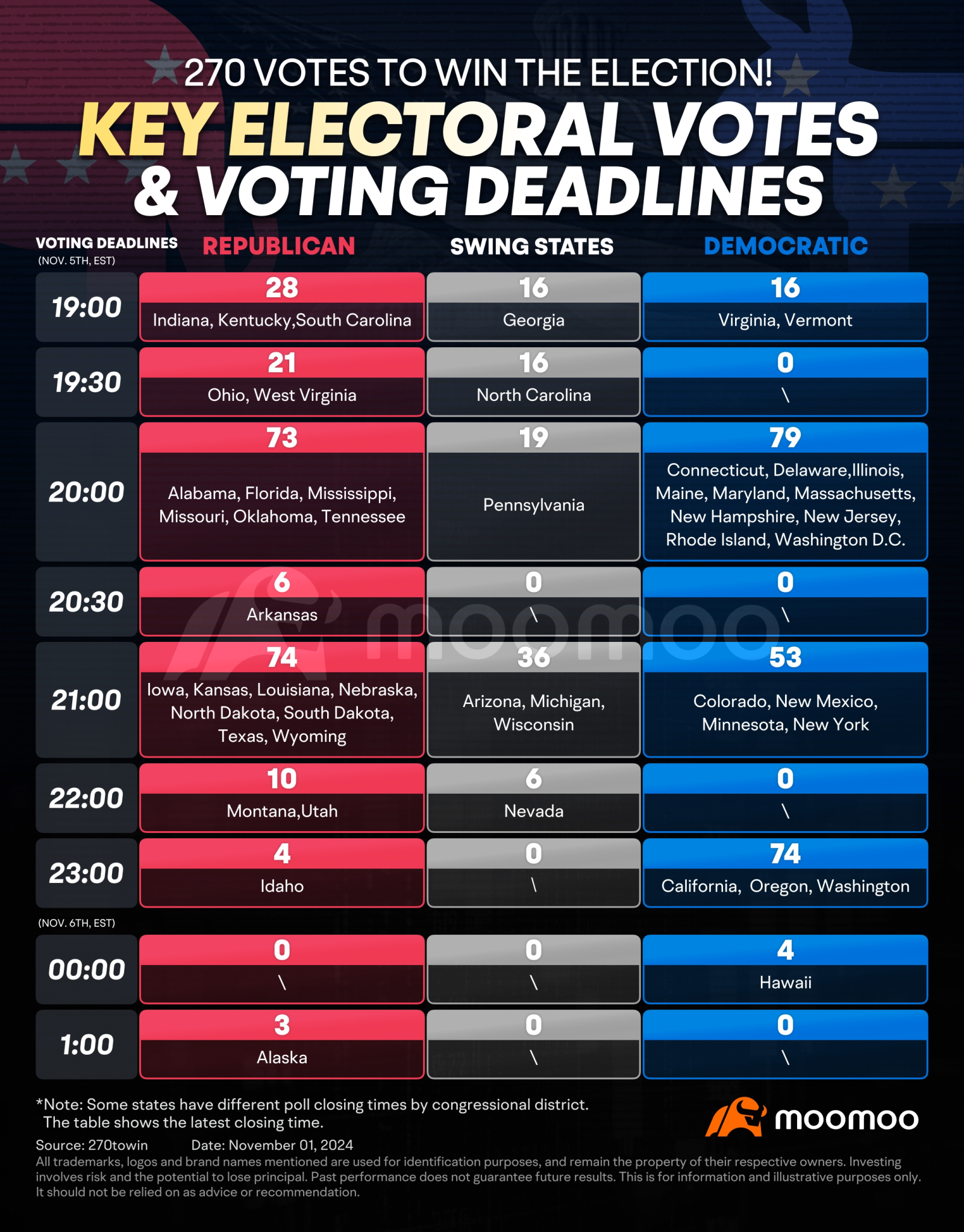

By noon on the 6th November (EST), the election outcome is expected to be all but certain, with Harris and Trump poised for the final face-off. Analysts suggest that several swing states could hold the key to victory, and the winner is likely to have a significant impact on US trade policy. In particular, if Trump wins, the global trade landscape could see a seismic shift. Market watchers expect that Trump's plan to cut corporate taxes could boost profits for companies, which might lead to a rise in the US stock market if he's elected. Conversely, Harris's potential policy of increasing taxes is viewed as bearish for the stock market.

103827296 : halo lagi What happen ai tadi mania finish money all money you take

70617193 : Trump leads in all swing states.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Is me Alvie : Is a 50/50 bet