NVDA

NVIDIA

-- 139.670 TSLA

Tesla

-- 430.600 PLTR

Palantir

-- 80.690 AMD

Advanced Micro Devices

-- 124.600 RGTI

Rigetti Computing

-- 10.9600

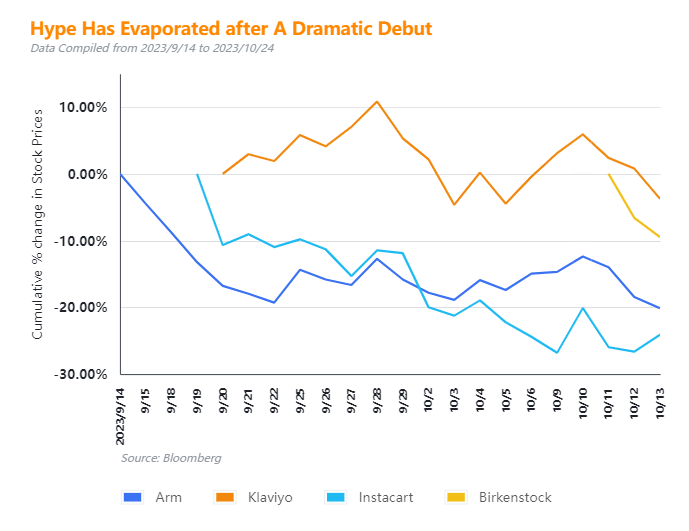

"I'm not expecting a lot of IPO activity between now and the end of the year," said David DiPietro, Head of Private Equity at T. Rowe Price. Historically, IPO market success has been driven by a strong stock market and demand for risky assets. However, due to the Federal Reserve's indication of maintaining rate hikes amid Middle East tensions and rising oil prices, the S&P 500 Index is expected to fall for the third consecutive month.

“From talking to clients and others in the ecosystem, there could be a window that opens up in mid-to-late-March and onwards,”said Conor Moore, head of KPMG's Private Enterprise practice.

lightfoot : Stocks to profit in the 6 weeks to 9 months. ASC , CARG. I have done much research. Undervalue and growing.

73418073 : nice![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)