<Weekly analysis October ①> Temporary decline due to worsening Middle East situation!? Will the decline continue in the future?

※In this section, we will conduct a comprehensive analysis by performing a multifaceted technical evaluation.

Points

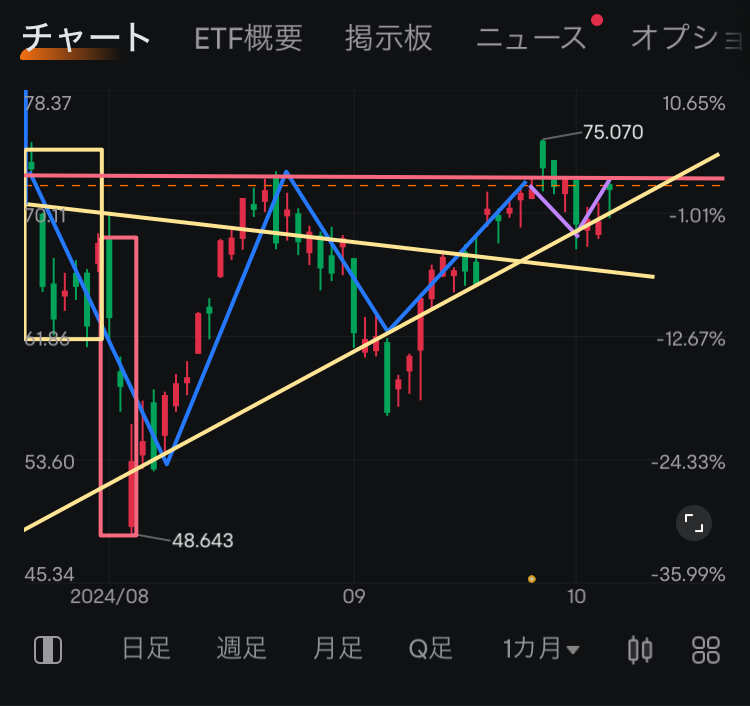

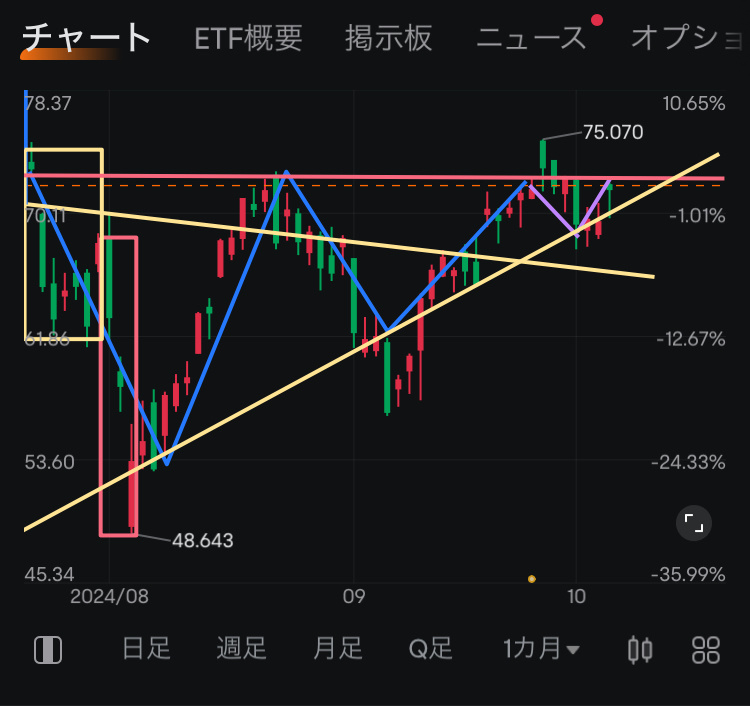

From a medium-term perspective, a triangle consolidation is forming. With the narrowing range and the candlestick chart closing with a bearish candle, is it right before breaking through the medium-term resistance?

Currently, the continuation of the downtrend is testing the factors '1. Concerns about Trump's trade' and '2. Yen carry trade resurgence/hard landing concerns'. As for 1, Trump's approval rating is rising, is it split evenly? Regarding 2, it shouldn't be a problem to exceed levels due to 'Internal Minister Ishiba's withdrawal of interest rate hike suggestion' and 'improvement in employment statistics'. However, concerns about the worsening Middle East situation are emerging, so we must not be complacent.

Even for momentum and volume, it could be said that the buy signal has been lit.

It seems likely to switch to an upward trend in the short to medium term. Especially from a medium-term perspective, there is a strong anticipation of a significant upward trend conversion happening soon.

Regarding overheating concerns, there wasn't much fear even during the decline on 10/1. Currently, it is slightly overheated, so unless significant negative factors arise, it could accelerate its upward movement, right?

☆ Market Sentiment (Rating: 4/5)

Analyzing the rough development using typical chart patterns for market sentiment.

- Candlestick patterns (4/5)

It has been moving in an upward range market since the beginning of August. There were some fluctuations, but supported by the medium-term (yellow) support line. Currently, even though it is in an upward range market, it has been blocked around the medium-term (red) resistance line (near 73) about three times.

→ From a medium-term perspective, forming a triangle consolidation. The range is narrowing, and considering that the candlestick closed with a bearish trend, could it be just before breaking through the medium-term resistance?

Dow Theory (4/5)

・Although it was able to surpass the level of the bearish trend material "② Trump Trade Concerns", the failure of the medium-term upward trend reversal due to the decision (?) of the LDP President and the worsening situation in the Middle East. However, with the improvement in US employment statistics (10/2-4), it is moving towards attempting "③" once again.

→Currently, there continues to be downward trend factors such as '① Concerns about Trump trade' and '② Reversal of Yen Carry Trade/Hard landing concerns'. Regarding ①, is Trump's approval rating rising to a 50-50 split? Concerning ②, it should not be a problem to break through levels due to 'Abe's Prime Minister's interest rate hike suggestion withdrawal' and 'improvement in employment statistics results'. However, there are concerns about the current situation of 'worsening Middle East situation', so caution is necessary.

* The contents of the 'Dow Theory' have already been analyzed in relation to 'SOXX/SOXL' and are almost the same. This is because it confirms correlativity in multiple markets from the standpoint of the fourth rule of the Dow Theory, which states 'averages must confirm each other'.

☆ Trading timing (Rating: 3.5/5)

* Analyze the timing of selling or buying by combining moving averages and trading volume.

・Moving Average Line (3/5)

Regarding the candlestick chart, it is developing with support from the 75-day moving average line to the 5-day moving average line. A golden cross has occurred on the 21/50 day moving average lines.

* Volume Moving Average Line (4/5)

Golden cross occurred with short-term/medium-term moving averages. There is no overheating in the volume.

→It would be fair to say that a buy signal has been lit for momentum and volume.

☆Trend (Rating: 3.7)

I will analyze the long-term upward and downward trends.

- Ichimoku Kinko Hyo (4/5)

Playing a role in the turnaround. However, it seems that breaking through the late span candlestick chart and the cloud breakout may be possible soon. It's also a good impression that the positive cloud is getting thicker.

- DMI (3.5/5)

Recently, the Positive Directional Indicator (PDI) is rising while the Negative Directional Indicator (MDI) and Average Directional Index (ADX) are turning downwards. Is it likely to see a trend reversal from the point where PDI and ADX are about to cross?

It seems like a trend reversal to the upside in both the short and medium terms.Especially from a medium-term perspective, there is a strong anticipation of an imminent significant uptrend reversal.

☆Overheating sensation (Rating: 2.3/5)

※Analyzing the overheating sensation based on levels of excessive buying etc.

・BOLL (3/5)

After a temporary drop to +1σ to the baseline, there was a recovery back up to +1σ.

- Relative Strength Index (2/5)

Even with the decline on 10/1, the drop to around 50 is at a reasonable level. The fact that it is hovering around the mid-55s afterwards indicates a bit of overheating.

- MACD (2/5)

A death cross has occurred. However, there is a possibility of a fakeout with this death cross.

Regarding overheating,Even with the decline on 10/1, it seems that cigna corp is not that fearful.Currently, it seems slightly overheated, so could there be an acceleration in the rise unless significant negative news emerges?

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment