[US February CPI Preview] US Federal Reserve May Cautiously Send Easing Signals Will the Inflation Rate Remain at 3% or More?

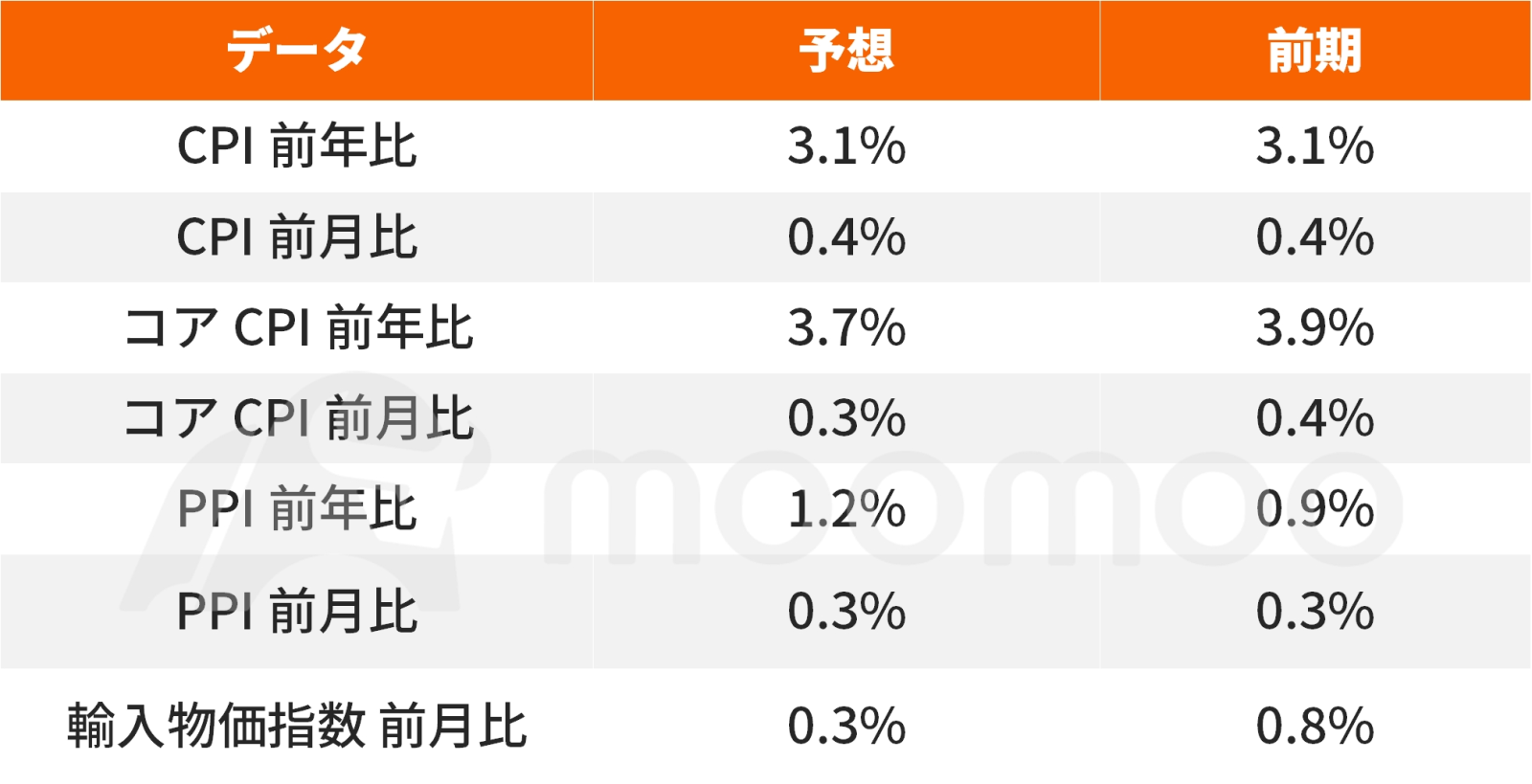

The US Bureau of Labor Statistics is scheduled to announce the US February Consumer Price Index (CPI) at 21:30 (Japan time) on 3/12. According to Bloomberg polls, the February CPI was compared to the same month last year3.1%It remains, and the core CPI is3.7% increase(3.9% increase from previous value) is expected.

![[US February CPI Preview] US Federal Reserve May Cautiously Send Easing Signals Will the Inflation Rate Remain at 3% or More?](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240311/73727ed26e414b4f95002357229179f6.png/big?area=105&is_public=true)

Since WTI crude oil prices rose to close to $80 at the end of the month,Energy prices are trending upward in FebruaryIt was there. However, due to the fact that crude oil imports in China for the first two months since the beginning of the year fell by about 5.7% to 10.8 million barrels per day,Uncertainty on the demand side still overshadows extended supply cuts due to OPEC+It's possible.

![[US February CPI Preview] US Federal Reserve May Cautiously Send Easing Signals Will the Inflation Rate Remain at 3% or More?](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240311/271dc471b92f4e75962e7c8724fc1a66.png/big?area=105&is_public=true)

The 2024/2 FAO Food Price Index fell 0.9 points (0.7%) from the January revised value to 117.3 points. This is because the decline in the grain and vegetable oil price index slightly exceeded the increase in the price index for sugar, meat, and dairy products. The index fell 13.8 points (10.5%) from a year earlier.

![[US February CPI Preview] US Federal Reserve May Cautiously Send Easing Signals Will the Inflation Rate Remain at 3% or More?](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240311/fd73028866454c2ca1dfae68cbfa879e.png/big?area=105&is_public=true)

According to the national rent report for apartment listings, rent growth was -1% compared to the same month last year, and has continued to be negative for the past few months. Looking at each city, the decline in rent compared to the same month last year is conspicuous in the Sunbelt metropolitan area, and in particular, in Austin, it has fallen by 7% in the past 12 months, making it the top position.

![[US February CPI Preview] US Federal Reserve May Cautiously Send Easing Signals Will the Inflation Rate Remain at 3% or More?](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240311/8339c6f43bc9401e907d90e452b4ec96.png/big?area=105&is_public=true)

On the supply side of the housing market, vacancy rates across the country are on an upward trend and have now reached 6.6%. Since the number of completed housing units this year is expected to be the highest in the past few decades, it is expected that a considerable vacancy rate will continue next year.

![[US February CPI Preview] US Federal Reserve May Cautiously Send Easing Signals Will the Inflation Rate Remain at 3% or More?](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240311/40a77dca6849457b93bc0f0e243ac79b.png/big?area=105&is_public=true)

Housing expenses in January surged to an astonishing 0.6% increase from the previous month, accounting for more than two-thirds of the monthly rate of increase for all items. Goldman Sachs analyst Jan Hatzius pointed out that attributable rent (OER), which is the biggest component, is actually a price no one is paying.The Bureau of Labor Statistics reviewed the CPI measurement method and increased the proportion of rent for single-family housing。

However, according to data from Zillow, Yardi, and CoreLogic, the growth in single-family house rents is quite moderate, and the annual rate is around +2 pp. This gap can only explain a quarter of the OER rise in January. Simply put, OER in January rose 7% in terms of an annualized rate, but the growth in single-family rents is less than half of that pace. Accordingly,You don't need to worry too much about January's effects。

Used car wholesale prices in February (on a seasonally adjusted basis) fell compared to January. The Mannheim Used Car Price Index (MUVVI) fell 13.1% from the same month last year to 203.8. The index fell 0.1% compared to 2024/1.

![[US February CPI Preview] US Federal Reserve May Cautiously Send Easing Signals Will the Inflation Rate Remain at 3% or More?](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240311/7308ea3348b1477788d5075e49b10a85.png/big?area=105&is_public=true)

The important thing is that this year is veryAn important election yearIt is,Political risks are affecting expectationsThat's it.

Considering the current economic situation (easing of financial conditions, rising housing prices, stock markets close to historical highs, etc., all contributing to sustainable demand through the effects of wealth), it is unlikely that the consumer price index for February will immediately hit the Fed's inflation target.

The US Federal Reserve (Fed)Political movements calling for interest rate cuts are conspicuous. In Chairman Powell's Senate testimony, it was suggested that the Fed is getting closer to a position to consider interest rate cuts.

Since there is a possibility that changes in the Fed's outlook will have a major impact on the market and the US economy, it seems a good idea to maintain a hawkish stance until the inflation rate reaches the target range of the Fed. The Federal Reserve is at a standstill high stageThere is a possibility that mitigation signals will be carefully issued。

Nevertheless, according to Jane Hatzius, despite adjusting weights in the previous announcement, Goldman Sachs only slightly revised its 2024 core inflation forecast to 2.3%, an increase of 0.1 pp. In other words,Interest rate cuts later this year are still possibleThat's it.

![[US February CPI Preview] US Federal Reserve May Cautiously Send Easing Signals Will the Inflation Rate Remain at 3% or More?](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240311/f1a9b074848c440a9d16ed0e62d9da67.png/big?area=105&is_public=true)

Source: Apartment List, FAO, Cox Automotive

-MooMoo News Calvin, Sherry

This article uses automatic translation for some of its parts

-MooMoo News Calvin, Sherry

This article uses automatic translation for some of its parts

![[US February CPI Preview] US Federal Reserve May Cautiously Send Easing Signals Will the Inflation Rate Remain at 3% or More?](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240308/1709863587974-d20c6602fd.png?area=105&is_public=true/bigmoo)

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment