US Bond Market's Bearish Trend: Is the End in Sight or Just a False Alarm?

During the last three trading days, the yield on 10-year notes declined by 12.2 basis point to close at 4.668% on Thursday. This marks the longest losing streak since the end of August. Similarly, the yield on 30-year notes fell by 15.4 basis point and closed at 4.820%,also marking a three-day decline streak.

The movement in yields occurred following two significant announcements made by the Treasury this week. On Monday, the Treasury Department stated that as it expects higher tax receipts than previously projected, it will reduce its debt issuance in the fourth quarter compared to what it had communicated to investors previously. On Wednesday, the department announced that it plans to offer slightly less 10-year and 30-year debt at next week's auction than what was initially presented in August.

On Wednesday afternoon, news from the Federal Reserve further contributed to the downward pressure on yields. The policy-setting committee of the central bank announced that it would maintain interest rates at their current level for the second consecutive meeting.Additionally, Chairman Jerome Powell provided comments that heightened expectations that the Bank may soon conclude the series of rate increases it began in early 2022.

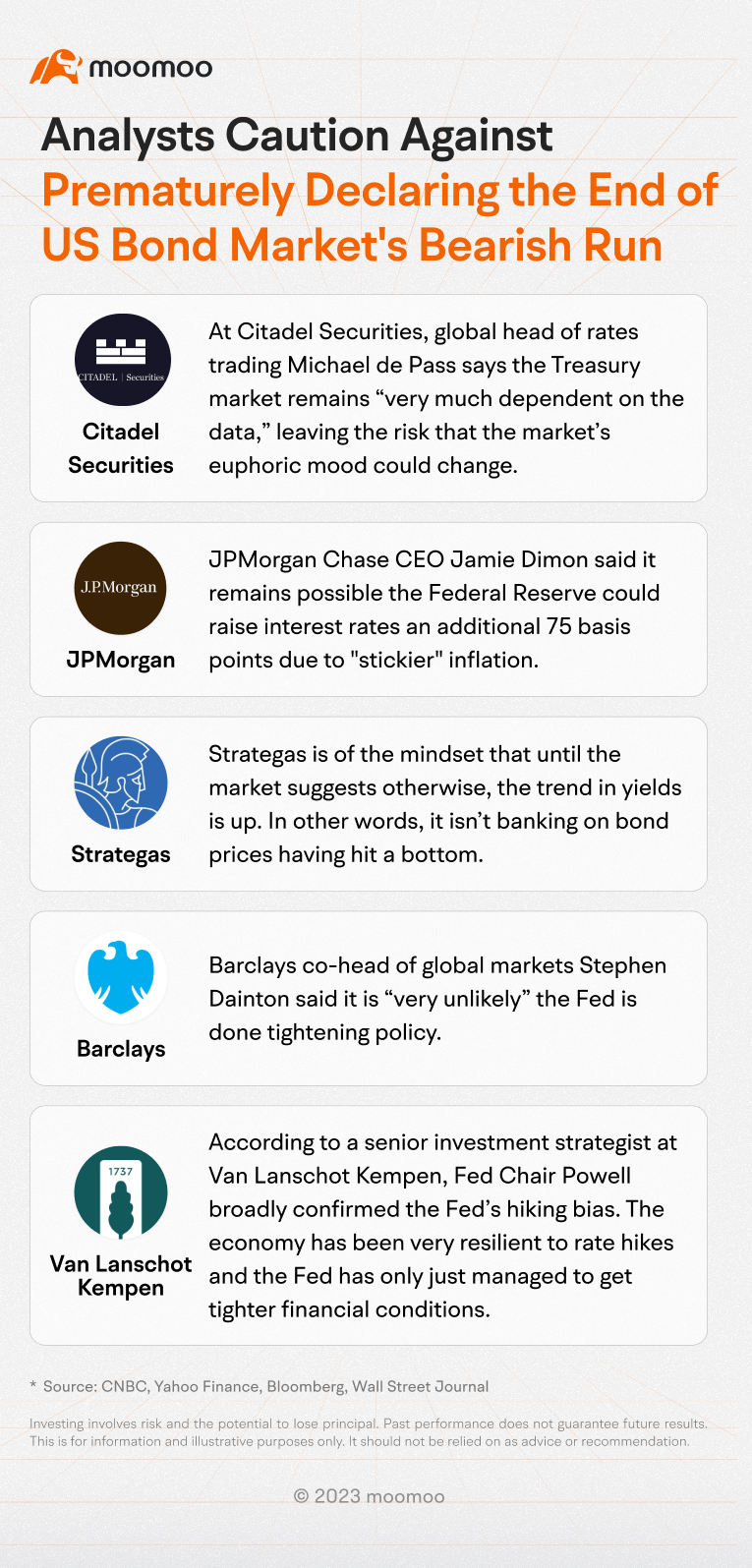

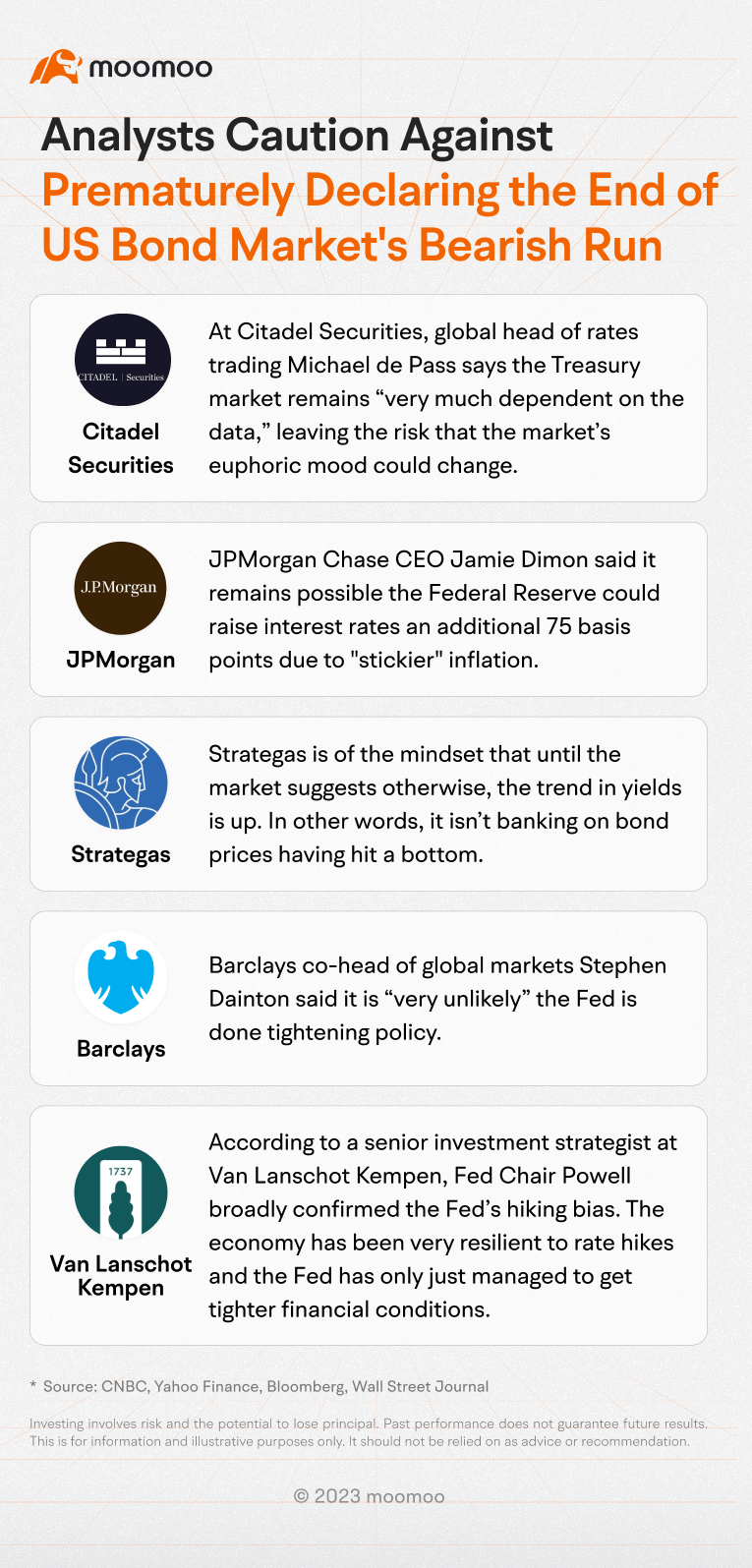

However, an increasing number of analysts are warning against declaring prematurely that the US bond market's severe decline is over for good.

Nevertheless, there is still a widely held belief that the most significant losses have already occurred.According to the Bloomberg Markets Live Pulse survey conducted after the Fed meeting, nearly 90% of respondents believe the 10-year yield has either reached its peak or will not rise above 5.5%.

Source: CNBC, Yahoo Finance, Bloomberg, Wall Street Journal

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

我是姜涵涵 : If you can destroy China , even if it rises to 7%, it's a sprinkling of water!

, even if it rises to 7%, it's a sprinkling of water!