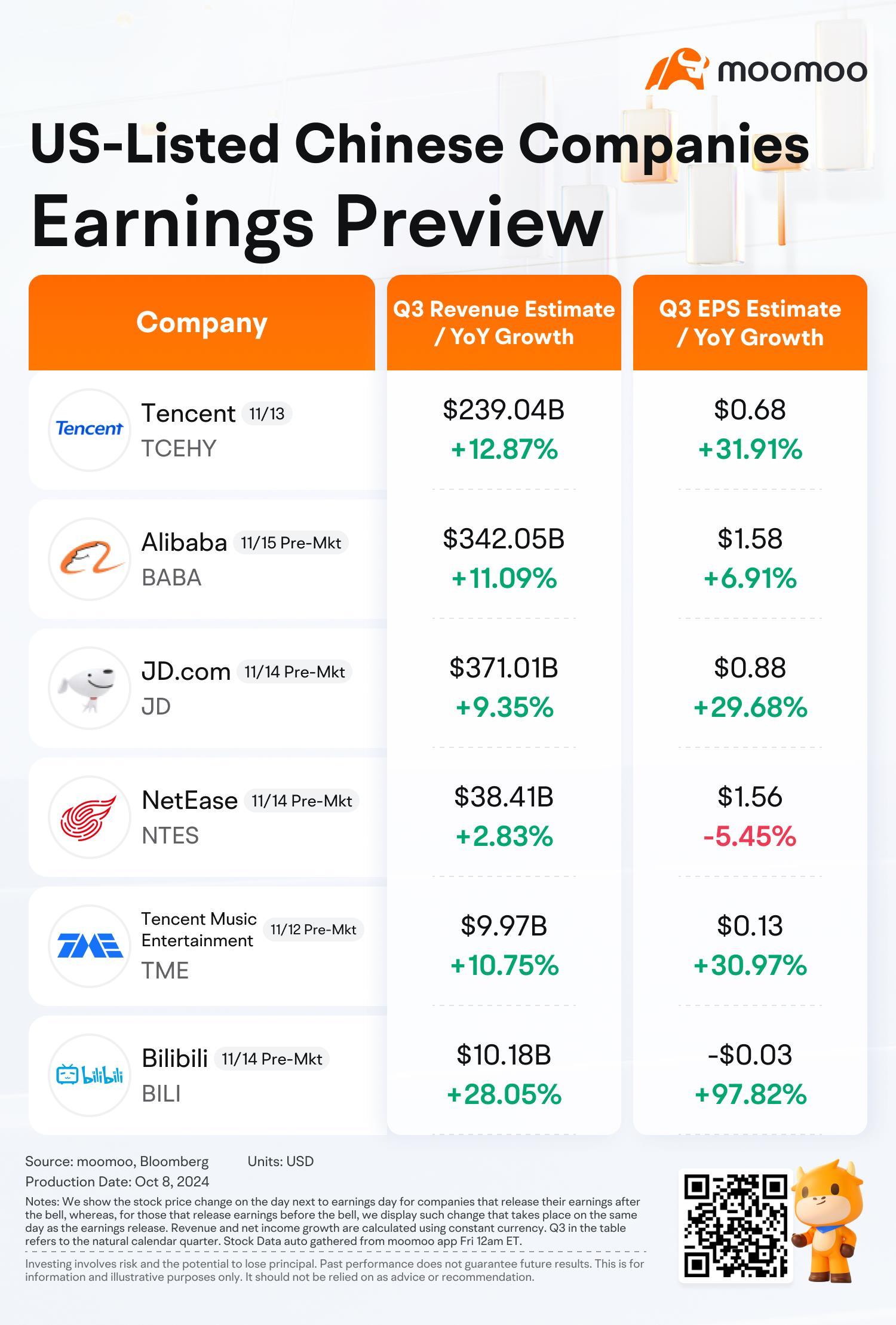

Since late September, Chinese assets have experienced a strong rally, particularly Hong Kong tech stocks and U.S.-listed Chinese companies, which were doing well. However, recently, these stocks have seen some pullbacks. As a result, this earnings season is crucial, as it will largely determine whether the current rebound can continue.

105668020 : yes

Mrgotchaa : B$Alibaba (BABA.US)$![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101852215 : better wait after the results are announced to avoid being a leek. I suspect that every time after there is an announcement or upgrade, the fund managers are unloading. A typical example is the CCB which they had purchased it between 4 to 5, now recommend a target price of about 11 about 2 weeks ago. How do they value CCB to such a high price?

Mr Value investor : Look too positive for me, Alibaba and jd.com may not post very strong eps growth. If it does I will be surprised

905745367 Mr Value investor : Still go down…