Unstoppable Gold Rally! Top Gold Stock Has Doubled in Value This Year

In 2024, gold has undoubtedly emerged as one of the standout global asset classes, second only to $Bitcoin (BTC.CC)$. This impressive performance, with $Gold Futures(FEB5) (GCmain.US)$ soaring by 30% year-to-date, surpasses the approximately 20% gains of both the $Nasdaq Composite Index (.IXIC.US)$ and the $S&P 500 Index (.SPX.US)$. Several factors have fueled this surge, including robust demand from central banks, frequent geopolitical events, uncertainties surrounding the U.S. presidential election, and the initiation of an interest rate cut cycle by the Federal Reserve.

On October 23rd, both COMEX gold and spot gold surged past the $2,750 mark, setting a new all-time high. Gold is perceived as a convergence point for several prevailing trading themes, including rate-cut trades, safe-haven trades, Trump trades, and "reflation" trades. Investors are eager to partake in this gold price rally by diversifying their asset allocations and making strategic adjustments to their investment portfolios.

Extending the timeline to the beginning of this gold bull market in November 2022, gold prices have impressively surged by over 70% in less than two years. Such a sustained and rapid increase introduces some short-term correction risks, yet some analysts remain optimistic about further upside potential, anticipating that gold prices could continue to reach new heights.

Paul Wong, a market strategist at Sprott Asset Management, attributes this new bullish phase for gold to factors such as central bank purchases, rising U.S. debt, and the potential peak of the U.S. dollar. The erosion of trust in fiat currencies has enhanced gold's appeal as a reliable store of value.

In its latest report released on Monday, Citigroup raised its three-month gold price forecast from $2,700 per ounce to $2,800, citing the possibility of further deterioration in the U.S. labor market, Federal Reserve interest rate cuts, and strong physical and ETF demand. The bank further projects that gold could rise to $3,000 per ounce within six to twelve months. Vivek Dhar from the Commonwealth Bank of Australia also noted on Monday that due to the "persistent weakness of the dollar," he expects the average gold price to reach $3,000 by the fourth quarter of next year.

