US October CPI Preview | Will Sturdy Inflation Propel or Pause the Trump Trade?

On November 13, the U.S. Bureau of Labor Statistics will release CPI data for October at 8:30 a.m. ET.

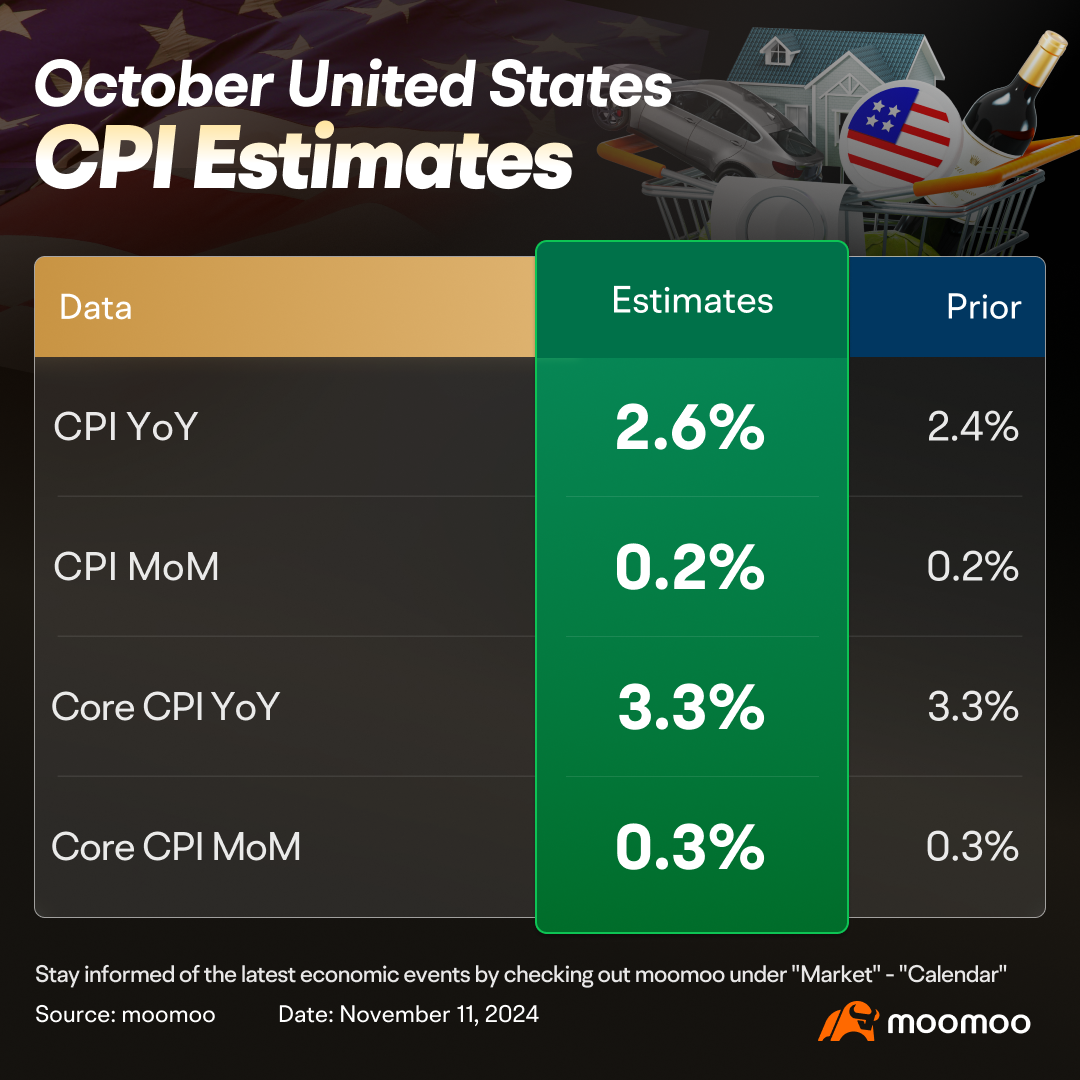

Economists expect the overall CPI to rise by 2.6% in October, up from 2.4% in the previous month. Excluding food and energy, the core CPI is anticipated to record a third consecutive monthly increase of 0.3%, maintaining a year-over-year rise of 3.3%—approximately one percentage point above its pace before the pandemic.

Several risks could potentially drive prices higher in the near to medium term, including a pullback in labor supply, the effects of deglobalization on import prices, and continued robust demand.

Both CPI and PPI are expected to show higher readings, which will likely drive long-term interest rates even higher — thereby further constraining economic growth over the next few months.

▶ Oil prices experienced significant fluctuations in October

Oil prices surged at the beginning of October, but as geopolitical tensions eased, prices fell again in the latter half of the month. Average Crude Oil Spot Price was at a level of $73.97 in October, up from $72.42 in the previous month and down from $89.08 one year ago. This is a change of 2.14% from the previous month and -16.96% from one year ago.

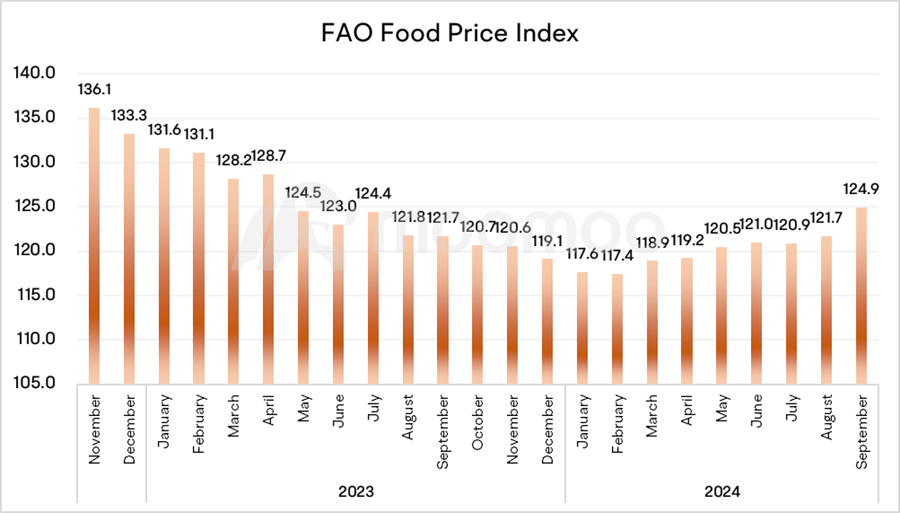

▶ Food prices set to rise in October

In October 2024, the FAO Food Price Index (FFPI) reached an average of 127.4 points, marking a 2 percent increase from its adjusted level in September and achieving its highest value since April 2023. Prices for all commodities listed in the index, except for meat, experienced an uptick. Vegetable oils saw the most significant rise, jumping by 7.3 percent. When compared to historical data, the FFPI in October was 5.5 percent above its value from the same month the previous year.

▶ Car prices fell in October

October saw a dip in wholesale used-vehicle prices compared to September. The Manheim Used Vehicle Value Index (MUVVI) dropped to 202.8, marking a 3.2% decrease from the previous year. Without seasonal adjustments, October prices fell by 1.9% relative to September.

In comparison, new car prices are stable, but remained near record highs since 2022. Still, certain new car segments are witnessing significant price drops. Particularly noteworthy is the luxury vehicle sector, where prices have taken a considerable dip, largely due to Tesla’s aggressive pricing strategies. CarEdge analyst Justin Fischer said year-end car sales may push prices lower in November and December.

▶ Rent decreases following a seasonal pattern

Rent is one of the most significant factors affecting inflation. Excluding shelter costs, the rest of the CPI basket only saw a 1.1 percent increase over the past year, which is significantly below the Federal Reserve's long-term inflation target of 2 percent.

According to Apartment List, nationally, rent growth on a year-over-year basis has been negative since June 2023, currently sitting at -0.7 percent, a figure that has remained relatively stable throughout much of the year. From a month-on-month perspective, rent also decreased by 0.7%.

▶ What's the implication?

Trump's second term faces far more complex inflationary pressures than in 2016/2017. During his first term, inflation did not spiral out of control because the United States had just emerged from a balance sheet recession at that time.

Currently, geopolitical conflicts in Eastern Europe and the Middle East remain unresolved; American residents are burdened with higher loan interest rates; the Treasury Department is heavily indebted; and speculations about reflation make the U.S. economic outlook uncertain. Moreover, Trump's tax reduction policies could increase the U.S. government deficit, further contributing to pressures of currency devaluation and inflation.

Consequently, the Federal Reserve might be forced to reconsider its policy path, potentially adopting a more hawkish stance. CME FedWatch shows that market expectations for the Federal Reserve to cut interest rates at the December FOMC meeting are at 65.6%, down from over 80% a month ago. Additionally, investors are also anticipating that the rate cuts in 2025 will be smaller than previously forecasted.

The extent of the Federal Reserve's rate cuts also depends on the timing of the implementation of Trump's policies. If the tax cuts are implemented sooner, the fiscal deficit will be larger, and the Federal Reserve is expected to adopt a more hawkish stance. However, since tax cuts would also lead to an increase in earnings for companies, a more hawkish Federal Reserve might not necessarily hinder the stock market's upward momentum.

Source: Cox Automotive, CME, Trading Economics

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SpacemanSter : add food back into that and it'll be skyrocketing

152275795 dfaulkner :

103773948 : pause

far008 : I think tomorrow will be another red day. looking at the 30 years yields and the bond markets. it's starting to prepare for Trump policy moving forward. There will be concern that the numbers come in hot and this will only be the beginning of what's to come.

72446552 far008 : all green