NVDA

NVIDIA

-- 108.380 TSLA

Tesla

-- 259.160 PLTR

Palantir

-- 84.400 AMZN

Amazon

-- 190.260 AAPL

Apple

-- 222.130

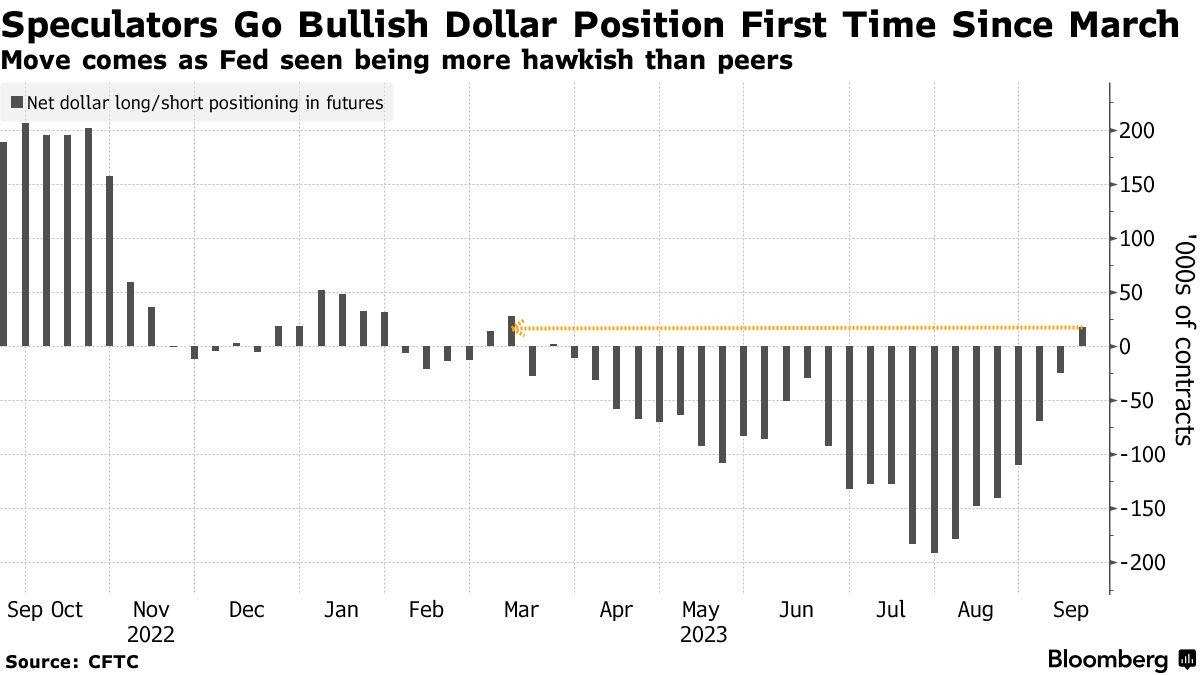

With the US data remaining relatively strong, we believe the dollar rally will continue," Win Thin, global head of currency strategy at Brown Brothers Harriman & Co. in New York, wrote in a client note.

We expect a hawkish hold from the Fed this week that leaves the door open for further tightening," he said. "On the other hand, virtually every other major central bank that's meeting this week is expected to follow in the ECB's footsteps and hike rates 25 basis points whilst signaling a peak is near."

On November, we think that further labor market rebalancing, better news on inflation, and the likely upcoming Q4 growth pothole will convince more participants that the FOMC (Federal Open Market Committee) can forgo a final hike this year, as we think it ultimately will," the investment bank's strategists wrote in a report. The strategists expect to see some "gradual" rate cuts next year if inflation continues to cool.

Jokester Be Helms : Funny printing fake money to help HFs. Do you have a clue what your actually talking about, in the aspect of why they are actually an legally raising rates??