Unpacking Long-Term Inflation and Interest Rate Trends: The Three Driving Factors

While many experts believe that inflation will naturally subside, the similarities between current events and those of the 1970s indicate that we may be in for a prolonged period of inflation.

$Bank of America (BAC.US)$'s Hartnett believes that the 2020s will be a period of inflation and rising interest rates. He cites three reasons for this trend.

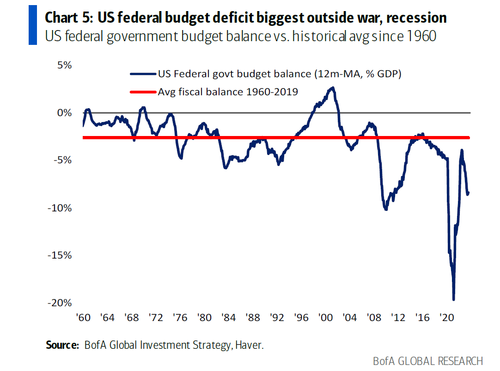

US Fiscal Policy

Hartnett said despite a 40% surge in nominal GDP, the US fiscal deficit remains at 7-8% of GDP. This implies an increase in the supply of US bonds, and yet for three consecutive years, bond return have fallen - a phenomenon unseen in America's 250-year history.

One of the most important factors is that if the US Treasury bond supply rises and investor expectations for future inflation remain unchanged, falling bond prices may increase bond yields. This can attract more investors seeking a higher yield, subsequently lowering borrowing costs, boosting economic activity, and increasing inflation under certain circumstances.

Workers' Movements

According to Hartnett, the United Auto Workers is asking for a 36% wage increase over four years, while automakers are proposing a 20% raise. Either way, the wages of 146,000 American auto workers will increase by at least 4-8% every year in the next four years.

The UAW strike will directly increase inflation because they're walking off the job when they would be making cars. This means that in the short term, consumers are likely to face limited choices and higher prices for cars, which further complicates the Federal Reserve's efforts to combat inflation.

In addition, the International Brotherhood of Teamsters, which represents over 300,000 UPS workers, declared that its members had approved a new labor contract with UPS. This agreement includes wage increases of at least $7.50 per hour for existing employees over the span of the five-year deal.

In August, American Airlines pilots approved a new contract that includes more than $9.6 billion in total pay and benefits increases over four years.

When employees go on strike, production costs may increase as companies need to pay higher wages, improve benefits, or spend more time resolving labor disputes. These additional costs may eventually lead to price increases for products or services. Moreover, strikes may result in supply shortages, which can drive up prices if demand remains constant. This shows that strike has become a core driving force of inflation.

Geopolitics

Though the Fed targets core inflation with its policies, the August CPI report showed that transportation services rose 2% for the month, the biggest rise of any category outside of energy.

Oil prices rose for a third straight session on Monday, buoyed by forecasts of a widening supply deficit in the fourth quarter after Saudi Arabia and Russia extended cuts and by optimism about a recovery in demand in China.

Both Brent and WTI crude have recorded three consecutive weekly gains to reach their highest levels since November, and are poised for their largest quarterly increase since Q1 2022, when Russia invaded Ukraine. As of 0622 GMT, Brent crude futures rose by 71 cents, or 0.8%, to trade at $94.64 per barrel.

Moreover, diesel, jet and marine fuel prices are soaring, pressuring the construction companies, transportation businesses and farmers that are the biggest users.

Source: Bank of America, Wall Street Journal, The New York Times, Seeking Alpha, Reuters

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment