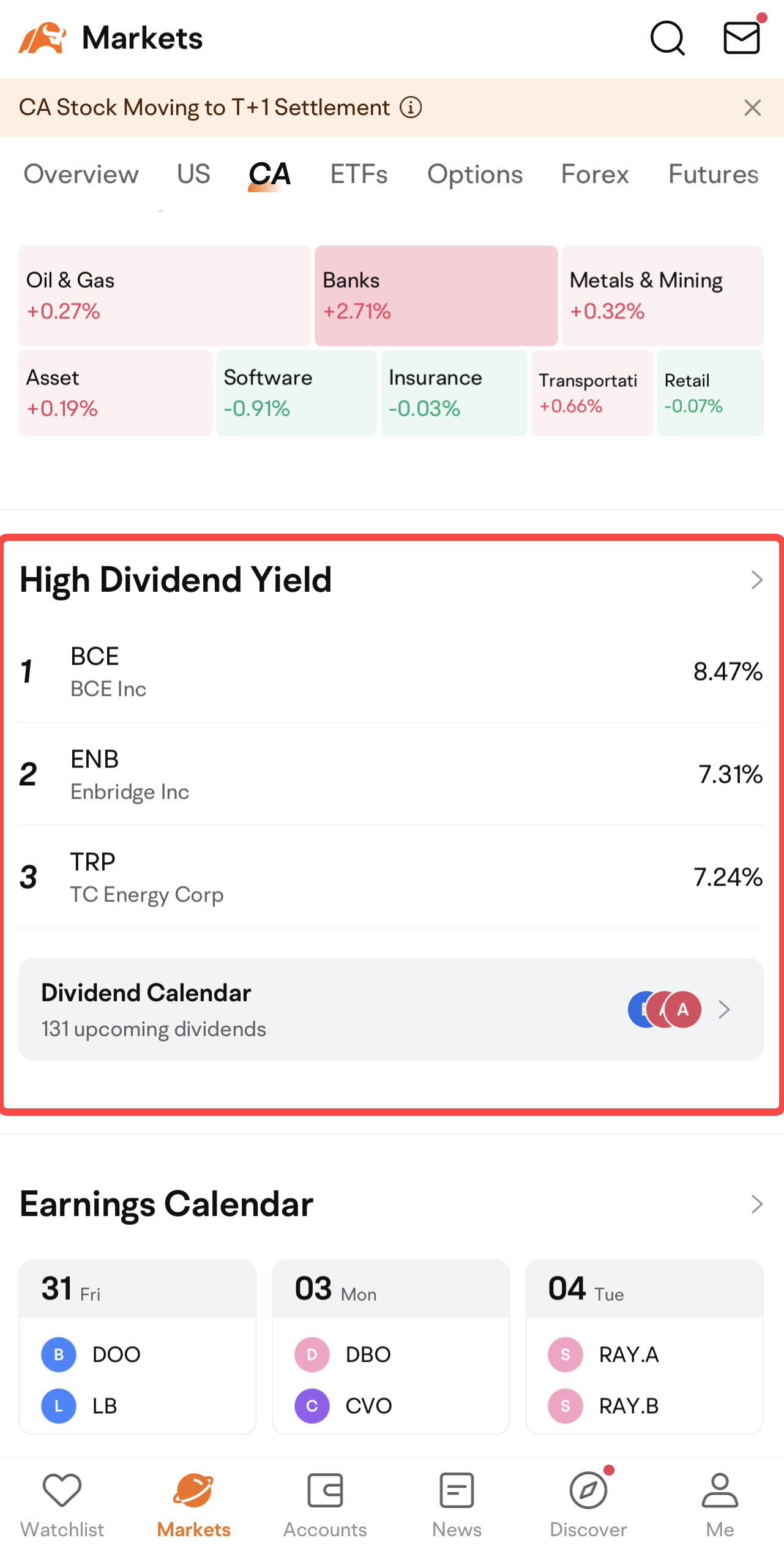

Tips: MOOMOO has launched multiple high dividend screening tools

1. Click the question mark in the upper right corner of the APP homepage, and click "Screener" to select stocks independently.

2. Click "Markets" at the bottom of the main page to enter the CA section, where you can view the high dividend list and the "Dividend Aristocrats" concept section.

In addition to individual stocks, investing in high dividend ETFs is also a good choice

Although there are many high dividend companies in the market that are willing to return to shareholders, for investors who are not good at stock selection, there is a more stable and secure way to invest in stocks - high dividend ETFs.

High dividend ETFs mainly use the "cash dividend distribution status" to determine the selection of component stocks and the weighting of holdings. The different underlying stocks tracked by different products can diversify risks, making them a good product for conservative investors seeking stability and growth.

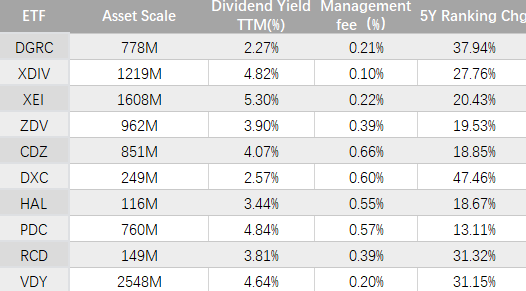

Below, we have screened out the most mainstream high dividend ETFs in the Canadian market based on various factors and listed their core indicators for comparison:

Based on the data listed in the table above, we have selected four ETFs from the plus-share market to introduce in detail, considering the four important indicators of market value, dividend yield, management fee, and stock price increase. They have all performed well in the past period of time and have high investment value when interest rate cuts come.

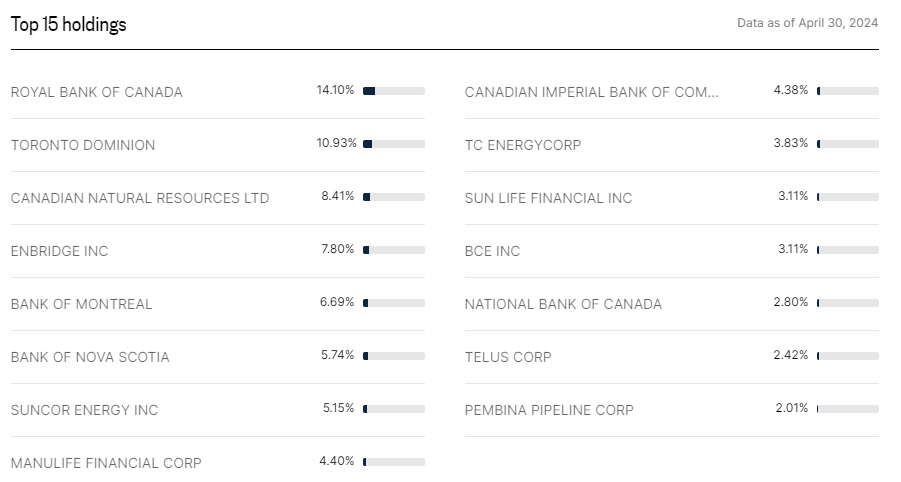

This ETF tracks the FTSE Canada High Dividend Yield Index and has the largest market capitalization among the ten products we surveyed. Currently, there are a total of 56 high dividend stocks from global markets in its portfolio, mainly concentrated in the financial sector (with a focus on banking) and the energy sector, with these two types of companies accounting for over 80% of the total holdings. The top three holdings are Royal Bank of Canada, Toronto Dominion, and Canadian Natural Resources Ltd, with these three stocks accounting for a total of 32% of the ETF's portfolio, directly affecting its overall performance.

The most direct impact of lower interest rates on the banking industry is a decrease in interest expenses on deposits, which has an overall positive effect. Energy companies, on the other hand, are less affected by macroeconomic conditions due to the nature of their industry, have stable operating conditions, and are willing to return to shareholders. As a result, VDY is expected to benefit from a rate cut strategy by the central bank. As of May 31, over the past five years, this ETF has risen by 31.15%, and currently has a dividend yield of 4.64%, both of which are at a relatively high level among similar products.

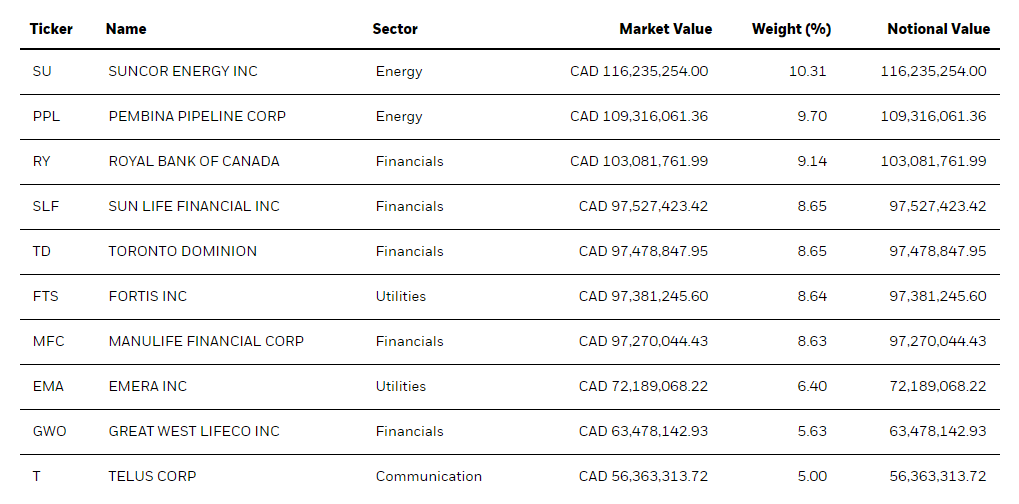

Similar to VDY, XDIV also has a large market capitalization and is a high-quality product that combines quality, yield, and growth. It includes about 30 high dividend stocks in the Canadian market, and the management team constantly adjusts the portfolio. It is a low-cost investment portfolio of high dividend Canadian stocks, with a management fee of only 0.10%, which is the lowest among the ten products and the best choice for investors seeking cost-effectiveness. XDIV mainly selects stocks with strong overall financial conditions, including stable balance sheets and stocks with less revenue volatility. Here are the top ten stocks in the ETF's holdings, which are also mainly focused on the financial and energy sectors:

As of May 31, over the past five years, this ETF has risen by 27.76%, and has a dividend yield of 4.82%. Its performance has been excellent.

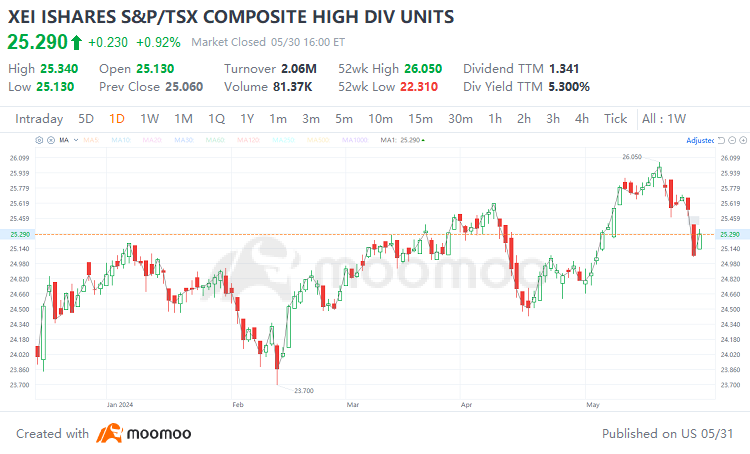

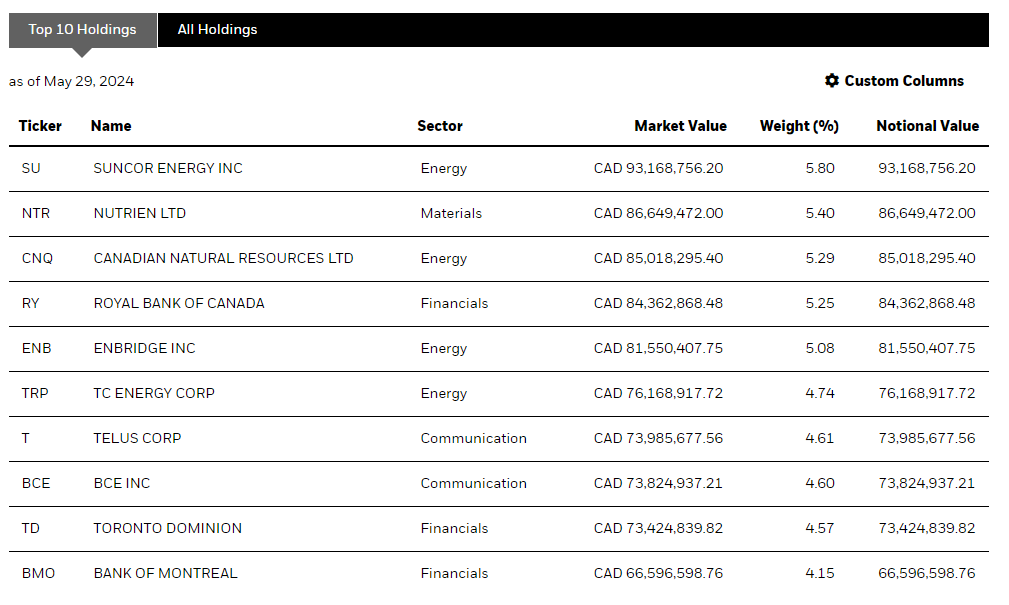

This ETF tracks the S&P/TSX Composite High Dividend Index and currently holds 75 stocks, mainly concentrated in the energy sector. Its top ten holdings are all around 5%, which means that compared to the previous two products, XEI has a more diversified portfolio, with a smaller impact from individual stocks. This implies a higher risk diversification ability.

XEI has a dividend yield of 5.30%, which is the highest among the ten products. However, as of May 31, over the past five years, this ETF has risen by only 20.43%, which is relatively low compared to other products. The main reason is that the diversified portfolio pursuit of stability has also weakened the direct upward pressure on stock prices from large companies. However, when interest rates fall and the market is volatile, this ETF is expected to achieve long-term and stable profitability across cycles.

Risk Warning

While the above US high-dividend ETFs provide investors with an ideal tool to diversify risk and obtain passive income while pursuing stable income and potential capital appreciation, investors still need to be aware of the following risks:

Although high-dividend ETFs diversify individual stock risks, they still face overall market risks.

The decision-making and behavior of ETF management teams may not fully align with investor interests, and there may be problems such as poor management quality, tracking errors, and insufficient transparency leading to potential losses or poor performance. Investors need to pay attention to these factors, choose suitable ETFs, and effectively manage risks.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment