According to Apartment List, the national median rent experienced a 0.4% increase in June, reaching $1,411, although the growth rate has decelerated a bit this month. Normally, this period marks a time when rent growth tends to pick up due to the high season for relocation. However, this year's seasonal rent hikes have been comparatively subdued, leading to rents that are, on average, marginally lower than they were at the same time last year. The year-over-year rent growth is currently at -0.7 percent, and it has been negative since the previous summer.

YawningKitty_x_x :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

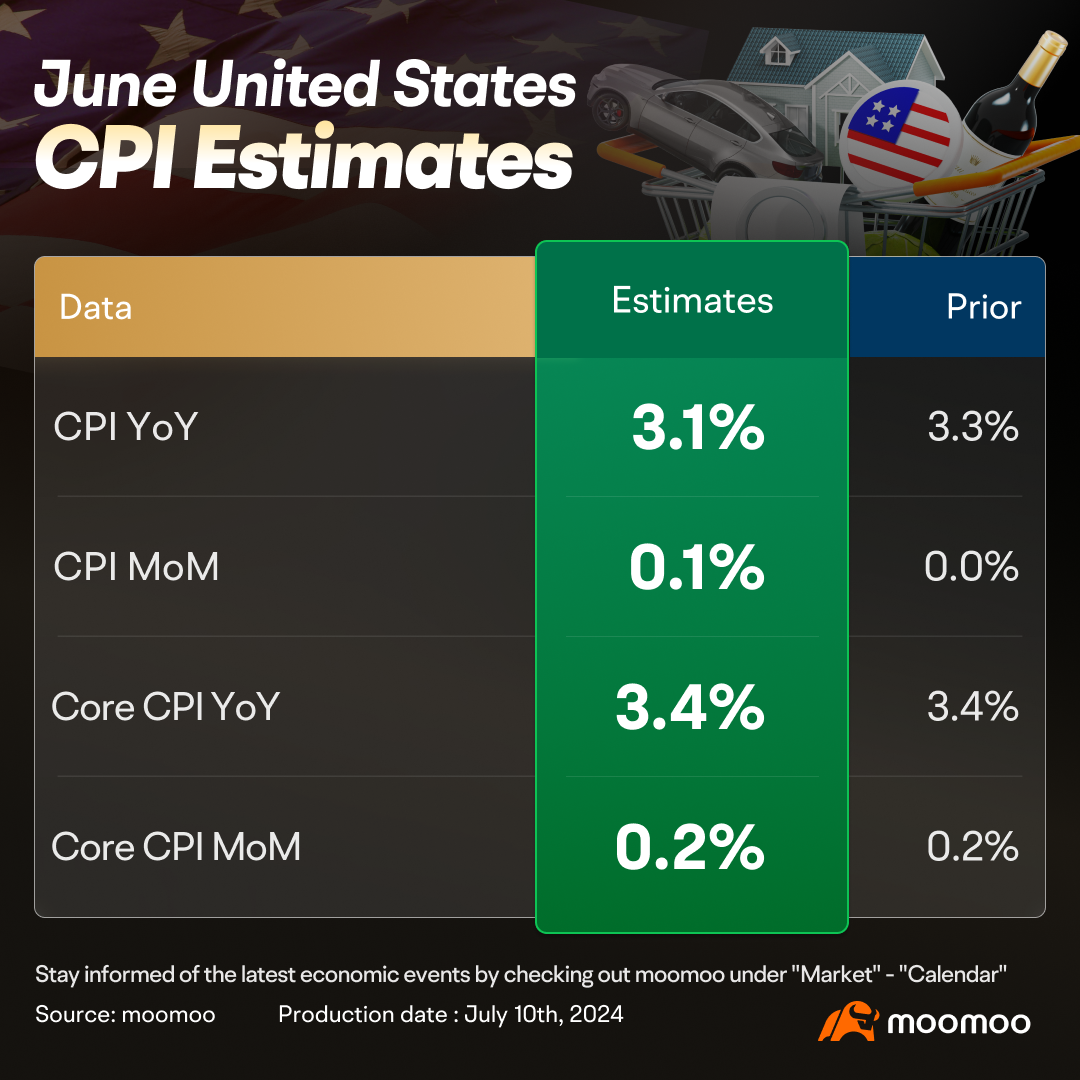

Gilley : cpi estimate isn't good if it stays the same it should drop the markets

pokemon pang :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104327919 : good

105241192 : The stock market is rising and interest rates are not being cut.

VERY LUCKY : I am wondering way 3% is so hard to break and why the FED is targeting a 2% inflation.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)