Wall Street Today | Market Flat Despite Nvidias Drop, Direction is Changing

The market is in the green Thursday, and the S&P 500 was flat for the day by the close after pulling close to an all-time high. Nvidia fell 6% for the day, but the market did not feel it as it normally does.

Just past the 4 pm ET close, the $S&P 500 Index (.SPX.US)$ traded exactly flat for the day, the $Dow Jones Industrial Average (.DJI.US)$ climbed 0.59%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 0.23%.

MACRO

Thursday, US gross domestic product, was revised up to a 3% increase for Q2 from a 2.8% gain in the previous estimate, above expectations. GDP rose by 1.4% in Q1.

Initial jobless claims fell by 2,000 to 231,000 in the week ended August 24, the Labor Department said Thursday, right at estimates and just below the revised 233,000 from last week.

Last week, Fed President Jerome Powell did not specify the timeline for these rate cuts. Still, he said he was confident the economy was on the way to 2% inflation. "The time has come to adjust, and the direction is clear," Powell said.

Investors are watching for macroeconomic data that might inform when and how strong rate cuts will come.Friday, the July person Consumption Expenditure index (PCE), the Fed's favorite inflation measure, will be released. Last time, the PCE came in at 2.6% year over year, the lowest since 2021. Michigan consumer expectations and confidence will also drop on Friday.

SECTORS

Within industries tracked by moomoo, Semiconductors were in the red, while Semi suppliers were climbing higher: it is a different market than Wednesday, where the direction of AI and Semis led the direction of tech, and the direction of the indexes.

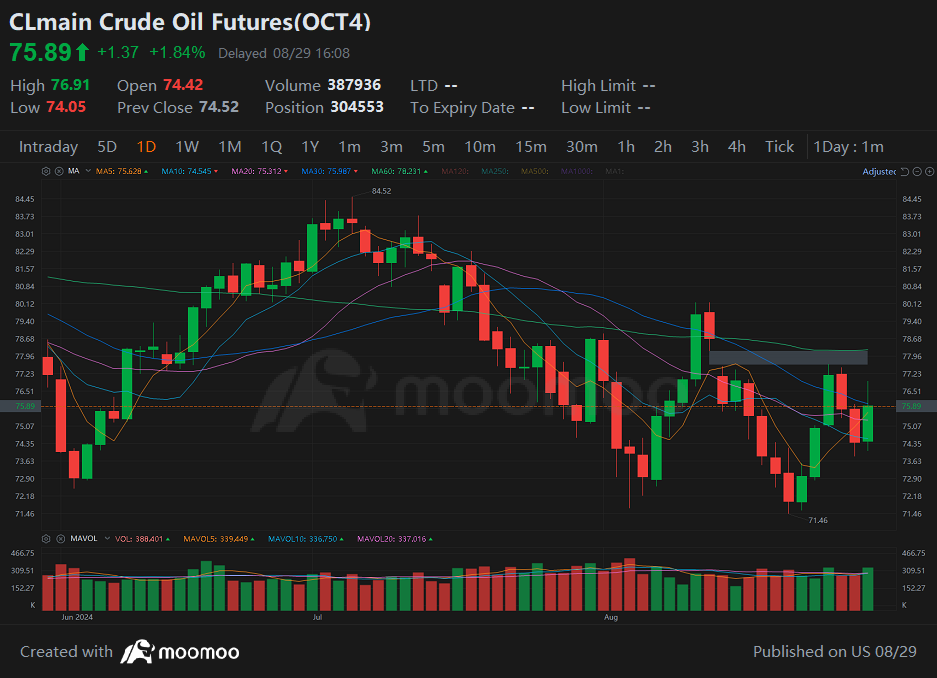

$Crude Oil Futures(MAY5) (CLmain.US)$ climbed even further, past a volatile period of lows.

$Bitcoin (BTC.CC)$ hovered near $60k, Gold and silver were climbing, the $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ and the $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ climbed, but still below 4%.

MOOVERS

$NVIDIA (NVDA.US)$ earnings came in above estimates, but forward-looking guidance was not as perfect as could be Wednesday night. Bernstein Analyst Stacy Rasgon said investors expected higher projected revenue, and Nvidia's gross margin fell slightly to 75.1% from 78.4%. The firm expects a gross margin below estimates in the mid-70% range for the year. Nvidia was one of the lowest decliners on the Nasdaq 100 by % change.

Shares of Affirm Holdings, Inc. $Affirm Holdings (AFRM.US)$ shares jumped 31% Thursday after the firm reported a smaller loss than expected Wednesday of 14C a share vs. 51C a share, and upbeat first-quarter guidance.

Dollar General $Dollar General (DG.US)$ was the lowest decliner on the S&P500 after the firm lowered its full-year outlook Thursday amid softening sales trends, and missed Q2 earnings estimates.

Best Buy $Best Buy (BBY.US)$ was the highest gainer on the S&P 500, climbing 14% after the firm lifted its full-year earnings outlook on Thursday morning. Adjusted earnings are now set to be in a range of $6.10 to $6.35 per share for fiscal 2025.

Marvell Tech $Marvell Technology (MRVL.US)$ reported quarterly earnings of $0.30 per share which met the analyst consensus estimate.

Dell Technologies $Dell Technologies (DELL.US)$ reported quarterly earnings of $1.89 per share which beat the analyst consensus estimate of $1.71 by 10.53 percent.

Interested in Options? To see these stocks and more on the options page, click here. Want to learn more about options, check out moomoo education with this link. Click here to join our exclusive options chat with personal callouts from our resident expert, Invest with Sarge.

Word from the herd: Mooers, what are you watching?

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See this link for more information.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See this link for more information.

Within industries tracked by moomoo, Semiconductors were in the red, while Semi suppliers were climbing higher: it is a different market than Wednesday, where the direction of AI and Semis led the direction of tech, and the direction of the indexes.

$Crude Oil Futures(MAY5) (CLmain.US)$ climbed even further, past a volatile period of lows.

$Bitcoin (BTC.CC)$ hovered near $60k, Gold and silver were climbing, the $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ and the $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ climbed, but still below 4%.

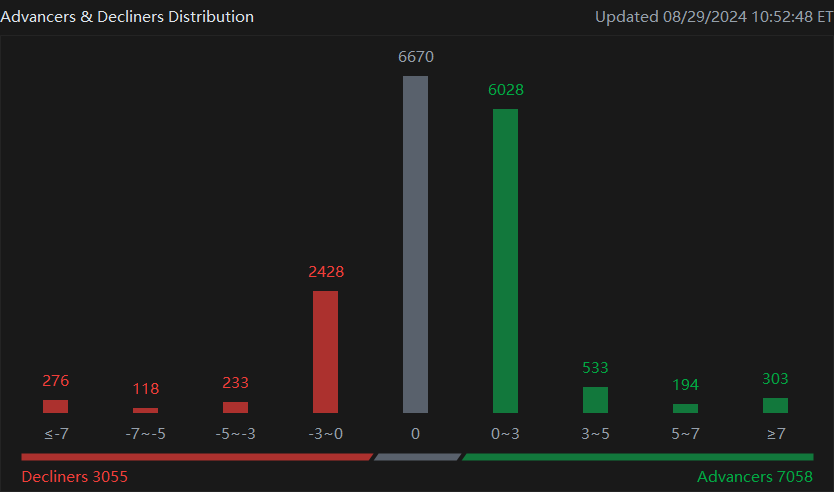

The market was climbing Thursday despite Nvidia's earnings, 7k equities were advancing compared to 3k falling, according to moomoo.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

71323557 : Haha

Bullish Law : positive

Malik ritduan : ok

章允量 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

1000proof : Made money with the SPY free fall. Nividia news not bad at all. Knew the market would retrace and I love it. Although there is a FVG from 499.32 to 484.65 and we all know the gap must be filled. Question now is when will it happen?

affable Blobfish_403 : The suspicion of data falsification is becoming increasingly heavy, and this is the key!

103677010 : noted

Clement Lemons : okk

hcteh2008 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...