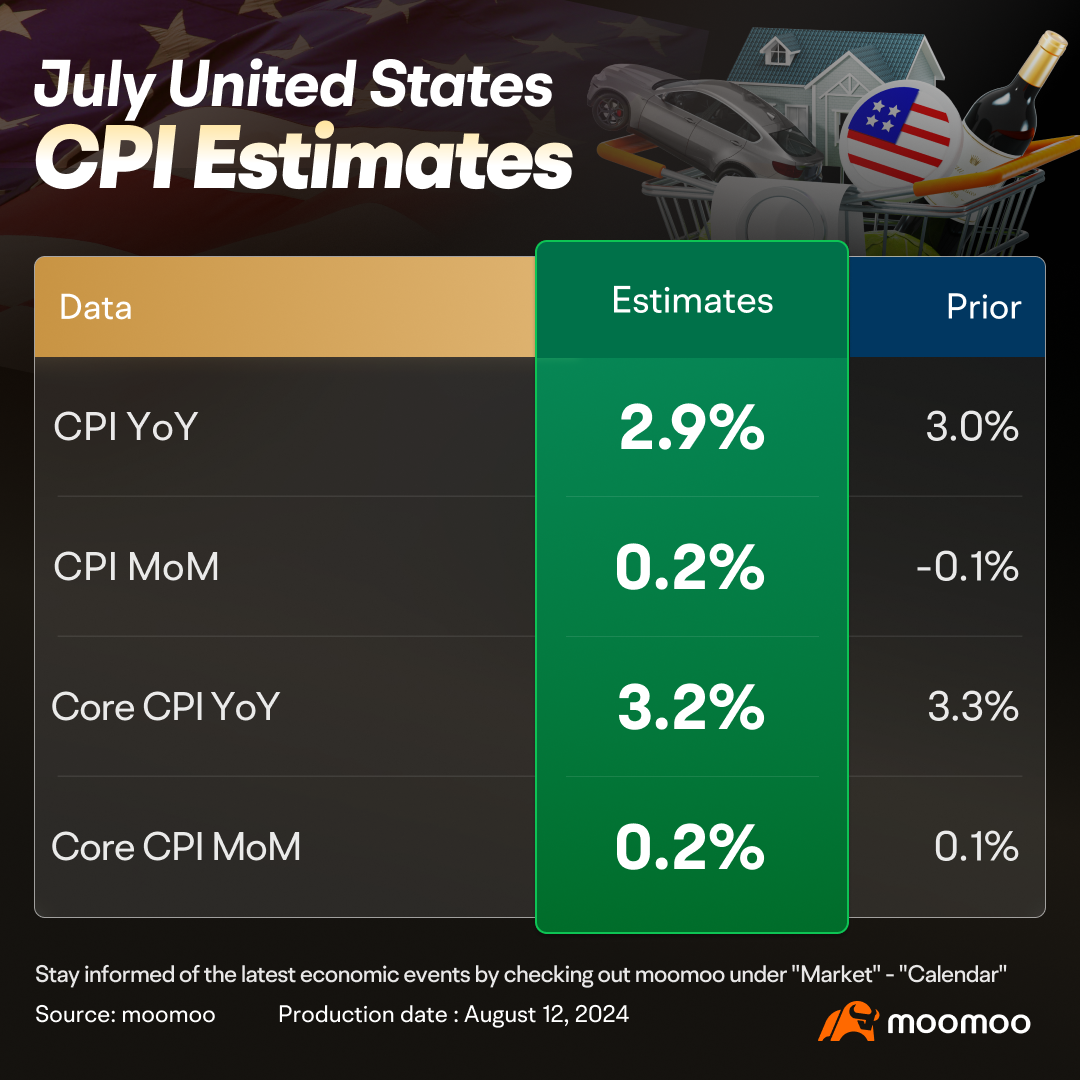

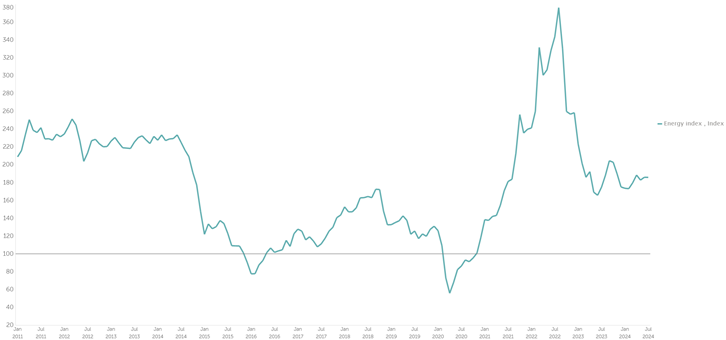

Since interest rate cuts have been fully priced this year, investors need appropriate CPI data showing that inflation is declining, but there are no signs of recession. It's still not clear how the market could react to the upcoming report, but if the CPI's downward trend slows again, it could put the Federal Reserve in a dilemma of whether to prioritize employment or to continue fighting inflation. On the other hand, if the CPI falls too rapidly, the Fed will face the difficult decision of whether an emergency rate cut is needed, with still about 36 days left until the next FOMC meeting.

103350489 : $MAYBANK (1155.MY)$

山芭佬 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103865972 Gurcharn S : $MAYBANK (1155.MY)$

104309970 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103175053 : Really well written, thanks!