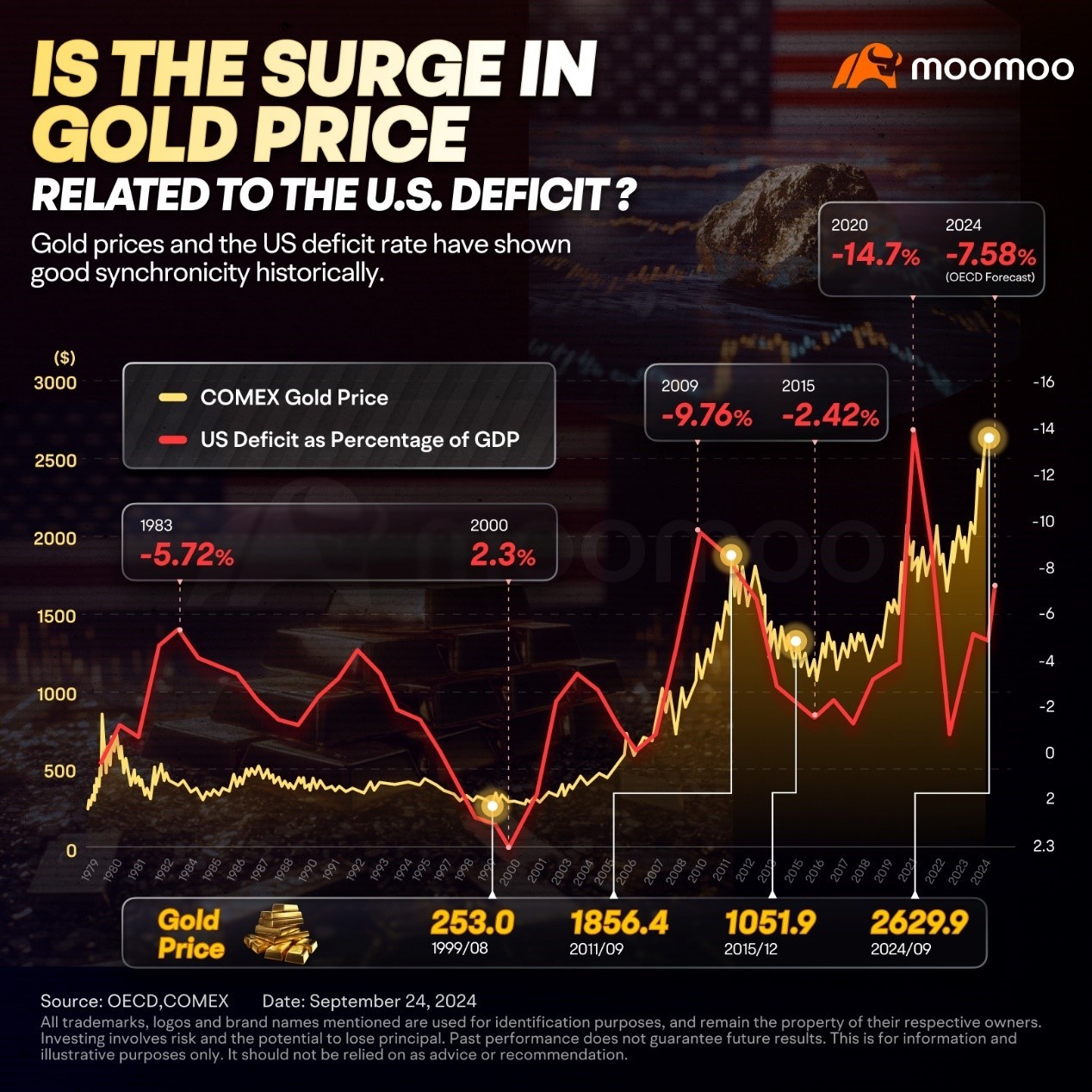

1. Increasing U.S. Deficit Enhances Gold Appeal

In the article "The U.S. Fiscal Deficit Remains High. Is This Why Gold Prices Keep Breaking Records?" it is noted that concerns over the sustainability of U.S. debt, the devaluation of the dollar, and debt monetization are driving factors behind the rising gold prices. Historically, there has been a notable correlation between gold prices and the U.S. fiscal deficit.

With the recent surge in support for Republican candidate Trump, his proposals for domestic tax cuts and significant expenditures on border enforcement and immigrant deportation could further exacerbate the deficit. The market appears to be responding to this scenario by increasing gold purchases and selling off long-term U.S. bonds. Compounding the issue, whether Harris or Trump wins the election, their policies are unlikely to alleviate deficit pressures. An Associated Press report highlights that neither Trump nor Harris has emphasized the importance of reducing the fiscal deficit in their campaigns.

According to projections from the Congressional Budget Office, the ratio of public debt to GDP is anticipated to rise from 98% in 2023 to 181% by 2053, marking an unprecedented level in U.S. history.

2. Gold's Safe Haven Qualities Highlighted by Frequent Risk Events

Amid ongoing geopolitical tensions in the Middle East and escalating divisions surrounding the U.S. presidential election, coupled with rising uncertainty, investors are increasingly gravitating towards gold, a traditional safe-haven asset.

3. Global Rate-Cut Cycle

The European Central Bank has cut interest rates for the third time this year, while the Federal Reserve's generous 50 basis point rate cut in September has significantly boosted market optimism regarding the easing of monetary policies by central banks worldwide. Currently, the market anticipates that the Fed has an additional 50 basis points of rate cuts available by the end of 2024. This wave of rate reductions by central banks globally aids in lowering the holding costs of gold, a non-yielding asset, thereby providing support to gold prices.

4. Long-Term Gold Price Stability Anchored by Central Bank Demand

According to the World Gold Council, the net gold purchases by central banks soared to 483 tons in the first half of 2024, marking a 5% increase over the record set in the same period last year. Furthermore, a survey conducted by the organization in April this year revealed that 29% of central bank respondents intend to boost their gold reserves within the next 12 months.

Additionally, the World Gold Council's latest report indicates that globally, physically-backed gold ETFs experienced net inflows for the fifth consecutive month in September, with total holdings rising to 3,200 tons. This trend underscores the robust investor interest in gold.

In addition to purchasing physical gold and gold futures, investors may also find gold mining stocks to be ideal investment options. Analysts have noted that investing in gold mining stocks may offer certain advantages over directly purchasing gold. Some gold stocks can potentially increase in value more rapidly than the price of gold itself, providing a form of leveraged exposure to gold.

As gold prices rise, the profits of gold mining companies tend to expand accordingly. Additionally, gold stocks typically offer significantly higher liquidity compared to physical gold investments, and those with strong financial health often pay substantial dividends to investors. These factors collectively contribute to a more resilient bull market for gold mining stocks.

It is important to highlight that the ability of mining companies to benefit from rising gold prices varies greatly. Companies with high-grade mines generally incur lower production costs and operate more efficiently, as they can extract more gold per ton of ore. This often results in higher profit margins when gold prices climb. Moreover, geographical location and political environment are crucial, as certain mining regions offer more favorable regulatory and operational conditions, enhancing its stability and growth prospects. Financial health is also critical, as miners with robust balance sheets are better positioned to expand production or acquire new assets counter-cyclically when market conditions are favorable.

The risk in investing in these companies lies in the fact that not all gold mining stocks are pure gold plays, making it challenging to assess the extent of their benefit from rising gold prices. When selecting gold mining stocks, investors should focus on factors such as the proportion of revenue derived from the gold sector, debt servicing capability, growth performance, and dividend yield.

$Harmony Gold Mining (HMY.US)$ listed in the U.S. has surged by over 100% this year, with $Kinross Gold (KGC.US)$ and $AngloGold Ashanti (AU.US)$ following closely, both having gained over 70%.

Source: Investopedia, forbes, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

HUANG AI : UP, UP

EZ_money :

EZ_money : deja vu

152315081 : ZENA