US September CPI Preview | Declining Inflation Will Support a Modest 25bp Rate Cut Next Time

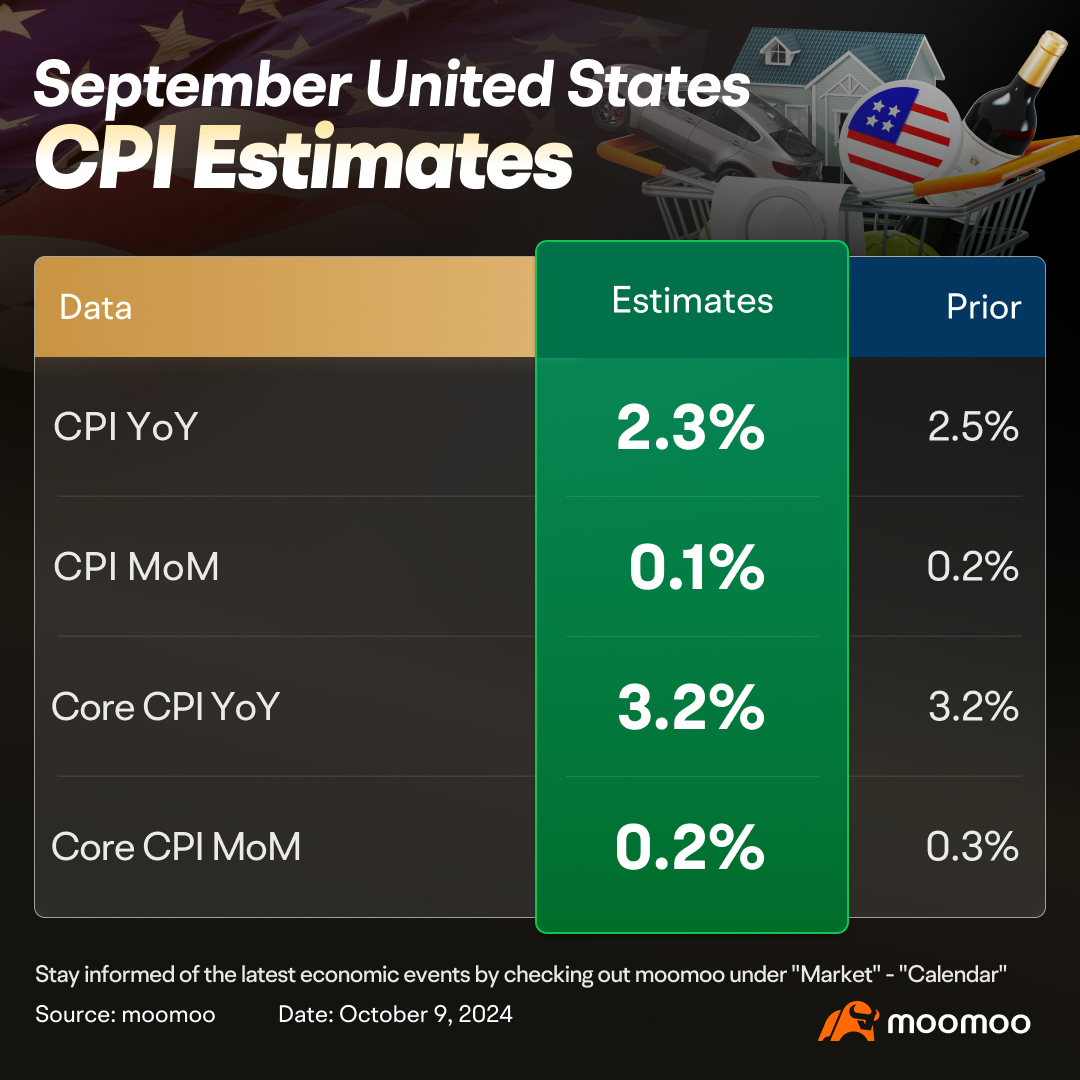

On October 10, the U.S. Bureau of Labor Statistics will release CPI data for September at 8:30 a.m. ET.

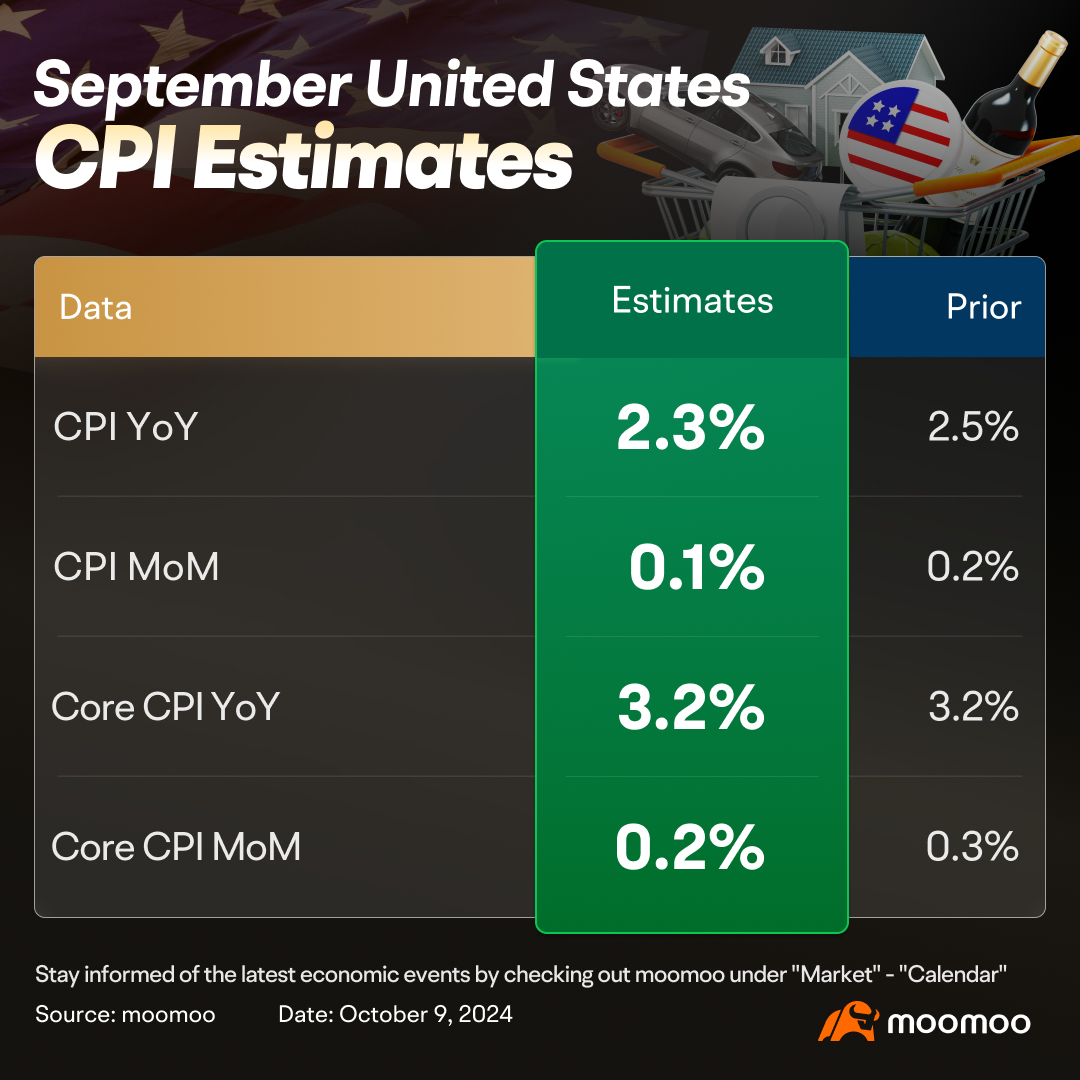

Economists expect the overall CPI to rise by 0.1% in September, which will bring the annual rate to 2.3%, equal to the inflation rate immediately before the pandemic in February 2020. The core CPI is also expected to increase by 0.2% in September. The 12-month change rate of the core CPI is expected to remain at 3.2%.

▶ Oil price tumbled in September

Crude oil prices may not be a major factor causing inflation in the coming months. Average Crude Oil Spot Price is at a level of $72.42 in September, down from $78.12 in the previous month and down from $92.22 one year ago. This is a change of -7.29% from the previous month and -21.47% from one year ago.

Despite the recent tensions in Lebanon, oil prices have not risen above $80 recently. At the same time, API data revealed a significant increase in US crude oil inventories, with a surge of 10.9 million barrels last week—marking the largest weekly build since November 2023 and greatly surpassing the anticipated increase of 2 million barrels.

▶ Food prices are likely to rise in September

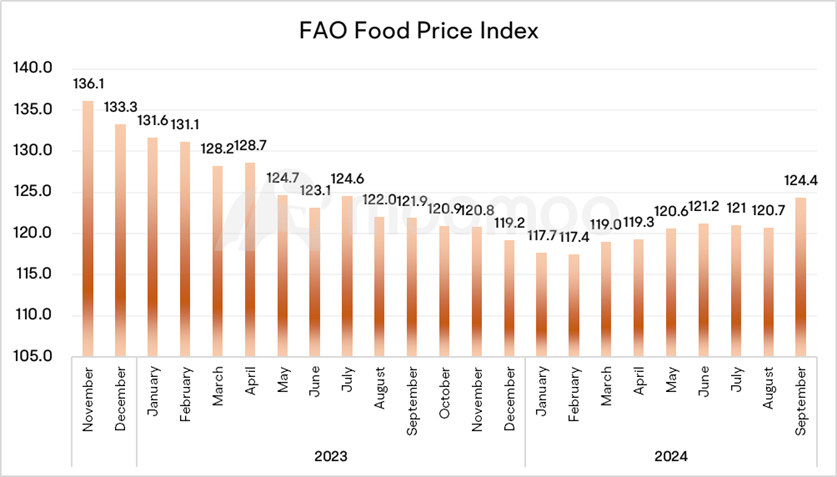

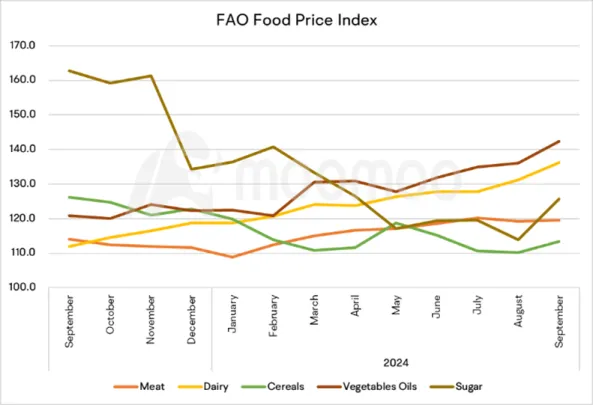

In September 2024, the FAO Food Price Index reached 124.4 points, a 3 percent increase from August and the most significant month-to-month rise since March 2022. Prices for all commodities in the index saw gains, with increases varying from 0.4 percent for the meat price index to 10.4 percent for sugar.

Wheat prices rose significantly, driving cereal prices higher, primarily due to concerns about unfavorable weather conditions affecting key exporting regions. Excessively wet conditions in Canada and the European Union delayed harvests in Canada and resulted in a substantial reduction in the production forecast for the EU.

▶ Rent prices declined, especially in the Sun Belt market

Wells Fargo's Chief Economist Jay H. Bryson noted that shelter remains the primary culprit behind stubborn services inflation. Shelter inflation accelerated 0.5% over the month of August, but hemaintainsthe view that shelter inflation should slow more materially in the months ahead.

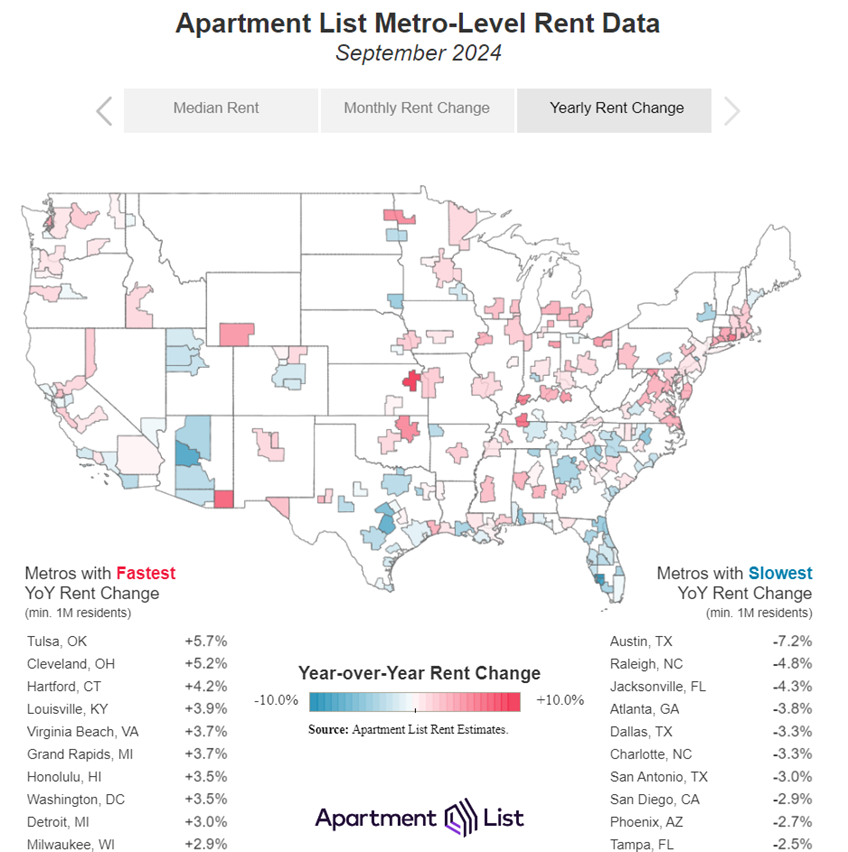

Apartment List's latest report shows that, an increase in new housing supply has led to falling rents in the U.S. especially for the Sun Belt markets, while rents in the Midwest and Northeast show positive growth. The metro-level map highlights the trend of year-over-year rent decreases across the Sun Belt. Specifically, the Austin metro area has experienced the most significant decline among large metros nationwide, with rents dropping 7.2 percent over the past year.

Nationwide, rents are down 0.5% month-over-month and down 0.7% year-over-year, according to Apartment List. For the past two years, monthly growth has turned negative starting in August, which is earlier than typically anticipated by the market. This minor change in timing appears to primarily reflect the persistent sluggishness in the market.

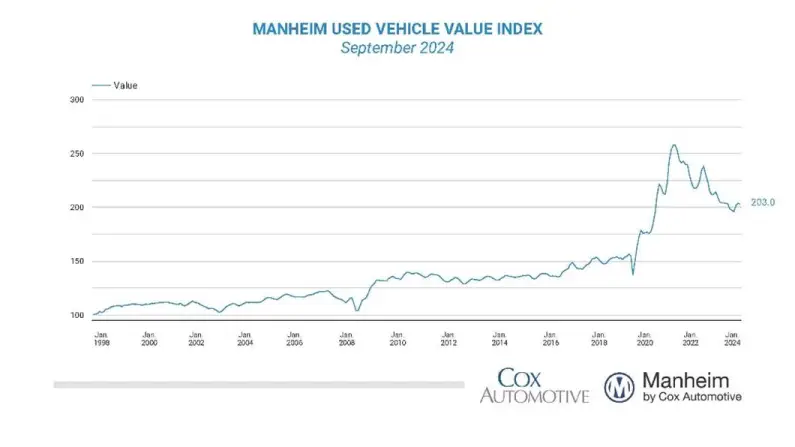

▶ Used EV values fell faster than non-EVs

Wholesale used-vehicle prices decreased in September compared to August. The Manheim Used Vehicle Value Index (MUVVI) dropped to 203.0, marking a decline of 5.3% from the previous year.

Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive, noted, "Wholesale values reversed course and turned negative over the month of September after rising in July and August. The new normal is likely that we continue to see wholesale depreciation, although it may be more muted than the market is accustomed to for the rest of the year."

▶ What's the implication?

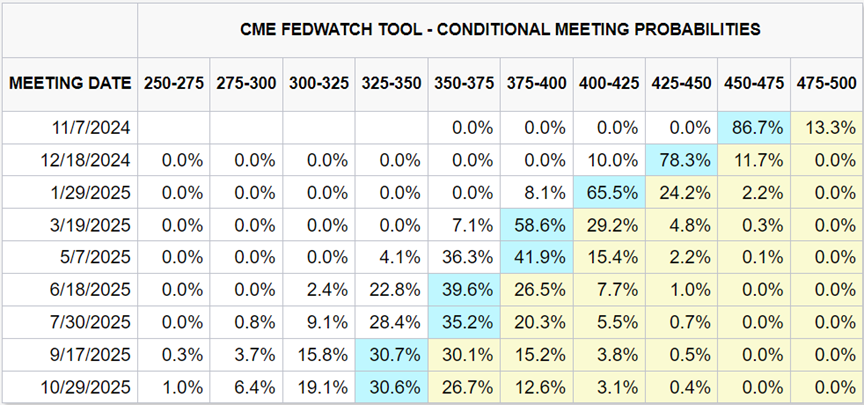

After the Fed cut the fed funds rate by a jumbo 50bps, there was speculation about whether the central bank would opt for a more conservative 25 basis point cut in November instead. The unexpectedly robust September jobs report also cast doubt on the likelihood of a 50bp rate cut at the November FOMC meeting.

Following the robust jobs report, some Federal Reserve officials might shift their focus back to inflation data. The upcoming CPI report is unlikely to significantly alter the FOMC's confidence that inflation is on a sustained downward trend, and it may solidify expectations that the Fed will cut interest rates by 25 basis points.

Moreover, CPI inflation has historically been 0.4 percentage points higher than PCE inflation. Adjusting for this difference, a CPI reading of 2.3% in September would be the first since March 2021 that isn’t above a level consistent with the 2% target in PCE terms.

Source: Wells Fargo, Bloomberg, Trading Economics, Apartment List

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

山芭佬 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Yani3167 : Afraid

103677010 : noted

affable Blobfish_403 : This kind of data is to be expected. The election situation is more important than everything else during the election. Wall Street understands that this is an opportunity to hype up the stock market to the cloud, and retail investors can lick blood from the tip of a knife; it's just too dangerous.