USD 80-90 is a sweet spot for oil

Due to the extended production cut by the

OPEC+, oil price had been spinning up like a hot wheel since July, from USD 75+ + per barrel until USD 95+ + per barrel

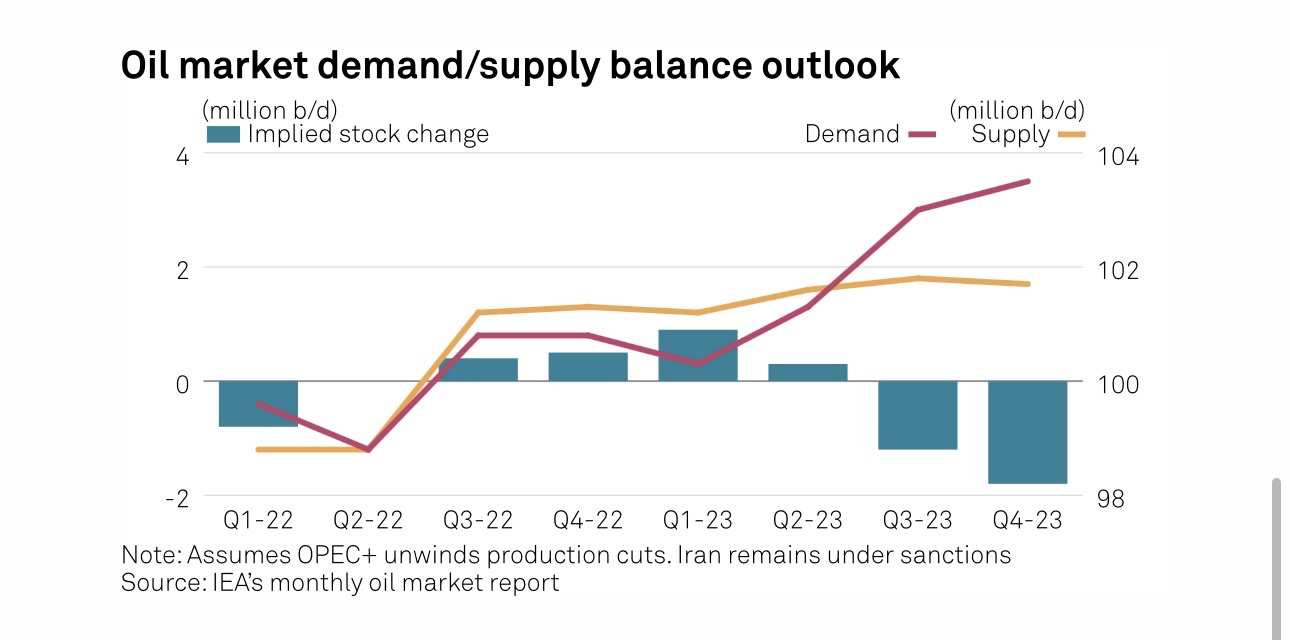

According to OPEC+ and IEA, both of the organizations are expecting an even worser shortage in supply of crude oil.

An uptick in demand , supported by the gradual recovery in China, plus the production cut by OPEC+ , has been causing further imbalance in the supply/demand.

While the recent Hawkish statements made by

FED officials, together with the strong job market data, sparks and strengthen the idea of one more rate hike in the end of this year.

The stronger USD, plus the anticipated drop in demand due to higher rate for longer period of time, causes the heavy profit taking on oil price.

OPEC+, oil price had been spinning up like a hot wheel since July, from USD 75+ + per barrel until USD 95+ + per barrel

According to OPEC+ and IEA, both of the organizations are expecting an even worser shortage in supply of crude oil.

An uptick in demand , supported by the gradual recovery in China, plus the production cut by OPEC+ , has been causing further imbalance in the supply/demand.

While the recent Hawkish statements made by

FED officials, together with the strong job market data, sparks and strengthen the idea of one more rate hike in the end of this year.

The stronger USD, plus the anticipated drop in demand due to higher rate for longer period of time, causes the heavy profit taking on oil price.

During 2022, when the energy commodities price were rising , most of the oil stocks were having a good run in the share price, such as $Exxon Mobil (XOM.US)$ $Occidental Petroleum (OXY.US)$ $Chevron (CVX.US)$ , but for this year , despite the hike in oil price , albeit at a lower pace than last year , is not bringing up those related stocks.

In my opinion , USD 80-90 per barrel of oil is a sweet spot for the world, while the producers can make decent income, the engineering services providers can also be benefiting from oil asset owners due to more capex allocation. And the inflation wont be out if control if the oil price stays at this range.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment