Wall Street Stays Bullish on Apple Despite Berkshire Halving Stake

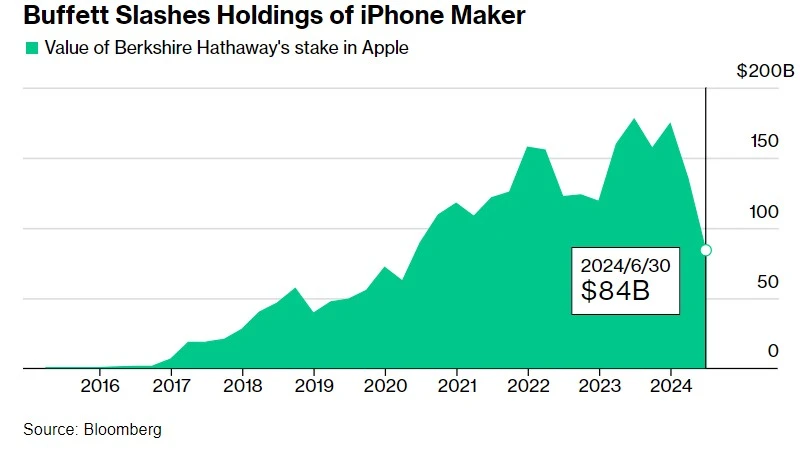

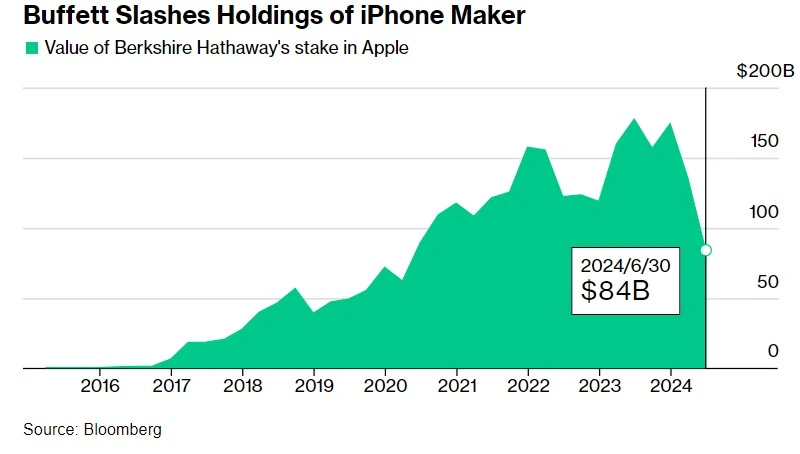

Warren Buffett's $Berkshire Hathaway-B (BRK.B.US)$ slashed its stake in $Apple (AAPL.US)$ by 49.9% in Q2, valued at approximately $75.5 billion. Despite the sell-off, Apple remains Berkshire's largest holding.

Previously, Berkshire trimmed its Apple stake by 13% in Q1, citing tax reasons during its annual meeting in May.

However, the scale of the recent sale suggests the move may go beyond tax considerations.

Why Sell?

Since Warren Buffett first disclosed his investment in Apple in 2016, the stock has surged nearly 900%, delivering billions in unrealized gains for Berkshire Hathaway. Analysts suggest the recent reduction in Apple's stake is more about risk management than doubts over the company's long-term prospects.

"Buffett’s reduction of his Apple stake is merely about risk management," said Joe Gilbert, senior portfolio manager at Integrity Asset Management. "If there were any concerns about the longer-term viability of Apple, Buffett would have exited the entire position. Similar to Berkshire’s other stock position reductions, Buffett has meaningful unrealized gains."

Apple's price-to-earnings ratio is currently at 34 times, 94% of its 10-year average and higher than the S&P 500's 26 times. When Warren Buffett started buying Apple shares, the forward P/E was below 15 times.

In addition to Apple, Berkshire has also trimmed its stake in Bank of America, reducing its holdings by 8.8% since mid-July. Some believe this indicates Buffett's lack of concern about these companies but rather a bet on weaker U.S. consumer strength and the broader economy.

"Buffett may sense an impending recession, and by raising cash now, he can buy companies at lower prices later," said Jim Awad, senior managing director at Clearstead Advisors. "He likely smells opportunity."

Strong Earnings

Apple reported stronger-than-expected earnings on August 1, with revenue for the June quarter reaching $85.8 billion, a 5% increase year-over-year and surpassing analysts' estimates of $84.5 billion. Earnings per share came in at $1.40, higher than the forecasted $1.35.

The earnings indicate a return to revenue growth and suggest that Apple Intelligence could significantly boost iPhone sales in the coming quarters.

Notably, Apple's AI-related capital expenditure grew by only about 3% year-over-year to $2.15 billion, much lower than the multi-billion-dollar spending by tech giants like Microsoft and Google. Instead of heavily investing in Nvidia AI GPUs, Apple opted to rent Google's TPU systems, which are more cost-effective for training large AI models. Additionally, Apple leases cloud capacity from Amazon, Google, and Microsoft.

With the uncertain prospects of AI monetization, the market favors tech companies that can develop AI technology while maintaining strong profit margins. Apple's gradual AI spending approach has garnered investor approval.

Despite a general downturn in U.S. stocks last Friday, Apple's shares maintained an upward trajectory post-earnings announcement, closing the week with gains against the market trend.

Wall Street Bullish on Apple

Investors should not overreact to Warren Buffett's sale of Apple shares, analysts say. Apple's robust financial health, brand loyalty, and potential in areas like AI make it an attractive long-term investment.

Historically, when institutions have significantly reduced their Apple holdings, causing a panic-driven sell-off, the stock has invariably recovered and reached new highs.

Wedbush analyst Dan Ives highlighted Apple's ongoing major upgrade cycle, expected to drive revenue growth in 2025 and 2026. "Some might interpret the sell-off as a lack of confidence, but Apple recently posted strong quarterly results and is poised for an AI-driven super cycle. We believe now is not the time to exit," Ives said.

Bank of America, in a Thursday report, stated, "We see upside in iPhones/Services given the upcoming launch of iPhone 16 with Apple Intelligence. We further see the potential for significant acceleration of units in the December quarter and overall in FY25 with the rollout of Apple Intelligence."

BofA noted that Q3 results showed accelerated growth in iPhone, iPad, and wearables, with strong global performance, and described the September quarter guidance as "conservative."

Goldman Sachs raised its price target for Apple from $265 to $275, citing robust iPhone delivery growth in the June quarter as a driver for EPS growth. The firm expects Apple to be "on the cusp of a multi-year replacement cycle" for iPhones, reinforcing its Buy rating.

Citi, confident in upcoming product upgrades and refresh cycles, increased its target price from $210 to $255.

However, some analysts remain bearish on Apple's prospects.

Barclays analyst Tim Long on Thursday trimmed his price target from $187 to $186, implying a 15% downside from Thursday's close of $218.36.

"We remain concerned about China, regulatory risks in services, and uncertainties around the AI features and timing for iPhone 16 initial sales," Long wrote in a research note.

In the June quarter, Apple's sales in China fell to $14.7 billion, below Wall Street's expectation of $15.7 billion. The region's performance was impacted by weak consumer behavior and intensified competition in the smartphone market.

Source: Bloomberg, Investing, CNBC, MT Newswires

by moomoo News Olivia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

70190156 : It's also a good company.

cold_shell_coin :

Peanny : Doubt it.

Yayababe :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Paul Purcell : Like

John E Vasquez : interesting

interesting

Robert Cumbie : got it

72175369 : The launch of Apple 16 will spark a new round of Apple craze

Bunneh : cool

Ben P : ah

View more comments...