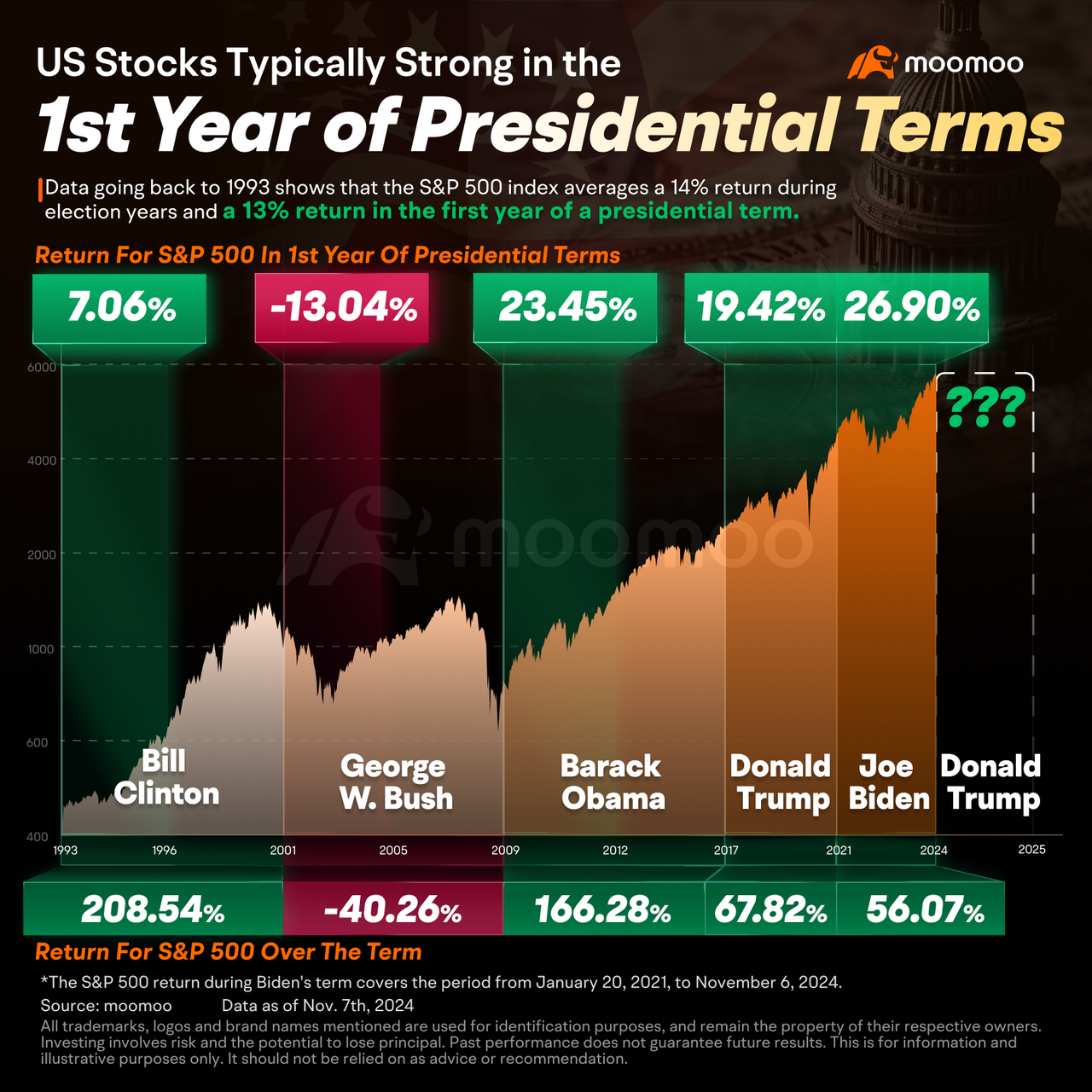

From 1950 to 2023, the historical data shows that the stock market often performed well in the first year of a presidential term, outperformed only by the third year. In the first year of a presidential cycle, presidents typically concentrate on fulfilling key campaign promises, often catering to the interests of their supporters. By the third year, the focus generally shifts toward stimulating the economy to bolster re-election efforts or strengthen their party's standing for the next election.

104556909 : good

ztock_boy : one paragraph of useful info. rest is political jargon. what asset classes are affected? what is market sector transition?

Treasury Debt Gets 'Punched in Face' After Trump Win. What to Do With Bonds Now

Laine Ford : this year is almost gone out no money tha Elaine have to show that why I am going offline for a while always log in but I will not say online like I used to

Laine Ford : good stock

Adrianlim90 : 1