US retail data tonight could be the boost market needs after losing steam following Powell's comments "No rush to cut"

US Market Key Charts (S&P, US Dollar, Gold)

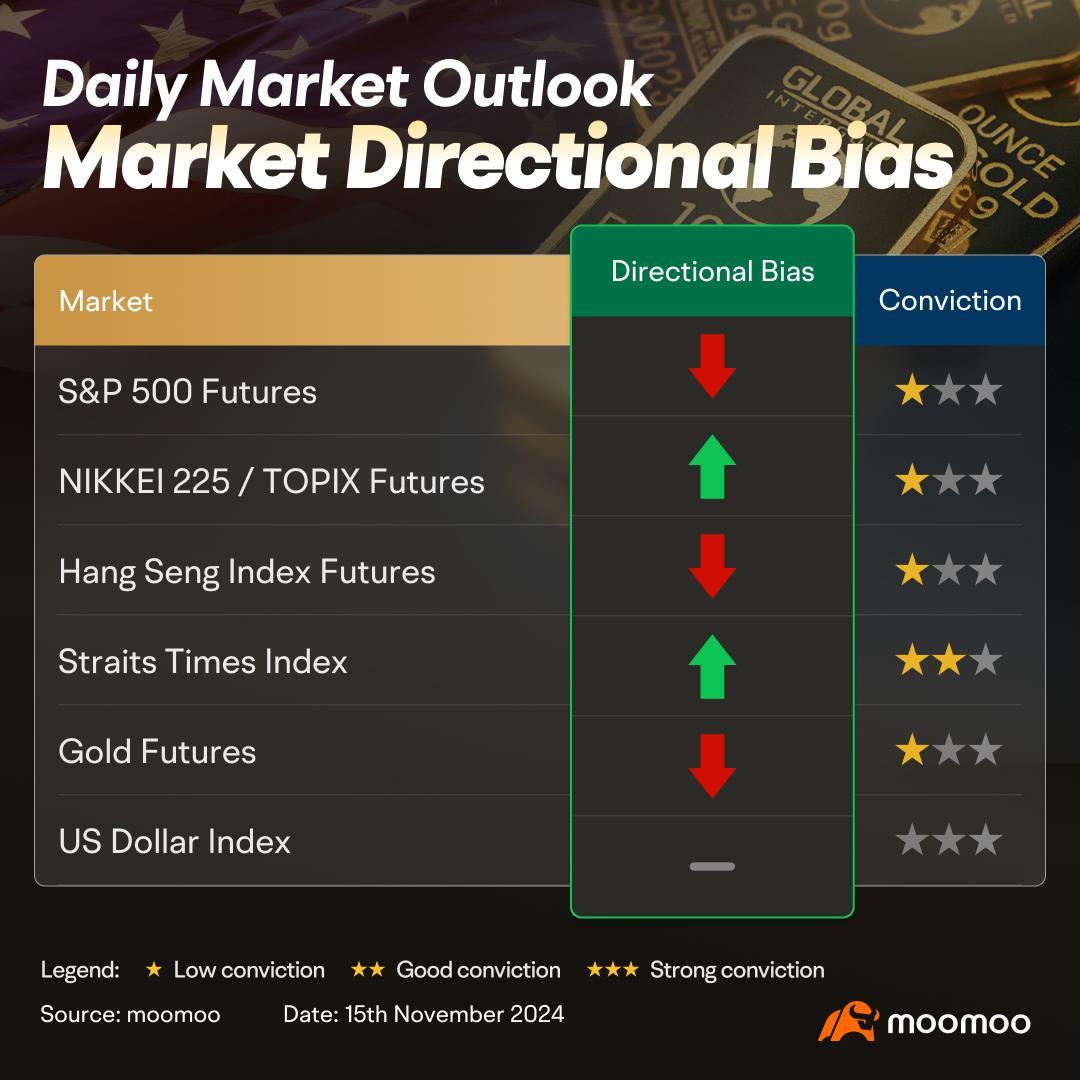

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We turn slightly bearish as long as price holds below 6000 resistance level. We expect price to push towards 5920 support level. Technical indicators are mixed for now, with price holding below 21-EMA period.

Alternatively: A 4 hour candlestick closing above 6000 resistance level would open next drop towards 6055 resistance level.

$USD (USDindex.FX)$ (4 Hour Chart) -[NEUTRAL]We turn neutral as price is hovering between 107.344 resistance and 106.428 support level. A 4 hour candlestick closing below 106.428 support would open second drop towards 105.842 support level. Technical indicators are advocating for a bullish scenario.

Alternatively: A 4 hour candlestick closing above 107.344 resistance level would open a push towards 107.790 resistance level.

$Gold Futures(FEB5) (GCmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We turn slightly bearish as price is currently near 2580 resistance level. We expect prices to drift down towards 2515 support level. Technical indicators are advocating for a bearish scenario as well.

Alternatively: A 4 hour candlestick closing above 2580 resistance level would open push towards 2600 resistance level.

NIKKEI 225 / TOPIX IndexFutures

$Nikkei 225 (.N225.JP)$ (4 Hour Chart) -[BULLISH↗ *]We stay bullish as price is holding above its ascending trendline support. As long as price holds above 38600 support level, we expect price to drift towards 39350 resistance level. Technical indicators have yet to display a bullish scenario.

Alternatively: A 4 hour candlestick closing below 38600 support level would drop towards 38000 support level.

HSI IndexFutures

$HSI Futures(DEC4) (HSImain.HK)$ (4 Hour Chart) -[BEARISH ↘ *]We stay bearish as we expect price to drift lower towards 19100 support level. Technical indicators are mixed, with price holding below 21-EMA period. A 4 hour candlestick closing below 19100 support level would open next drop towards 18300 support level.

Alternatively: A 4 hour candlestick closing above 20200 resistance level would open push towards 21300 resistance level.

SG Market - STI

$FTSE Singapore Straits Time Index (.STI.SG)$ (4 Hour Chart) -[BULLISH↗ **]We continue to stay bullish as we expect price to push towards 3800 resistance level as long as price holds above 3650 support level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 3650 support level will open droptowards 3580 support level.

Summary - What Is Happening In The Markets

US markets closed lower last night, with $E-mini S&P 500 Futures(DEC4) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ edging lower by 0.63% and 0.70% respectively. This comes after Powell's speech last night of not rushing to reduce interest rates given the economy's resilience. Traders are now currently pricing in a probability of 58.9% for a 25-basis-point rate cut, a sharp drop from yesterday's 82.8%. Among other stocks, $Leidos (LDOS.US)$ dropped the most by 13.60%. Traders should look to observe retail sales data released tonight.

Asian markets open mixed this morning. $Nikkei 225 (.N225.JP)$ drifted the highest by 0.62%. This is due to risk-on sentiment among traders after GDP data which performed as analyst's expectations. Traders should look to observe industrial production data released later. $HSI Futures(DEC4) (HSImain.HK)$ edged marginally higher by 0.19% this morning, with strength observed from the non-energy minerals sector. This comes after outperforming retail sales and unemployment rate data which came below analyst expectations. $NTES-S (09999.HK)$ climbed the most by 12.89%. However, traders should stay cautious as China's introduction on tax incentives on home and land transaction failed to excite the stock market. $FTSE Singapore Straits Time Index (.STI.SG)$ drifted marginally lower by 10%, with weakness observed in the finance sector. $UOB (U11.SG)$, $OCBC Bank (O39.SG)$ and $DBS (D05.SG)$ pushed slightly lower by 0.78%, 0.36% and 0.58% respectively.

Prepared by:

Moomoo Singapore

Isaac Lim CMT, CFTe

Chief Market Strategist

Chief Market Strategist

This report is provided for informational and general circulation purposes only and should not be construed as an offer, solicitation, or recommendation for the purchase or sale of securities, futures, or other investment products. It does not take into consideration any particular needs of any person. This advertisement has not been reviewed by the Monetary Authority of Singapore.

For full disclaimers, please visithttps://www.moomoo.com/sg/support/topic5_935.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Cui Nyonya Kueh :

933199333 : Seem No rate cut in dec