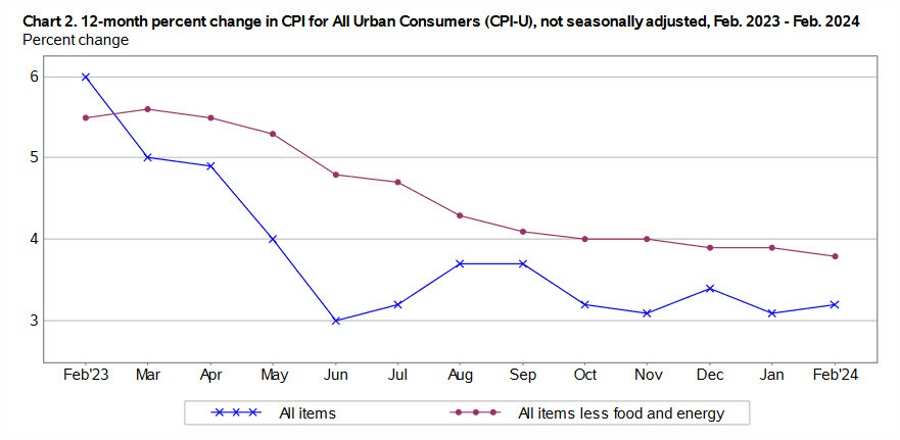

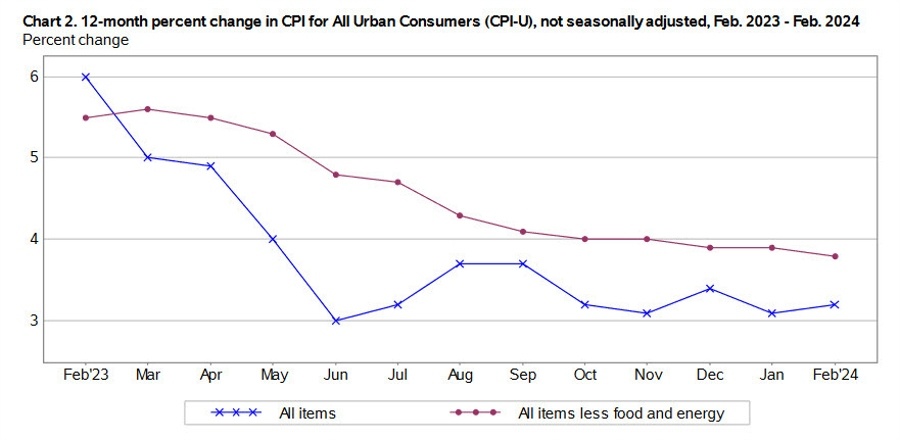

US February core CPI 3.8% y/y versus 3.7% y/y expected

US February 2024 consumer price index data

Headline measures:

CPI y/y +3.2% versus 3.1% expected

Prior y/y 3.1%

CPI m/m +0.4% versus +0.4% expected

Prior m/m 0.3%

Core measures:

CPI y/y +3.2% versus 3.1% expected

Prior y/y 3.1%

CPI m/m +0.4% versus +0.4% expected

Prior m/m 0.3%

Core measures:

Core CPI m/m +0.4% versus +0.3% expected. Last month 0.4%

Unrounded core was +0.358%

Core CPI y/y 3.8% versus 3.7% expected. Last month was 3.9%

Shelter +0.4% versus +0.6% last month

Shelter y/y +5.7% vs +6.0% prior

Services less rent of shelter +0.6% m/m vs +0.6% prior

Real weekly earnings 0.0% vs -0.3% prior (revised to -0.4%)

Food 0.0% m/m vs +0.4% m/m prior

Food +2.2% y/y vs +2.6% y/y prior

Energy +2.3% m/m vs -0.9% m/m prior

Energy -1.9% vs -4.6% y/y prior

Rents +0.5% m/m vs +0.4% prior

Owner's equivalent rent +0.4% vs +0.6% prior

Unrounded core was +0.358%

Core CPI y/y 3.8% versus 3.7% expected. Last month was 3.9%

Shelter +0.4% versus +0.6% last month

Shelter y/y +5.7% vs +6.0% prior

Services less rent of shelter +0.6% m/m vs +0.6% prior

Real weekly earnings 0.0% vs -0.3% prior (revised to -0.4%)

Food 0.0% m/m vs +0.4% m/m prior

Food +2.2% y/y vs +2.6% y/y prior

Energy +2.3% m/m vs -0.9% m/m prior

Energy -1.9% vs -4.6% y/y prior

Rents +0.5% m/m vs +0.4% prior

Owner's equivalent rent +0.4% vs +0.6% prior

CIBC says don't overreact to this report

While February's CPI report suggests ongoing inflationary pressures, particularly in core services and goods, CIBC advises against overreaction. The analysis points towards a gradual labor market rebalancing and decelerating wage growth as factors that could lead to softer service price gains moving forward. Consequently, while immediate rate cuts by the Fed appear less likely, CIBC forecasts a potential shift towards easing policy in the second half of the year, contingent on forthcoming economic data. $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment