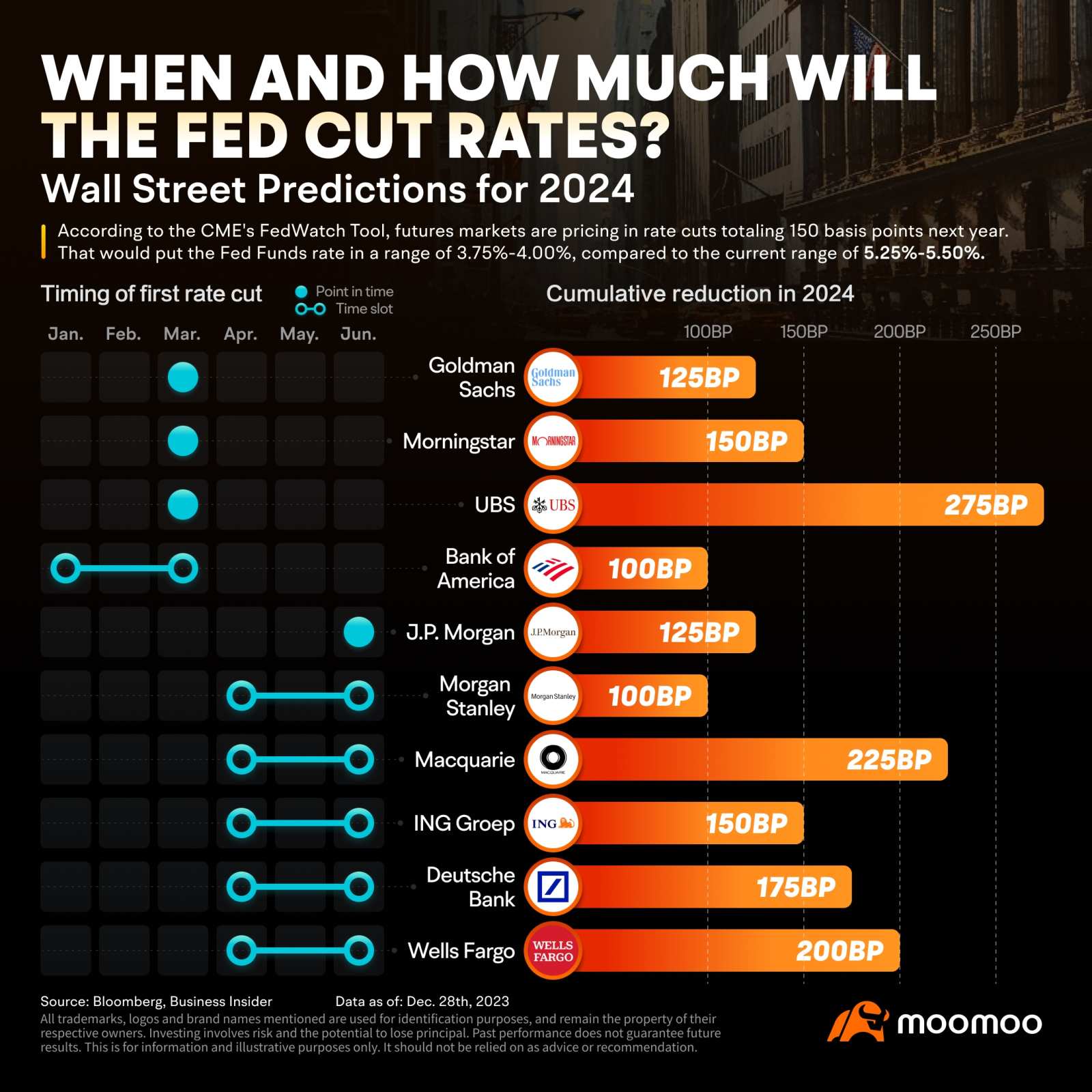

Wall Street Expects Rate Cuts to Begin as Early as Next March and a Reduction of Up to 2.75%

The discourse on Wall Street has shifted from the likelihood of interest rate cuts to speculating on their timing.

The Fed is now viewed as being dovish relative to other major central banks. Pricing for a rate cut in March increased after Fed Chairman Jerome Powell was unexpectedly dovish at the Fed's December meeting.

The CME's FedWatch Tool indicates that futures markets are pricing in rate cuts totaling 125 basis points next year. That would put the Fed Funds rate in a range of 4.00%-4.25%, compared to the current range of 5.25%-5.50%.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

虚拟账户 : Trick people into the venue!! The opinion was expressed. Foolish people are in economic decline. People's wisdom, on the other hand, cannot control it.

lSlippyl : Lmao holy shit, green light![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

newstock lSlippyl : whatever!

6MooTrader : Wah...how genuine can this be [Sob]. then I better dump my banks soon.

70185181 : If the Federal Reserve cuts interest rates in March, then US stocks will plummet from January to March 2024, and the Federal Reserve will have to cut interest rates before the market shows signs of a sharp decline. The Federal Reserve has a habit of finding a reason and excuse no matter what it does.

Laine Ford : maybe look at the future