Wall Street's 'Magnificent Seven' Brace for Earnings Season Challenges

During the latest market downturn, the NASDAQ Composite index decreased 0.77%, while the $S&P 500 Index (.SPX.US)$ and $Dow Jones Industrial Average (.DJI.US)$ also experienced drops of 0.61% (25.77 points) and 0.63% (208.87 points), respectively.

As tech giants Microsoft, Amazon, Meta, and Alphabet- known as the "Magnificent 7"- brace themselves for their upcoming earnings reports, which make up roughly a quarter of the S&P 500's market cap, the market continues to navigate uncertainty following Tesla's disappointing results last week that led to a 10% decline in stock value.

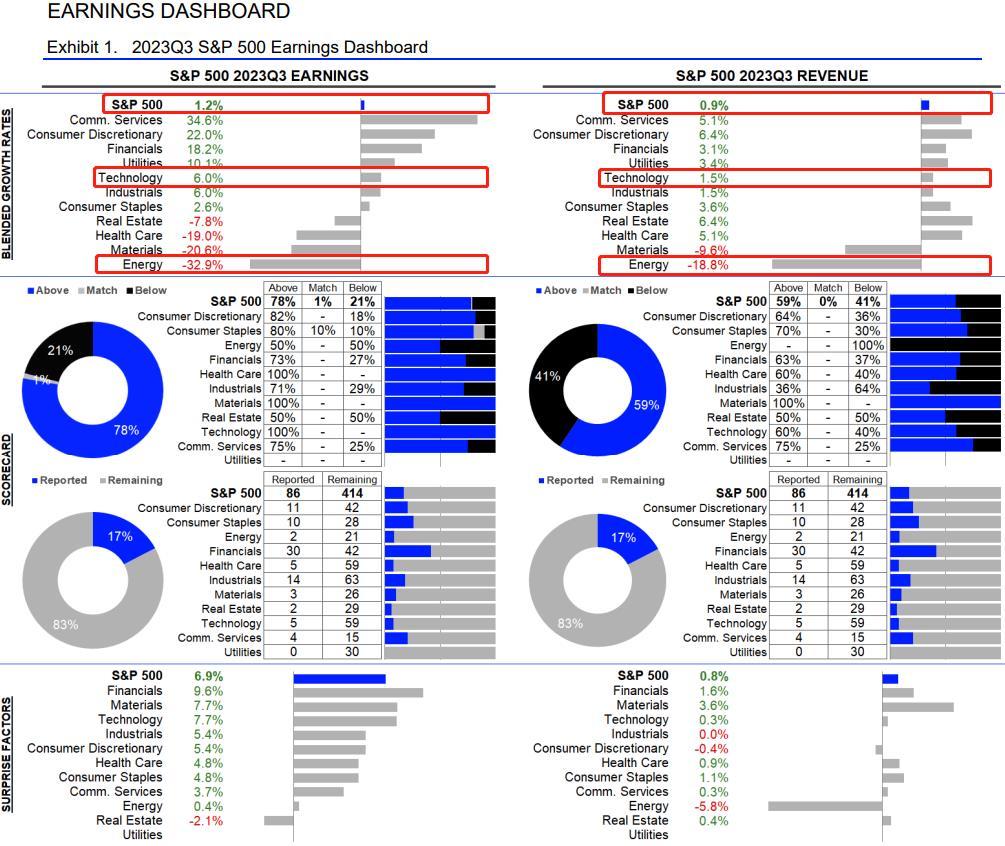

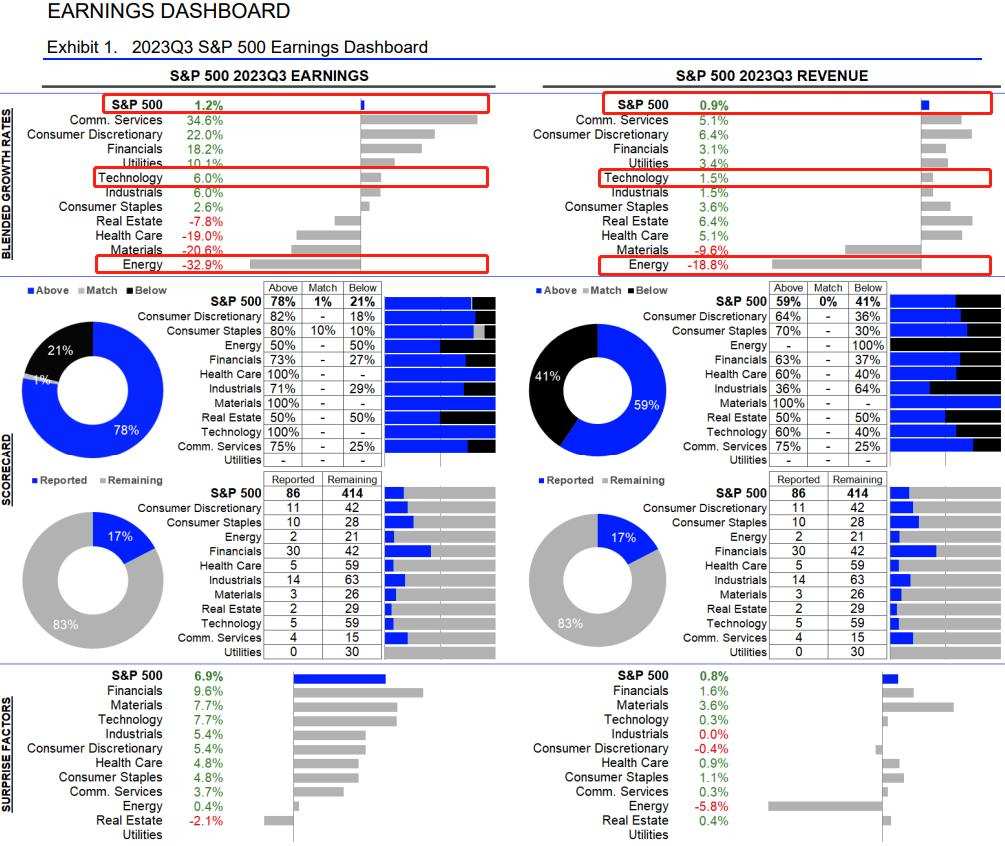

S&P 500 Aggregate Estimates and Revisions

The blended earnings growth estimate for the S&P 500 index in Q3 2023 is 1.2%. However, the growth rate rises to 5.8% if the energy sector is excluded. At present, 86 companies within the S&P 500 have reported their earnings for Q3 2023, with 77.9% of these firms surpassing analyst expectations. This positive development exceeds the long-term average of 66%.

Moreover, the Q3 2023 Y/Y blended revenue growth estimate is 0.9%. If the energy sector is removed from the index, the growth rate increases to 3.4%.

However, the fact is that the S&P 500 index is expected to benefit from outstanding performances and significant year-over-year growth rates in the tech industry. The exclusion of these tech giants would result in a 5% drop in average earnings for the S&P 500.

Here are some highlights of the coming "Magnificent Seven" earnings:

Microsoft-10.24 (today)

$Microsoft (MSFT.US)$'s recent $10 billion investment in OpenAI. Even though the official launch of Microsoft 365 Copilot, the company’s new artificial intelligence service for large businesses, is still more than a week away,on Nov. 1, it may not have a significant impact on today's earnings report. But it is still worth hearing the preliminary thoughts from CEO Satya Nadella's upcoming address on the conference call.

Investors will be keen to understand the progress and returns on this significant investment, particularly as Microsoft has incorporated OpenAI's language models in its Bing search engine and Edge browser.

SeekingAlpha analyst Brian Gilmartin suggests that the release of Copilot could impact the December '23 quarter's results, with investors eager to quantify the effects of AI initiatives following the hype surrounding Spring '23. Despite this uncertainty, EPS, revenue, and stock trading trends indicate that Q3 2023 will likely align with expectations. Microsoft is expected to remain at the forefront of AI technology, as it did with cloud computing in previous years.

