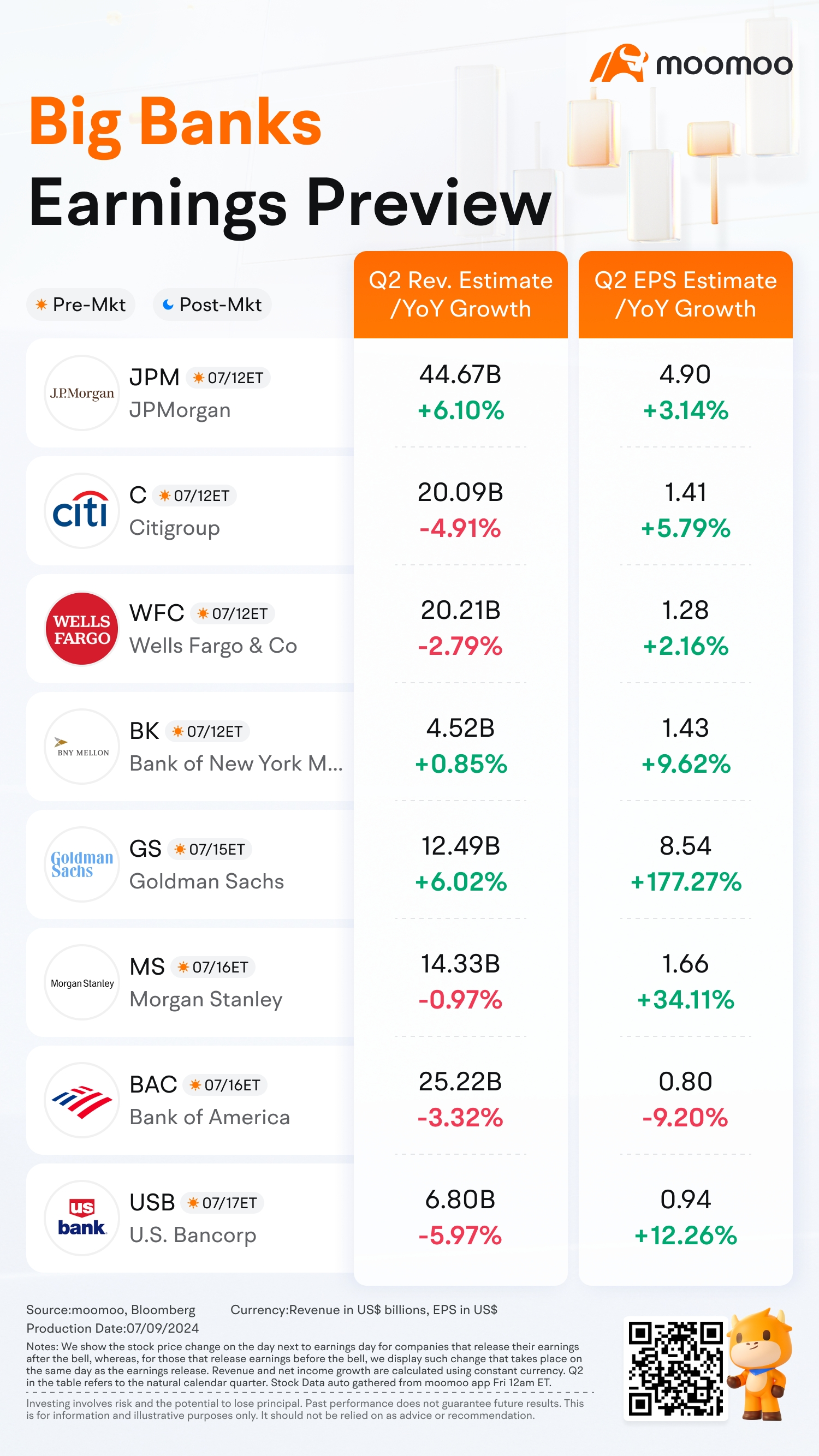

According to Barclays analysts, "While mixed trends are expected this quarter, they believe most banks will exceed consensus EPS expectations. At the median bank, lower net interest income, stable fee income, lower expenses, slightly higher loan loss provisions, and modestly lower share counts are forecasted."

Dumb Money Space Ape : I’m staying far away from these. Probably crashing any day.

AmbitiousMiser : Yeah, banks are busy creating inflation so I'm probably staying away from these.

103677010 : noted

Pokoo Pokoo Dumb Money Space Ape : $YTLPOWR (6742.MY)$

Irwan Harlan cahyadi 103677010 : $JPMorgan (JPM.US)$

104138715 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

54088 FROM RWS : flew

104394221 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104327919 : ok

Szeto : good

View more comments...