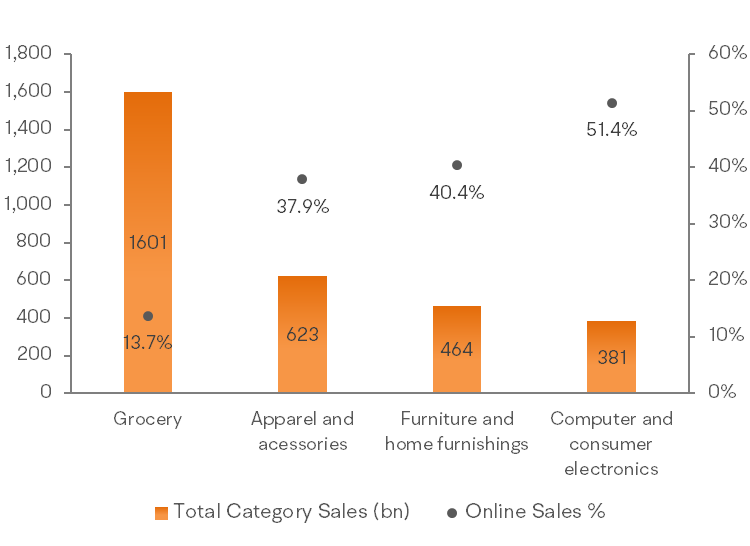

Walmart holds a strong position in the online grocery sector, boasting a broader and more competitively priced product range than Amazon. In contrast, Amazon's primary categories are electronics, fashion and apparel, and leisure and entertainment, accounting for 29%, 26%, and 12% of its sales, respectively. Both companies are increasingly focusing on online pharmaceutical sales.

joemamaa : great stuff