In addition to AI and the cloud, Microsoft investors and analysts will be keen to receive updates on the impact of its $68.7 billion acquisition of Activision-Blizzard, the company's largest deal to date. The acquisition was completed on Oct. 13, after the close of the recent quarter, and as a result, Microsoft's Q3 earnings report will likely provide insights into the long-term outlook for the company following the 21-month regulatory review.

Google-10.24 (today)

As $Alphabet-C (GOOG.US)$ , the parent company of Google, continues to face an antitrust trial with the US government, investors are waiting for CEO Sundar Pichai's update on the legal proceedings and their potential implications for the company. The lawsuit accuses Alphabet of engaging in anticompetitive practices that restricted competition in online search. Moreover, Alphabet is also facing similar antitrust probes in foreign markets, including a recent investigation by the Japanese government.

The cloud service segment is the focal point of Alphabet's Q3 earnings report. The company is expected to benefit from its robust cloud division, contributing substantially to revenue growth. Additionally, Alphabet's continued expansion of data centers will strengthen its presence in the cloud space.

In Q2, Alphabet's Google Cloud segment recorded a year-over-year revenue growth of 28%, demonstrating the strength of its cloud business. Its AI-optimized infrastructure drives adoption, with over 70% of AI startups partnering with Google Cloud.

Meta-10.25

$Meta Platforms (META.US)$ has outperformed its FAANG peers by a considerable margin, with an impressive YTD gain of over 162%. It is also the S&P 500 index's second-best-performing stock. However, investor expectations remain high for its Q3 earnings report, and Meta will need to justify its outsized rally this year.

The company has provided Q3 revenue guidance of between $32 billion-$34.5 billion, while Wall Street analysts expect revenues of $33.4 billion for the quarter. Even at the lower end of its guidance, Meta's Q3 revenue growth should be the highest since Q4 2021. In addition, CEO Mark Zuckerberg's efficiency and cost-cutting measures have propelled the company's stock price to exceptional highs, and investors are keen to learn about his plans for new product investments and future hiring strategies. They are also interested in finding out if Threads, Meta's text-based platform competing with Elon Musk's X, has been able to retain users after a rocky start.

UBS analyst Lloyd Walmsley remains optimistic about Meta's prospects, stating that despite elevated expectations into Q4, the GenAI consumer app bull case still needs to be appreciated and not priced into shares.

Amazon-10.26

$Amazon (AMZN.US)$ is expected to perform exceedingly well during the upcoming holiday shopping season as US consumers remain active in their retail spending. As one of the leading players in the e-commerce market, Amazon's strong performance is due to its ability to meet consumer needs through innovative technology and delivery mechanisms. The September retail sales figures exceeded expectations, indicating positive consumer trends. Moreover, FactSet's research suggests that Amazon's earnings per share in Q3 2023 are expected to double from a year ago.

Apple-11.02

The recently launched iPhone 15 lineup is a crucial revenue driver for $Apple (AAPL.US)$, and investors will be looking to the company's Q3 earnings report for insights into how the market has responded to the new products. However, the Chinese government's ongoing investigation into Apple's largest supplier, Foxconn, raises concerns about potential disruptions to the production chain. China's significant influence on the supply chain makes it vital for investors to learn CEO Tim Cook's insights into the situation and its impact on Apple's future performance.

Nvidia-11.21

Thanks to the AI boom, $NVIDIA (NVDA.US)$ has experienced significant growth this year and has almost tripled in value to become a trillion-dollar giant. The company is now developing personal computer chips utilizing Arm Holdings' technology, putting it in direct competition with Intel. Advanced Micro Devices (AMD) reportedly plans to make PC chips using Arm technology.

Furthermore, Nvidia's expertise in AI chips will result in robust third-quarter earnings. Its earnings per share are forecast to increase by nearly 475% from a year ago. FactSet predicts that Nvidia's earnings will be the most significant contributor to profit growth for the entire S&P 500 index in Q3. This expansion into the personal computer chip business, combined with its longstanding expertise in AI technology, positions Nvidia well for continued growth and market leadership in the future.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

MonkeyGee : OMG, that is one amazing earnings dashboard! where can I find it?