The US stock market and Japanese stock market both collapsed! The correction is far from over, can the Hong Kong stock market benefit from it?

The U.S. stock market plummeted.

Last Friday, the three major US stock indexes all fell sharply. Intel fell 26%, marking its largest drop since at least 1982, while Amazon fell 8.78%, leading the Dow Jones Industrial Average lower. Since mid-July, the Nasdaq has experienced three consecutive weeks of significant decline, with a retracement of more than 10% from its high point. Meanwhile, long-term US Treasury yields rose 3.12%.

The recent decline in US stocks is mainly due to multiple factors such as the continued decline in US economic data, underperformance in monetizing AI, high overall valuations of US stocks, and disappointing performances of leading companies during earnings season. At the same time, all of these fluctuations are due to the just released July unemployment rate data. According to the recent employment report released by the US Bureau of Labor Statistics, the US unemployment rate reached 4.3% in July, an increase of 0.2 percentage points from June's 4.1%, setting a new high since October 2020. This has caused market panic. Although in historical terms, a 4.3% unemployment rate is not considered high, the recent upward trend has made the market very uneasy, raising concerns of entering a recession. Because the unemployment rate is not a leading indicator, an increase in the unemployment rate does not necessarily indicate that the market is on the verge of a recession, but rather suggests that the market may already be in a recession. Therefore, even though the increase in the unemployment rate is only 0.2 percentage points, it is enough to trigger market panic.

The rising unemployment rate data has triggered the Sam Rule, which is an indicator for predicting a recession. The specific rule of the Sam Rule is that if the unemployment rate (based on a three-month moving average) rises 0.5 percentage points above its low point from the previous year, then the economy is in a recession. Since 1970, this indicator has had a 100% accuracy rate. Bloomberg analysts have stated, 'The Sam Rule has been triggered, and the US is not moving in a positive direction.'Although the Sam Rule is a statistical law, it doesn't mean that something is definitely going to happen. However, the turning point of market sentiment has already preceded the arrival of a recession.

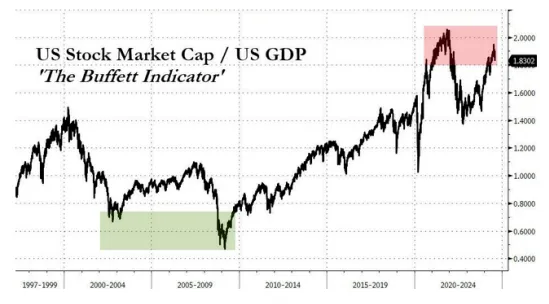

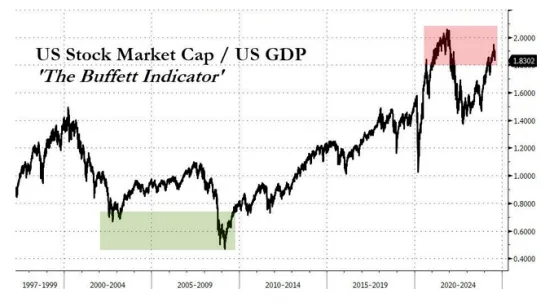

Warren Buffett has been the first to release a bearish signal. The Buffett Indicator, which reflects whether the market is overheating (the ratio of total stock market capitalization to GDP), has now surged above 180%, indicating that the market is severely overvalued.

What's next for the US stock market?

After the employment data was released, Fed Watch data showed that the probability of a 25bp and 50bp rate cut by the Fed in September was 26% and 74% respectively, with the former value being 78% and the latter being 22%.

In terms of major asset reactions, the yield on 10-year US Treasury bonds fell sharply below 4%, reaching a new low since February; the US dollar index fell to 103.223. Gold rose, fell, and then rose again. The three major US stock indexes all fell significantly, showing clear signs of recession trading.

If we choose the interest rate cut cycles in 1995, 2001, 2007, and 2019 as a retrospective analysis, each of these four interest rate cut cycles includes two rounds of recessionary rate cuts and two rounds of preventive rate cuts. The former is accompanied by a rapid cooling or recession of the economy, with a fast pace and large magnitude of rate cuts; the latter is the process of the economy transitioning from overheating to normalization, with a slow pace or small magnitude of rate cuts.

In terms of US interest rate trading, there are two elements: first, the initial interest rate cut. Second, it is divided into two stages: trading interest rate cut expectations (the time frame is set as the 3 months before the interest rate cut, during which the probability of rate cuts quickly rises from below 50% to close to 100%); trading interest rate cut implementation (the time frame is set as the 6 months after the interest rate cut, during which the market has a rough idea of the pace and magnitude of the Fed's rate cuts). Interest rate trading is more inclined towards event-driven short-term trading. If a longer time frame is set, it may inevitably be confused with fundamental trading and be more influenced by other factors.

Just.the overall US stock market,in preventive interest rate cuts, US stocks can be boosted by both trading interest rate cut expectations and interest rate cut implementation stages, driving index increases through valuation growth; or valuations can stay steady, with earnings resilience on the numerator side supporting index increases. In other words, due to the strong earnings resilience of individual companies (the numerator), they can achieve stable profits even under unfavorable economic or market conditions. This stability and earnings resilience enhance investor confidence, thus driving the overall market index up. This usually indicates that the market has optimistic expectations for the future performance of these companies, which in turn drives up stock prices and overall index.

In recessionary interest rate cuts, US stocks fall in both stages, which is a valuation contraction. ("Valuation contraction" refers to the process of the market sharply lowering its expected value (i.e. valuation) for certain stocks, sectors, or assets. This process is usually accompanied by a sharp decline in stock prices. "Valuation contraction" reflects the market's pessimistic expectations for the future prospects of specific assets or industries, resulting in a significant decline in their valuations.)

US Treasury Bonds:Whether it is a preventive or recessionary interest rate cut, the long-term US Treasury bond rates show a clear downward trend during the interest rate reduction trade in both stages. In the case of a recessionary interest rate cut, due to the faster decline in short-term interest rates, there is not much change in the US Treasury C-limit yield spread during the preventive interest rate cut.

US Dollar Index:During the preventive interest rate cut, the US dollar fluctuates weakly during the trading phase of the interest rate cut expectation, and after the rate cut lands, the US dollar fluctuates strong. In the case of a recessionary interest rate cut, during the trading phase of the interest rate cut expectation, the US dollar is relatively weak; after the rate cut lands, the strength or weakness of the US dollar is uncertain. The closer the timing of the rate cut is to the onset of a recession, due to safe-haven demand, the US dollar may strengthen.

Gold:Whether it's a preventive or recessionary interest rate cut, during the two stages of the interest rate reduction trade, gold tends to have a basic trend of fluctuating strength.

The Nikkei is also affected.

On August 5th, the Tokyo stock market saw a sharp continuous decline in the Nikkei average index. The Nikkei average index fell by 4451 points (12%) at the close of the market compared to August 2nd, the previous weekend, to 31458 points. This decline is the largest in the history of the Japanese stock market, exceeding the 3836-point drop after the US stock market crash on October 20, 1987. Overseas institutional investors, hedge funds, and individual investors all engaged in selling. The Nikkei index has fallen below the closing price at the end of 2023 (33464 points), wiping out all the gains in 2024. Nevertheless, some believe there is still room for further decline, and the market's turmoil continues.

Securities firms' stock analysts calculated the overall PE (price-earnings ratio) of stocks based on the expected profits for the 2024 fiscal year (until March 2025), and found that the Nikkei average index was 14.9 times on August 2nd, lower than the average 15 times level of the long-term bullish market since Abenomics. Masago Ide from Japan Life Basic Research Institute said, "From a valuation perspective, the current price is relatively cheap, so it wouldn't be surprising even if the decline stops. However, if the US stock market experiences a large decline again, the Japanese stock market may be affected as well."

How does the Hong Kong stock market perform during the Fed rate cut cycle?

According to statistics from ICBC International, the average increase of the Hang Seng Index during all rate-cut cycles since 1983 was 22.0%, with a cumulative increase of 264.2%. Both the average and cumulative increases were higher than during rate-hike cycles.

However, recent rate-cut cycles have shown a significant decrease in the growth of the Hong Kong stock market.It is evident that the stimulating effect of loose liquidity on the Hong Kong stock market is diminishing.

When decomposing stock price changes, it can be seen that the main driver of the Hong Kong stock market's rise during the rate-cut phase has shifted from profit growth to valuation expansion.

Looking at all rate-cut cycles since 1993, the average PE ratio of the Hang Seng Index expanded by 20.9%, with a cumulative expansion of 125.3%. During all rate-cut cycles, the average profit growth of the Hang Seng Index was 12.8%, with a cumulative growth of 77.0%.

It can be seen that during rate-cut cycles, the Hong Kong stock market can still maintain profit growth, but the increase is not as large as the expansion of valuation during the rate-cut cycle, nor as much as the profit growth during the rate-hike cycle.

Overall, during the rate-cut phase, the valuation and profits of Hong Kong stocks can continue to rise.Valuation expansion has become the main driving force for the rise of Hong Kong stocks..

Industrial and Commercial Bank of China International Securities stated that the Hong Kong stock index's performance has a relatively high reaction to rate cuts.The main reason for this is that Hong Kong stocks are in the offshore US dollar market, and valuations are more sensitive to changes in US dollar liquidity. In addition, the Hong Kong stock market's focus on the financial industry attributes also makes the earnings of Hong Kong stocks respond more to changes in interest rates compared to US stocks. Of course, the triggering factors and timing of rate cuts may have a significant impact on investment returns. Therefore, it is crucial to analyze the scenario before the rate cut.

Excluding extreme events, this week will be a turning point in the Hong Kong stock market: whether to continue following the weakness of the external market or stabilize and rebound.

Summary

So, if investors can trade both US stocks and Hong Kong stocks on a single platform, it will undoubtedly greatly improve the convenience and efficiency of their operations, help enhance the efficiency of their investments, reduce costs, and improve the accuracy of investment decisions, thus achieving better investment returns. Platforms like Tiger Brokers, Kraken Exchange, and BiyaPay Multi-Asset Trading Wallet are available in the market. These platforms, through multiple financial licenses and special services such as non-freezing deposits and withdrawals, ensure the safety of investors' funds and provide them with better options beyond traditional brokerages.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment