US Stocks Brace for Big Tech Earnings and Economic Data Release: Receiving a Boost or Hitting a Wall?

This week is a pivotal one for the stock market. On the one hand, there will be a flurry of earnings reports from 99 companies, including tech titans like $Microsoft (MSFT.US)$, $Alphabet-A (GOOGL.US)$, $Advanced Micro Devices (AMD.US)$, $Amazon (AMZN.US)$, $Apple (AAPL.US)$, $Meta Platforms (META.US)$, and energy giants like $Chevron (CVX.US)$ and $Exxon Mobil (XOM.US)$. On the other hand, the highly anticipated first interest rate decision of the year will be revealed, with the market expecting the Federal Reserve to keep rates unchanged but possibly provide guidance on when a rate cut may be on the horizon. Furthermore, non-farm payroll data will also be a crucial determinant for the market to assess the Fed's next course of action.

1. Tech Stars' Earnings Reports: Will AI Craze Continue After Super Micro's Impressive Profit?

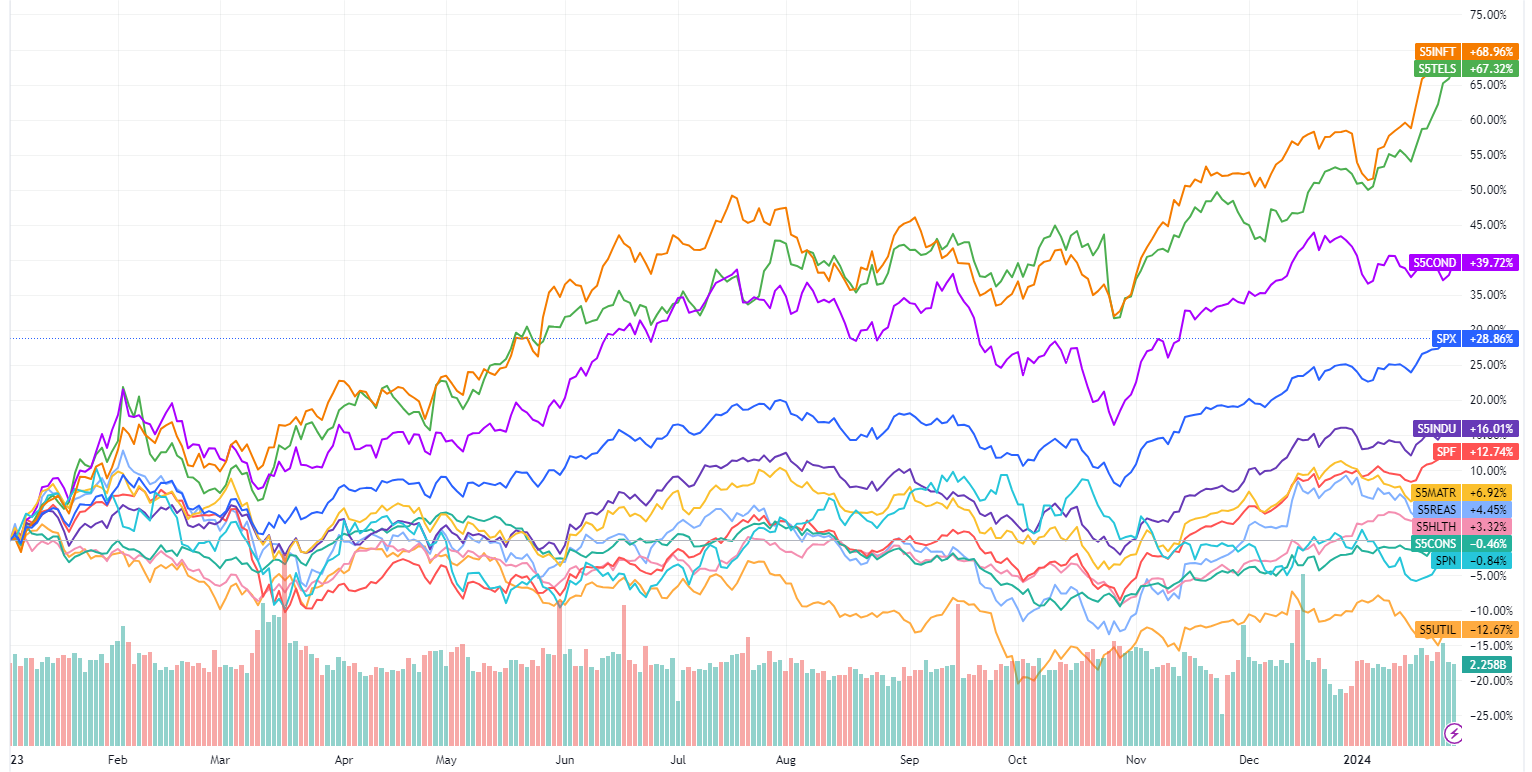

The surge in technology stocks, driven by the AI frenzy, has been the key driver of the US stock market's historic high, which had not been achieved in two years. However, amidst the current lack of hot market themes, the highly concentrated trading has inevitably made the AI sector and technology stocks vulnerable to significant market impact from even a minor misstep.

Data shows that among the 11 sector indices of the S&P 500, only the information technology index has hit a new high, with its top ten components including stars such as $Apple (AAPL.US)$, $Microsoft (MSFT.US)$, and $NVIDIA (NVDA.US)$. In contrast, during the last historic high two years ago, a total of eight sectors had achieved new highs, with a more balanced upward trend.

Investors are eagerly looking for signs of AI commercialization potential from the impressive performance of AI participants, otherwise, the sentiment regarding a technology bubble may become the biggest black swan for the US stock market in 2024.

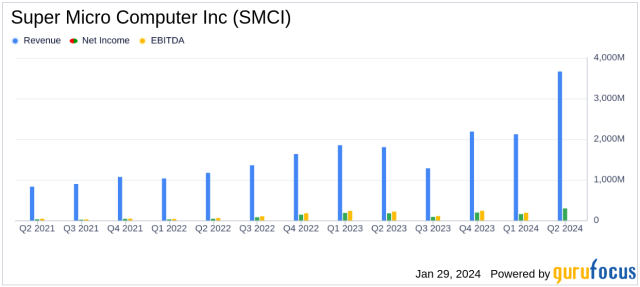

Fortunately, as the first AI star to be tested this week, $Super Micro Computer (SMCI.US)$ has delivered a satisfactory report card to the market. In addition to the previously announced Q2 (ending December 31) revenue and net profit exceeding expectations,the company's Q3 performance guidance has once again ignited the market. Driven by strong demand for AI servers, $Super Micro Computer (SMCI.US)$ expects Q3 (ending March) sales of $3.7 billion to $4.1 billion, with adjusted earnings per share of $5.20 to $6.01. Both figures are well above analysts' expected sales of $2.91 billion and adjusted earnings per share of $4.61, according to FactSet's survey.

Subsequently, another leader in the GPU field, $Advanced Micro Devices (AMD.US)$, and the leader in end-side AI technology, $Qualcomm (QCOM.US)$, will release their financial reports on Tuesday and Wednesday respectively. Analysts are closely watching whether other players are enjoying the dividends of the AI industry's development together or facing the squeeze effect from $NVIDIA (NVDA.US)$ in the current environment of strong AI demand and NVIDIA's rapid growth. Meanwhile, the financial reports of tech giants like $Meta Platforms (META.US)$, $Apple (AAPL.US)$, $Amazon (AMZN.US)$, $Microsoft (MSFT.US)$, and $Alphabet-A (GOOGL.US)$ will also answer the question of which companies are actually benefiting from AI.

Read More:

2. Fed's First Interest Rate Decision of 2024: Will the Timetable of Rate Cuts be Discussed?

The first interest rate decision of the year, which will be announced at 2 pm ET on January 31, is also one of the major events that global investors are closely watching. Although economists generally expect the Fed to keep interest rates unchanged at the January FOMC meeting, based on the cooling PCE data, the Fed's favorite inflation indicator, Powell may eliminate hawkish remarks and begin discussing the details of interest rate cuts.

Nick Timiraos, also known as the "Fed whisperer," pointed out that this is partly because officials are concerned that maintaining interest rates while inflation falls may cause inflation-adjusted real interest rates to rise to a level that unnecessarily suppresses economic activity.

In addition, several analysts have indicated that the Fed may provide more detailed information on slowing down quantitative tightening (QT) at this meeting. Bloomberg Intelligence and UBS both predict that the Fed may begin to slow down QT in May and Q2 of this year, respectively. Whether it's a dovish tone on interest rate cuts or a slowdown in QT, it could potentially support US Treasury yields, thus supporting US stocks from the denominator side.

3.Will the US Treasury's Surprising Cut of Q1 Borrowing Estimates Trigger the Stocks Rally Again?

On Monday, the US Treasury Department released its Quarterly Refunding Estimate (QRE), which showed that the net borrowing estimate for Q1 2024 is expected to decrease from the previous estimate of $816 billion to $760 billion, a decrease of $55 billion. This move could slow down market concerns about the imbalance between US Treasury supply and demand and trigger a similar rebound in the US Treasury market as seen at the end of last year, with falling bond yields also boosting the stock market.

In late October of last year, the US Treasury Department announced that fourth-quarter borrowing needs were lower than expected, with the previous estimate of $852 billion at the end of July reduced by $76 billion. The US Treasury's slowdown of Q4 borrowing has guided market expectations, reduced the impact of US Treasury supply, and combined with the Fed's pause on interest rate hikes at the time, the US Treasury market gained some breathing room. Details of the auction size will be released on January 31, and investors are expected to gain more information on subsequent Treasury supply.

4. Non-Farm Payroll Data Release: How Will Employment Trends Affect the Fed's Next Move and Market Trends?

A series of employment data will be released this week, including the JOLTS report on Tuesday, the private ADP employment report and employment cost report on Wednesday, the weekly initial jobless claims report next Thursday, and the non-farm payroll report on Friday. The market expects 180,000 new jobs to be added in January, a slight decrease from 216,000 in the previous month. ADP employment is expected to increase by 140,000, also lower than the previous month's 164,000. If the data indicates signs of a slowdown in the job market, it may provide support for the Fed to cut interest rates earlier this year.

Source: Gurufocus, Bloomberg, Investing, Reuters

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73545223 : send my program

73545223 : my data