TSLA

Tesla

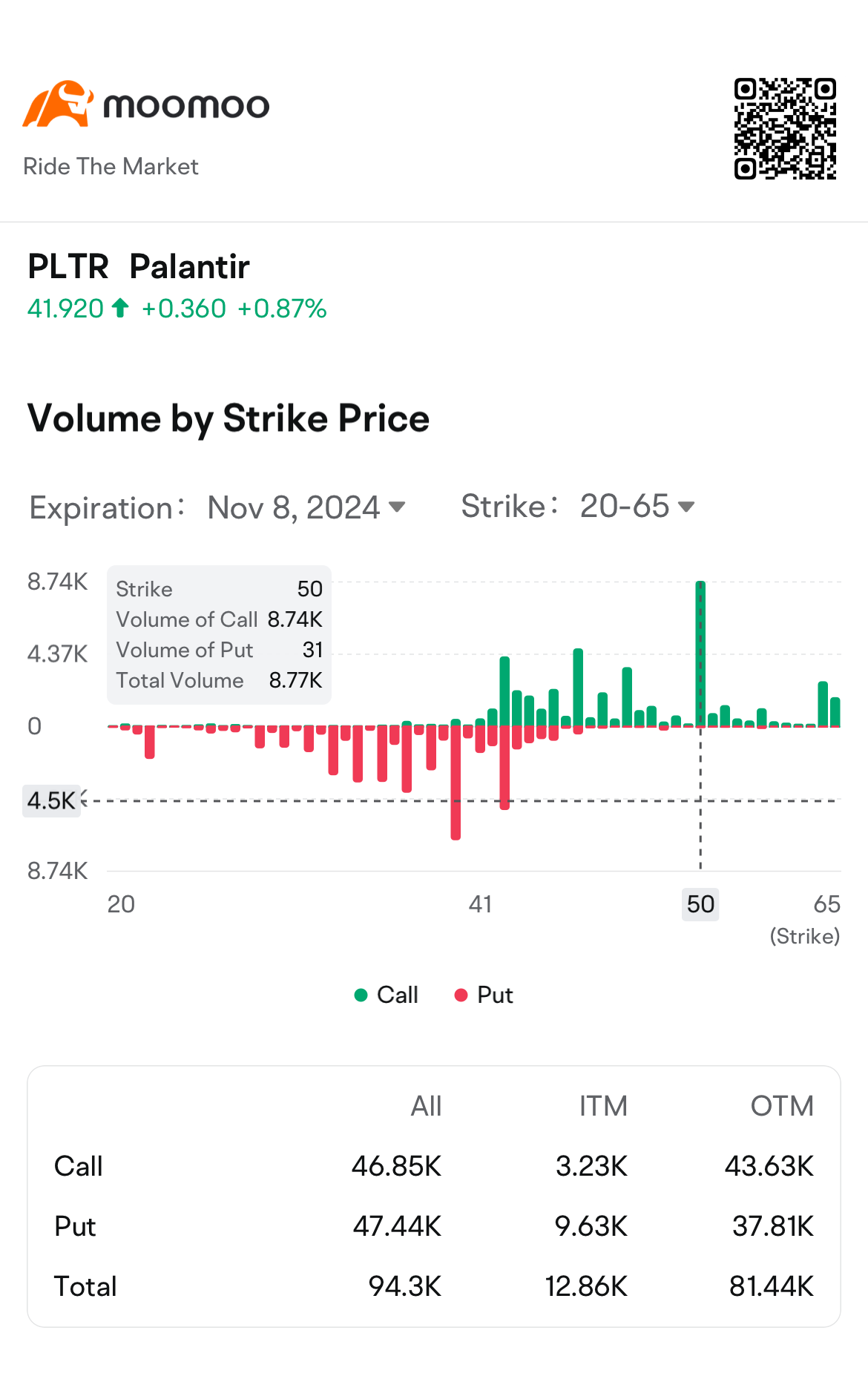

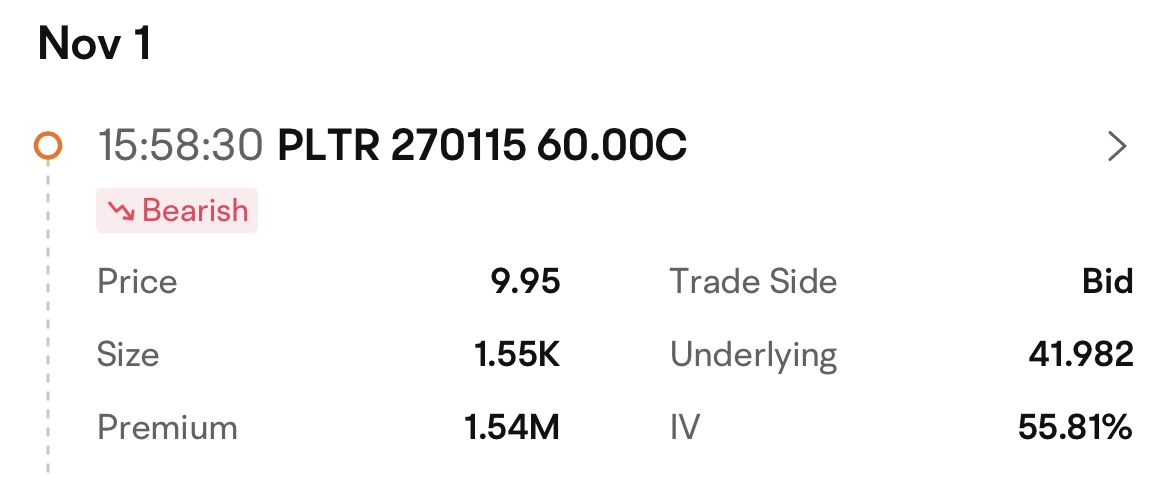

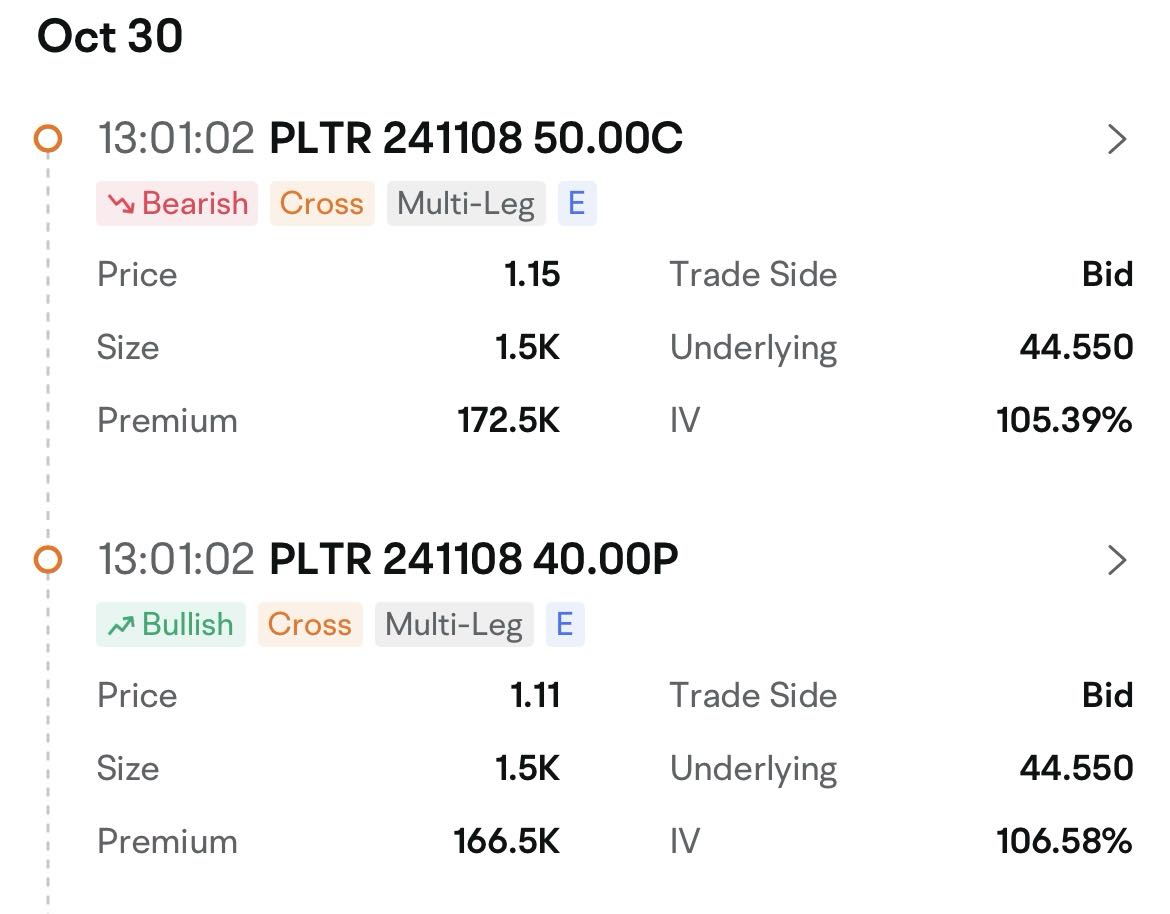

-- 421.060 PLTR

Palantir

-- 80.550 NVDA

NVIDIA

-- 134.700 OXY

Occidental Petroleum

-- 47.130 AMD

Advanced Micro Devices

-- 119.210 Currently, the general market consensus is that if Trump comes to power, he will continue to support traditional energy and infrastructure development.

On the other hand, if Harris takes office, there could be a greater focus on welfare policies, marijuana legalization, green energy development, which are likely to boost U.S. exports, and housing support.

Interestingly, many believe that whether Trump or Harris wins, both cryptocurrencies and gold are likely to benefit.

A Humble Mooer : PLTR has long term tailwinds and if you got in below 20 hold but it's seriously overvalued compared to its peers. It is only a swing trade at current valuations as wall street will eventually pull it back

Rich365 : what was that you were saying about a pull back.

ChrissyGee : PLTR is too volatile

MiMiMooo : v

Amylizheng :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Kelly_Liu :

72398691 : Nice!

70190156 :

Beatty988 :

Joey Bagadonuts : ok

View more comments...