Volatility Rules Monday as NVDA and Semi's, Tech, and Consumer Stocks Plunge| Moovin' Stonks

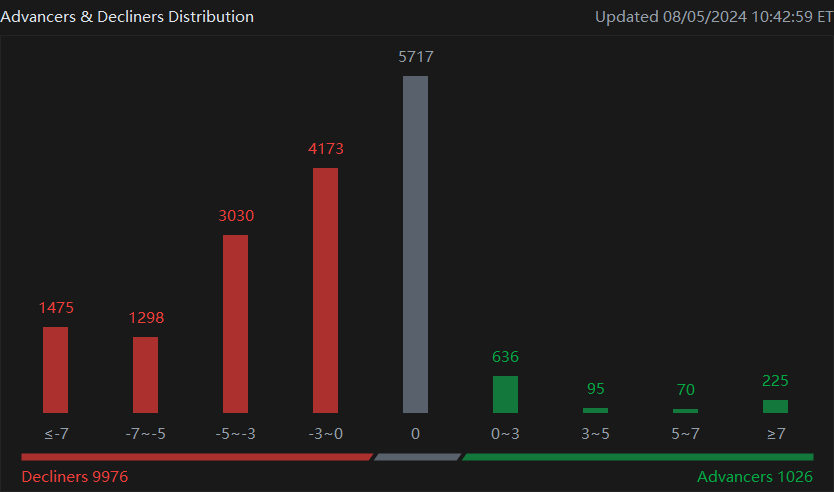

Good morning, traders. Happy Monday. What a red one it's turning out to be. August has proven painful overall, with only down sessions for Indexes. All 11 market sectors were in the red: here are stories from the herd on Wall St today, and here are moovin' stonks.

$AAPL.US$ fell 5% Monday morning just past 10:18 am ET, after Berkshire Hathaway $BRK.B.US$ earnigns over the weekend showed it had cut its stake in the tech giant by half and was sitting on $277B in cash. The giants investing dry powder sitting on the sidelines helped stir terror into the $.VIX.US$, that saw a 120% jump Monday.

$NVDA.US$ and other major tech stocks also fell, Nvidia pulling back 7% Monday, there are too many falling stocks to mention them all here; even brokerage firms like Fidelity and Schwab were reporting user issues with login: there was so much volatility investors were clogging web pages trying to get in.

$INTC.US$ fell a further 7%, the lowest on the Dow, S&P 500-, and Nasdaq 100, after its earnings miss hit the stock for a -30% price drop. It's report concerned investors that the AI tide was not pulling up every company, even long-established semiconductor chip companies like Intel.

$CLmain.US$ fell back 0.60%, $BTC.CC$ fell 10% to $52k, Gold and silver pulled back. $US2Y.BD$ fell, and remained below 4% for the first time since spring 2023, and the $US10Y.BD$ fell. Every top moving industry was in the red on moomoo, and the "Volatility" stock collection was the highest performing.

The market took a major hit Monday morning when the Nasdaq opened at -6%. A combination of worrying factors led to a $.VIX.US$ climbing 120% at one point.

Just past 10:31 am ET the $.SPX.US$ fell 3.33%, the $.DJI.US$ fell 2.7%, and the $.IXIC.US$ fell 4%.

The turbulence began last week after multiple earnings reports from the largest companies did not meet estimates. Then, minutes of Japan's head Bank showed some members wanted to raise rates, Friday, sending the $Nikkei 225.JP$ down 12% in Monday trading, the worst since the 1980s.

The U.S. market was already down Friday by about 3% on each index, and further stress pushed it over the edge. The Middle East conflict between Israel and Iran also threatened to inflame further over the weekend.

Meanwhile, last week's macro numbers pointed to a rush of unemployment. The numbers showed non-farm payrolls dropped from the month before, the economy only added 114k jobs vs 175k forecast and 179k in June, according to the Bureau of Labor Statistics. The unemployment rate in July rose to 4.3%, compared to 4.1% last month. The Federal Reserve has looked extensively at the labor market as an indicator of its monetary policy and appetite for rate cuts.

The FOMC left rates unchanged last Wednesday, and after the release at 2 pm ET, Federal Reserve President Jerome Powell answered press questions and said if all goes well, the FOMC would consider a rate cut in September.

"For example, if inflation was moving down quickly or in line with expectations, growth remains reasonably strong, and the labor market remains consistent with its current condition, then I would think that a rate cut could be on the table at the September meeting,' Powell said.

(To see these stocks and more on the options page, click here.)

Traders, what do you think, is the market in 2024 about following the herd? What you watching on the stock market today? What is the herd following? Let me know in the comments below!

Disclaimer: This content is for informational use only and is not a recommendation or endorsement of any particular investment or strategy. Indexes are unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances, before making any investment decisions. Past performance does not indicate or guarantee future success. Moomoo makes no representation or warranty as to its adequacy, or timeliness for any particular purpose of the above content. The data and information provided has been obtained from sources considered to be reliable, but moomoo does not guarantee that the foregoing material is accurate or complete. See the link in the Moovers Community post for more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

CasualInvestor : Painful day. All the best to the other causal investors. If you can don’t get margin call. Top up to tide it through if your bullish on the recovery. September will be better.

Salvador Ginori : I believe you are right on point on n a lot of points which I didn't think u mentioned yet the words from Trump about the chip stokes, we have NVDA being looked at by the DOJ, Election (no idea how Harris & VP ?), and the Feds like u said jus doesn't want to give in regarding the rate cuts. Jus seems like it's a wild fire w everyone starting sell and to top it off did u see how much Swab, Interactive brokerage & Robinhood are charging for Options? Crazy - I think once we finally get this rate cut and the elections get over w to see who w be the next president we'll give us investors a better feel as to what direction this economy will go. I foresee are weak second half even tho first half was off the charts in some categories. Good job on your story you wrote ! Keep up the good work

RandomTrader_ : Happy Monday no more when it’s a red bloodbath at the start of trading day…

Deep Value Kitty : Still waiting for the 20bucks I spent interviewing an hour with you in the midnight man

104166257 : hi