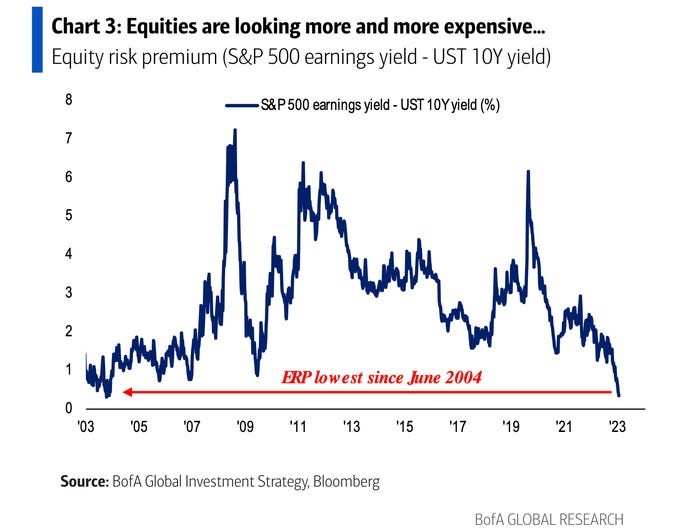

US Stocks Are the Most Expensive VS. Bonds in 20 Years. Time to Be Bolder With Bonds?

Stocks have surged in recent months as the US economy has proved resilient, but another threat to this year's rally has emerged in the form of rising interest rates.

The yield on 10-year government-bond settled at 4.339% on Monday, the highest since late 2007. This has put a damper on what was a 20% rally for the $S&P 500 Index(.SPX.US$ from January to the end of July. So far in August, the benchmark index is down 4%.

US Treasury Bonds May Look More Attractive Relative to US Equities

The equity risk premium, or the annualized excess return investors can expect by putting money in the stock market versus the 10-year Treasury note is currently at its lowest level since 2004.

Looking back at history, analysts say risk premiums revert to average over time. Assuming yields don't fall, the only way for the equity risk premium to improve is for stock valuations to fall. That would mean stock prices would have to drop if earnings expectations don't grow.

Options Market Signals A Bad Sign For Stocks

The focal point of concern centers around the CBOE Put/Call ratio. It has now surged above the critical 1 level benchmark, climbing to the highest levels since the end of April 2023.

The implications are clear – bearish sentiment is tightening its grip on the market, prompting investors to brace for potential downward moves or safeguard their portfolios against impending sell-offs.

"A bad sign if stocks can't hold here," said Michael Hartnett, the chief investment strategist at Bank of America.

A retest of the pivotal 4,200 level for the S&P 500 Index now appears to be within the realm of possibility, the expert said.

Time to Be Bolder With Bonds?

Bond investors say the best yields in many years more than compensate for the risk of further tumult, and the summer selloff in U.S. Treasury debt is providing the best buying opportunity in years.

Many bond bulls believe the sheer weight of U.S. debt being issued over time will play to their advantage, with increasing debt payments ultimately slowing economic growth and causing riskier assets to sputter. They predict this will fuel a debt-market rally that over time will bring rates back down, delivering a windfall to bondholders who buy now.

But Treasury-market bulls are in the minority at the moment. The current selloff is being driven in part by investors who believe the wave of federal spending and depressed demand from America's biggest foreign creditors will likely keep long-term rates elevated for years.

Source: Business Insider, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102130341 : Chatterbox Moo :US Stocks Are the Most Expensive VS. Bonds in 20 Years. Time to Be Bolder With Bonds...

https://www.moomoo.com/community/feed/110926719418373?global_content=%7B%22invite%22%3A%22102130341%22%2C%22promote_content%22%3A%22mm%3Afeed%3A110926719418373%22%7D&data_ticket=ddd27871c038df83c9b3b49f37cf1835&content_type=feeddetail