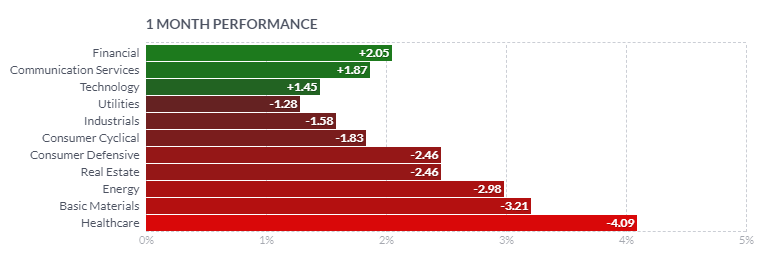

Due to a sell-off in tech stocks on Thursday, the US stock market gave back all of October's gains, resulting in the largest single-day drop on Wall Street in nearly two months. On the last trading day of October, the S&P 500 closed down 1.9%, while the tech-heavy Nasdaq Composite fell 2.8%. Large tech stocks led the declines, with Microsoft falling 6.1%, marking its biggest single-day drop in two years. Meta reported its earnings on Wednesday but saw its stock decline by 4.1%. The market decline occurred ahead of earnings reports from two other trillion-dollar tech giants, Apple and Amazon. Apple informed investors of moderate growth in smartphone sales, leading to a drop in its stock price in after-hours trading, while Amazon saw a significant increase due to strong performance in its cloud computing division.

Kuku bird on fire ❤ :

101775147 AL alfijai :

73138936 : El

103827296 : hai you bos