Outlook for the USA market: Bitcoin temporarily surpasses 0.09 million dollars, Dow starts 30 dollars lower.

Moomooユーザーの皆様、こんばんは!![]() 今晩のNY株の読み筋です。

今晩のNY株の読み筋です。![]()

市場概況

米国市場スタート、優良株で構成するダウ工業株30種平均は30.52ドル安の43880.46ドル、ハイテク株比率が高いナスダック総合株価指数が5.06ポイント高の19286.46で始まった。米国大型株である500社の銘柄で構成するS&P500種平均は1.76ポイント高の5985.75。

米国市場スタート、優良株で構成するダウ工業株30種平均は30.52ドル安の43880.46ドル、ハイテク株比率が高いナスダック総合株価指数が5.06ポイント高の19286.46で始まった。米国大型株である500社の銘柄で構成するS&P500種平均は1.76ポイント高の5985.75。

トップニュース

While the yen exchange rate hits a new low, bitcoin is turning upwards again, while gold bottoms out.

● Today's consumer price index statistics show strong inflation for the third consecutive month, leaving the Federal Reserve undecided on whether to cut interest rates next month. There is a risk that President Donald Trump's policies could generate further inflationary pressures next year.

● For the first time since July, the yen exchange rate exceeded 155 yen per dollar, with the risk increasing that Japan will intervene in the foreign exchange market to slow down the depreciation of the yen.

While the yen exchange rate hits a new low, bitcoin is turning upwards again, while gold bottoms out.

● Today's consumer price index statistics show strong inflation for the third consecutive month, leaving the Federal Reserve undecided on whether to cut interest rates next month. There is a risk that President Donald Trump's policies could generate further inflationary pressures next year.

● For the first time since July, the yen exchange rate exceeded 155 yen per dollar, with the risk increasing that Japan will intervene in the foreign exchange market to slow down the depreciation of the yen.

● Elon Musk and Vivek Ramaswamy lead a new government efficiency ministry to reduce bureaucracy. It is a temporary duty until July 2026.

● As the gold price seems to have bottomed out above $2,600, bitcoin's post-election rise is starting to revive.

● As the gold price seems to have bottomed out above $2,600, bitcoin's post-election rise is starting to revive.

US October CPI rose by 2.6% year-on-year, matching market expectations

Core also matches market expectations.

The Consumer Price Index (CPI) for October in the United Statesis Rising by 2.6% year-on-year.、Matches market expectations of 2.6%.The previous period rose by 2.4%.Rose 0.2% from the previous month.、Matches market expectations of a 0.2% increase.The previous period saw a 0.2% increase.

The Consumer Price Index (CPI) for October in the United Statesis Rising by 2.6% year-on-year.、Matches market expectations of 2.6%.The previous period rose by 2.4%.Rose 0.2% from the previous month.、Matches market expectations of a 0.2% increase.The previous period saw a 0.2% increase.

Amid rising inflation concerns in the USA, Trump's policies are putting pressure on the global markets.

Concerns about inflation centered in the USA and President Trump's tariff and tax reduction plans are putting pressure on markets outside the USA, with the MSCI USA External Index hitting a 3-month low and facing a sharp decline in emerging markets.

Investors are cautious about additional rate cuts by the Federal Reserve, and market expectations for the December rate cut are shifting from last week's optimistic expectations to a more balanced outlook.

In the global currency markets, the yen exchange rate has weakened to over 155 yen per dollar, and the People's Bank of China (central bank) has moved to curb the depreciation of the renminbi, but the Bloomberg Dollar Spot Index is maintaining a 2-year high.

Concerns about rising US bond yields have led to further selling of bonds, with forecasts suggesting increased selling pressure, and some investors are shifting their focus to assets more insulated from President Trump's policies, such as Thailand and Vietnam.

This pressure is expected to eventually impact US assets.

Concerns about inflation centered in the USA and President Trump's tariff and tax reduction plans are putting pressure on markets outside the USA, with the MSCI USA External Index hitting a 3-month low and facing a sharp decline in emerging markets.

Investors are cautious about additional rate cuts by the Federal Reserve, and market expectations for the December rate cut are shifting from last week's optimistic expectations to a more balanced outlook.

In the global currency markets, the yen exchange rate has weakened to over 155 yen per dollar, and the People's Bank of China (central bank) has moved to curb the depreciation of the renminbi, but the Bloomberg Dollar Spot Index is maintaining a 2-year high.

