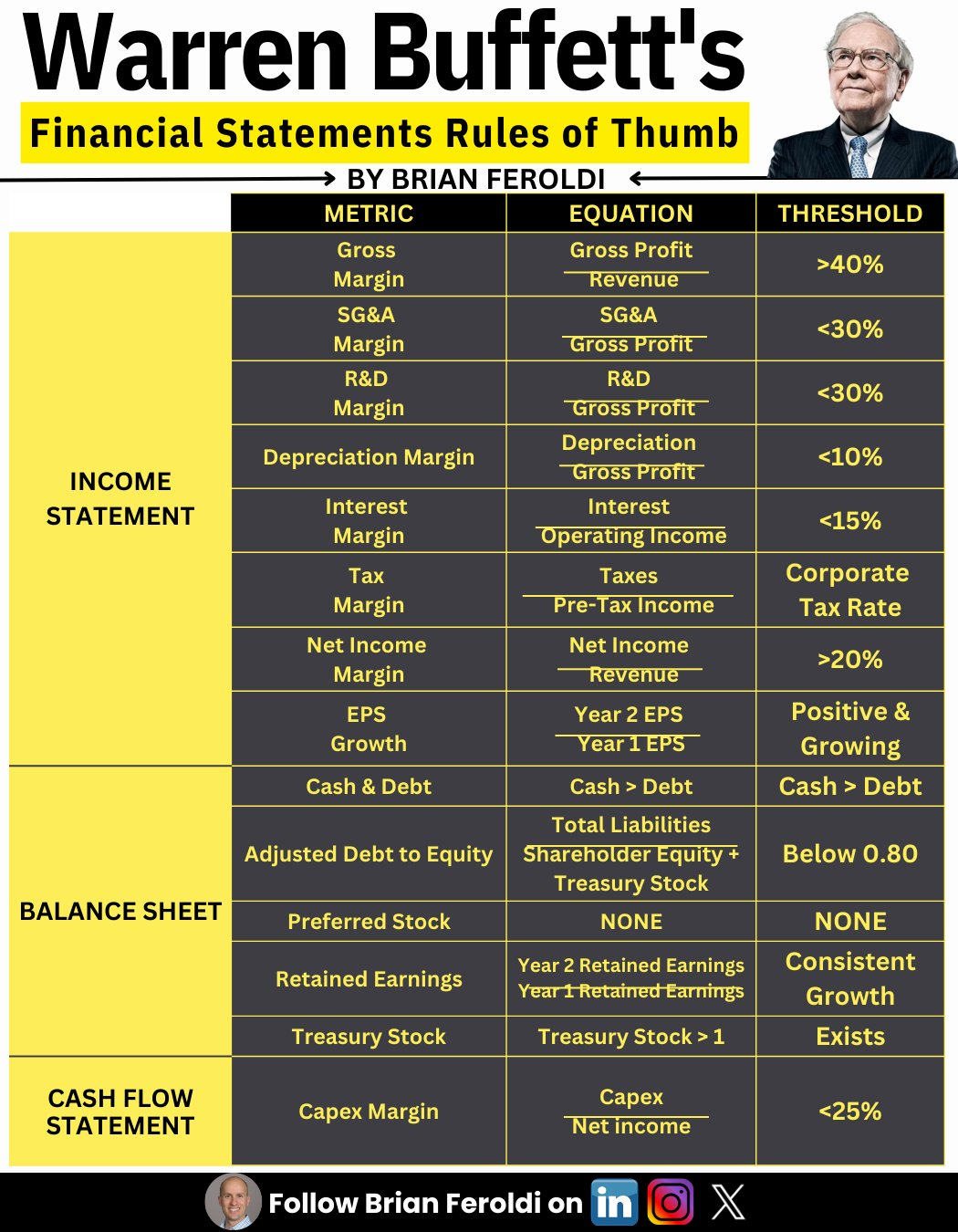

Warren Buffett’s Financial Statement Rules of Thumb:

INCOME STATEMENT RULES OF THUMB:

1: Gross Margin

→Equation: Gross Profit / Revenue

→Rule: 40% or higher

→Logic: Signals the company isn’t competing on price.

2: SG&A Margin

→Equation: SG&A Expense / Gross Profit

→Rule: 30% or lower

→Logic: Wide-moat companies don’t need to spend much on overhead to operate.

3: R&D Margin

→Equation: R&D Expense / Gross Profit

→Rule: 30% or lower

→Logic: R&D expenses don't always create value for shareholders.

4: Depreciation Margin

→Equation: Depreciation / Gross Profit

→Rule: 10% or lower

→Logic: Great businesses don't need a lot of depreciating assets to maintain their competitive advantage.

5: Interest Expense Margin

→ Equation: Interest Expense / Operating Income

→ Rule: 15% or lower

→Logic: Great businesses don’t need debt to finance themselves.

6: Income Tax Expenses

→ Equation: Taxes Paid / Pre-Tax Income

→ Rule: Current Corporate Tax Rate

→Logic: Great businesses are so profitable that they are forced to pay their full tax load.

7: Net Margin (Profit Margin)

→ Equation: Net Income / Sales

→ Rule: 20% or higher

→ Logic: Great companies convert 20% or more of their revenue into net income.

8: Earnings Per Share Growth

→ Equation: Year 2 EPS / Year 1 EPS

→ Rule: Positive & Growing

→ Logic: Great companies increase profits every year.

9: Cash & Debt

→ Equation: Cash > Debt

→ Rule: More cash than debt

→ Buffett's Logic: Great companies don't need debt to fund themselves.

10: Cash & Debt

→ Equation: Cash > Debt

→Rule: More cash than debt

→Logic: Great companies generate lots of cash without needing much debt.

11: Adjusted Debt to Equity

→Equation: Total Liabilities / Shareholder Equity + Treasury Stock

→Rule: < 0.80

→Logic: Great companies finance themselves with equity.

12: Preferred Stock

→ Rule: None

→ Logic: Great companies don't need to fund themselves with preferred stock.

13: Retained Earnings

→ Equation: Year 1 / Year 2

→ Rule: Consistent growth

→Logic: Great companies grow retained earnings each year.

14: Treasury Stock

Rule: Exists

→ Logic: Great companies repurchase their stock.

15: Capex Margin

→Equation: Capex / Net Income

→ Rule: <25%

→ Logic: Great companies don't need much equipment to generate profits.

Caveats:

1 There are plenty of exceptions to these rules.

2 CONSISTENCY IS KEY!

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment