TSLA

Tesla

-- 421.060 PLTR

Palantir

-- 80.550 NVDA

NVIDIA

-- 134.700 OXY

Occidental Petroleum

-- 47.130 AMD

Advanced Micro Devices

-- 119.210 The all-important US CPI revisions will be on watch on Feb 9 while US initial jobless claims will be released on Feb 8 (and are expected to rise). While in Australia, the RBA meets on Feb 6 with a hold at 4.35% widely expected. Here is what to expect and consider.

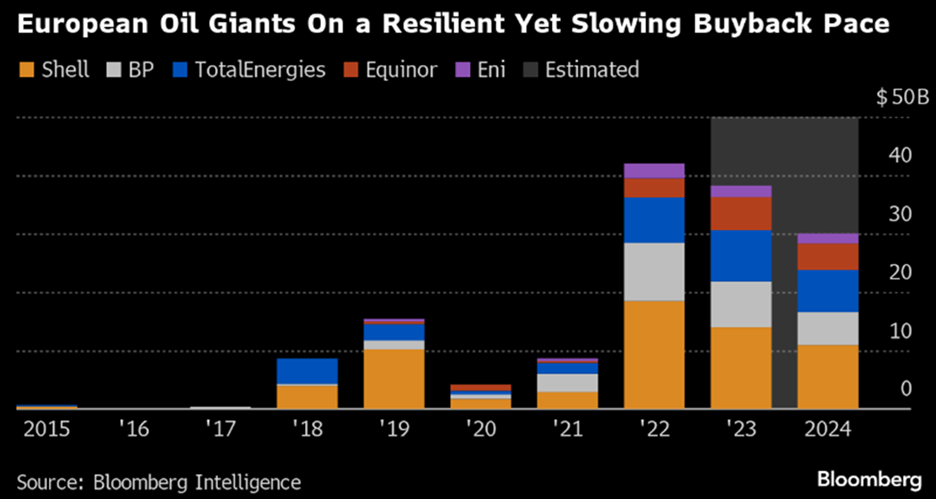

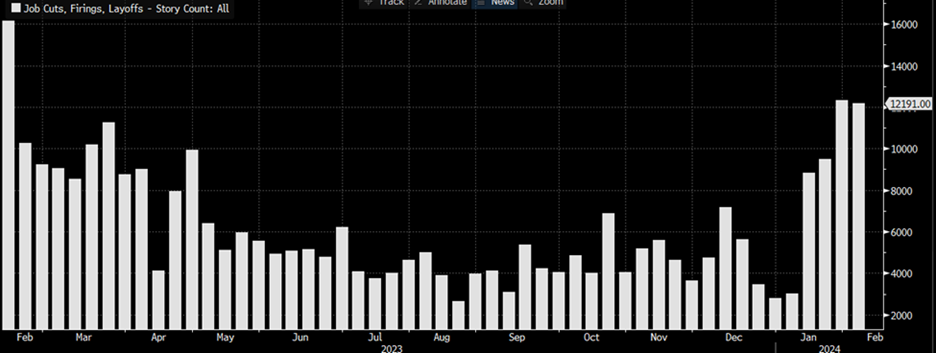

This week has another full slate of earnings releases including from McDonald's on Monday and Ford and BP on Tuesday and TotalEnergies on Wednesday. Layoffs and buybacks will be a focus this week. Here is what to consider.

Aussie earnings season kicks off this week with yearly ASX200 $S&P/ASX 200 (.XJO.AU)$ earnings expected to see a turnaround compared to last years. You could argue that the earnings expectation bar has also been set low, so you may be expecting more earnings beats given we have seen earnings downgrades over the last three months. Here is what to watch and consider.