Concerns about rising US bond yields have led to further selling of bonds, with forecasts suggesting increased selling pressure, and some investors are shifting their focus to assets more insulated from President Trump's policies, such as Thailand and Vietnam.

This pressure is expected to eventually impact US assets.

Rocket Lab USA's stock price is soaring.

Satellite launch companies $Rocket Lab (RKLB.US)$ In pre-market trading, it is soaring over 25%.

The company announced better-than-expected quarterly earnings outlook and the first contract using the new rocket system "Neutron".

The company's stock price has risen by over 160% just this year.

Satellite launch companies $Rocket Lab (RKLB.US)$ In pre-market trading, it is soaring over 25%.

The company announced better-than-expected quarterly earnings outlook and the first contract using the new rocket system "Neutron".

The company's stock price has risen by over 160% just this year.

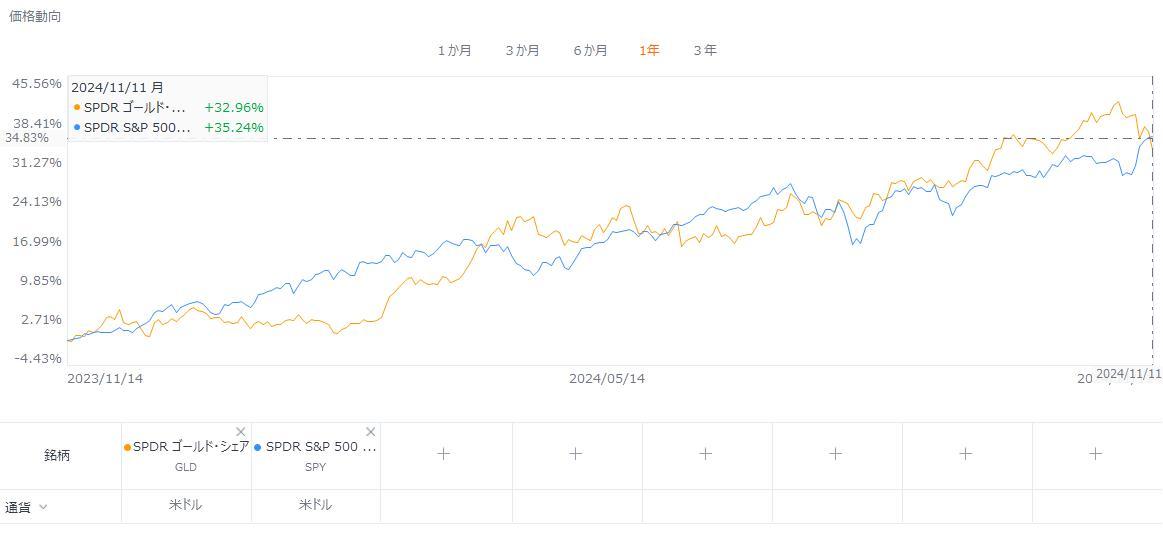

AI boom obscuring the second worst post-inflation-adjusted stock performance in the past 25 years.

According to Deutsche Bank's research, despite the AI boom and record highs, US stock performance after inflation adjustment is at the second worst level in the past 25 years.

The almost 5% annual increase is modest, and US stocks are set to fall below gold for the first time in a quarter century.

Since 1800, the real annual rate of return for US stocks has been 6.9%, surpassing the 10-year Treasury bond, but recent returns are far from "stunning" both absolutely and relatively.

One reason for the relatively poor returns dates back to the period starting with the peak of the historic high valuation of the dot-com bubble.

Deutsche Bank expects stocks to outperform bonds again, especially as the policy bias leans towards reflating amid economic crises.

According to Deutsche Bank's research, despite the AI boom and record highs, US stock performance after inflation adjustment is at the second worst level in the past 25 years.

The almost 5% annual increase is modest, and US stocks are set to fall below gold for the first time in a quarter century.

Since 1800, the real annual rate of return for US stocks has been 6.9%, surpassing the 10-year Treasury bond, but recent returns are far from "stunning" both absolutely and relatively.

One reason for the relatively poor returns dates back to the period starting with the peak of the historic high valuation of the dot-com bubble.

Deutsche Bank expects stocks to outperform bonds again, especially as the policy bias leans towards reflating amid economic crises.

moomoo News Zeber

Source: moomoo, Bloomberg

This article uses auto-translation in part.

Source: moomoo, Bloomberg

This article uses auto-translation in part.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

初音ミク0139 : Report the profits UFJ is making under the Great Oya Commercial Law.